Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 11, 2021

The potential for CCUS comes into greater focus in 2020 as more and more countries and companies make net-zero pledges

For as much hardship as the global pandemic has caused, it has also been referred to as a "great accelerator"; trends that may have taken 5-10 years to play out fully from the vantage point of 2019 and are now either completed or well underway.

As we discuss in our latest CCUS Industry Trends report (available on Connect to clients of our Upstream Transformation Service), such is the case for the energy transition. It does seem as if last year served as the "pivot point" about which operators took tangible steps not only to decarbonize their legacy energy portfolios, but also to begin investigation of new sources of greener energy.

These trends happened at the macro-level as well, with more and more regions pledging to reach net-zero emissions by the middle of the century; notably, China joined this growing group of nations. While China had not until recently explicitly committed to any carbon reduction targets, in late 2020, Chinese President Xi Jinping announced that China will target peak carbon emissions by 2030 and aim to achieve carbon neutrality by 2060. China is such a substantial emitter that early assessments indicate that if the region did indeed meet its 2060 goal, global warming projections would lower about 0.2-0.3° C. It is expected that China will reach this goal by funding wind, solar, electric vehicle, and battery storage technology, while de-emphasizing coal (the region currently makes up about half of global coal demand).

Announcements such as these herald hope that the energy transition will take place smoothly, while also underlining just how difficult this will be. To the extent that China is a large consumer of hydrocarbons, it will have to re-organize its energy supply chain, and of course affected, existing suppliers will have to make their own adjustments. Furthermore, there are currently no mechanisms in place to hold both countries and companies to account on their net-zero pledges.

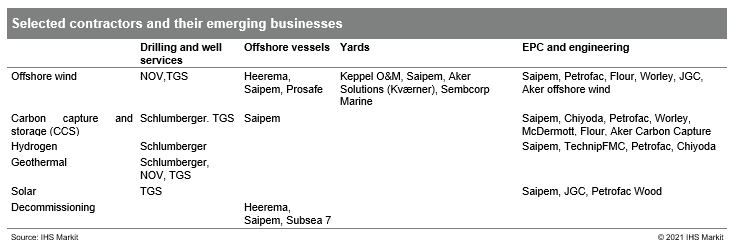

Going back to the company-level, upstream service companies are already having to make such adjustments as their operator clients cross the bridge to net-zero emissions. While one could argue that some are making moves outside of their traditional core competencies, an easy counter-argument is that no one knows the source rock better than these service companies. After all, who better to help put back emitted carbon than those who helped produce it in the first place?

For more information on the CCUS Industry Trends report and IHS Markit's Energy Transition research please contact James Blanchard or join our Upstream Transformation in 10 charts webinar series from the 6th to the 7th of May, the first of a summer webinar series from our new Upstream Transformation Service.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpotential-for-ccus-comes-into-greater-focus-in-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpotential-for-ccus-comes-into-greater-focus-in-2020.html&text=The+potential+for+CCUS+comes+into+greater+focus+in+2020+as+more+and+more+countries+and+companies+make+net-zero+pledges+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpotential-for-ccus-comes-into-greater-focus-in-2020.html","enabled":true},{"name":"email","url":"?subject=The potential for CCUS comes into greater focus in 2020 as more and more countries and companies make net-zero pledges | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpotential-for-ccus-comes-into-greater-focus-in-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+potential+for+CCUS+comes+into+greater+focus+in+2020+as+more+and+more+countries+and+companies+make+net-zero+pledges+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fpotential-for-ccus-comes-into-greater-focus-in-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}