Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 26, 2020

OSV market in Brazil: recovery postponed

<span/>Although coronavirus (COVID-19) and low oil prices will reduce activity, operators which have already rig contracts will likely stick with the drilling plan but with a smaller number of wells. This time drilling activity will be in both exploration at new wildcats and in some development wells. Shell, ExxonMobil and Petrobras are expected to spud new exploration wells in 2020 and Petrobras will continue focusing drilling wells at pre-salt fields in the Mero and Buzios fields, and maybe some Campos assets like Roncador and Albacora.

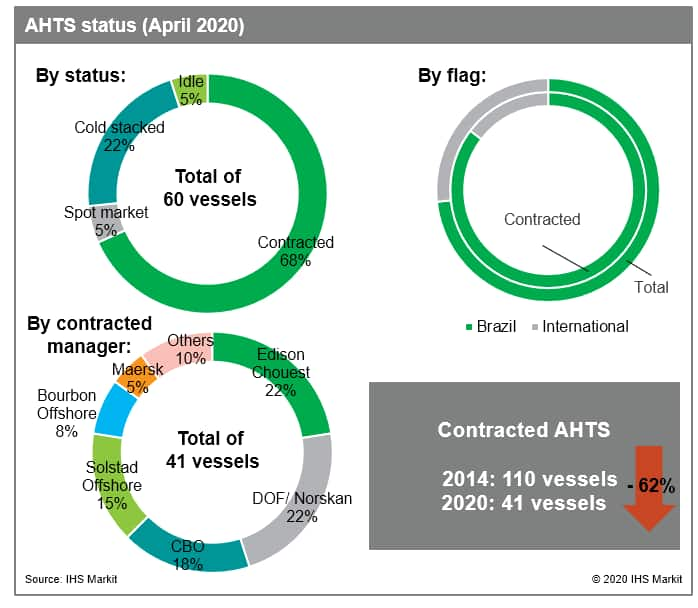

These will be the main drivers of the demand for AHTS that works in the anchorage, supply and installation activities associated with drilling and hook-up of new FPSOs or MODUs (mobile offshore drilling units). Adding to the reductions in the demand for new wells, Petrobras is hibernating several shallow water units, dropping also the demand for general purpose PSVs. Furthermore, some OSV operations have been suspended in Rio de Janeiro (from where the presalt and Campos are served), after some cases of COVID-19 contamination in crews were found.

All this cost saving measures in the Brazilian market will hit directly OSVs contractors in Brazil, remarkably the foreign ones, that do not have a "preference" guaranteed by law.

Figure 1: AHTS status (April 2020)

Since 2018, tenders for support vessels have started in a movement of recovering market as well as the contract were expiring. However, if the current market continues shrinking for longer, shipowners and brokers will have to deal with further hibernation of the vessels and low utilization.

OSV was one of the most affected sectors in the 2014 downturn. In Brazil, the market is still oversupplied, and suppliers are highly indebted impacting negatively their financials. Some companies are still renegotiating their debts and under restructuring process like Bourbon Offshore. Suppliers which are dedicated to the offshore support market being owners and operators of the vessels are in a challenging situation and worsen than the ones with a diversified portfolio. CBO, for instance, was less impacted because has a different structure in their portfolio with yard, construction and vessels and had increased its margin with the increase of fleet under contract since 2018.

The recovery is being difficult for contractors in Brazil, because the day rates are still in the minimum range observed in the previous period to the downturn (2010 to 2014). Petrobras, the operator that hires most of the fleet, has being efficient in keeping the pressure over the prices, greatly due to a continuously reduction of demand (owing to less investment but also improvement in the fleet operational management).

Mariana Anjos is a senior research analyst for the Cost

and Technology team at IHS Markit.

Thais Vachala is a senior research analyst for the Cost and

Technology team at IHS Markit.

Posted 26 May 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fosv-market-in-brazil-recovery-postponed.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fosv-market-in-brazil-recovery-postponed.html&text=OSV+market+in+Brazil%3a+recovery+postponed+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fosv-market-in-brazil-recovery-postponed.html","enabled":true},{"name":"email","url":"?subject=OSV market in Brazil: recovery postponed | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fosv-market-in-brazil-recovery-postponed.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=OSV+market+in+Brazil%3a+recovery+postponed+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fosv-market-in-brazil-recovery-postponed.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}