Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 26, 2017

Opportunity for renewable energy microgrids in emerging markets

Renewable-based microgrids/minigrids are increasingly attracting the interest of governments and multilateral institutions as a tool to achieve universal electricity access. Private industrial and commercial users have also considered the implementation of green microgrids (or a hybridization of existing diesel-based systems) to secure reliable power supply to their facilities.

Low electrification rates, economic and population growth, and large geographic areas with dispersed populations have driven the implementation of microgrid projects in emerging markets.

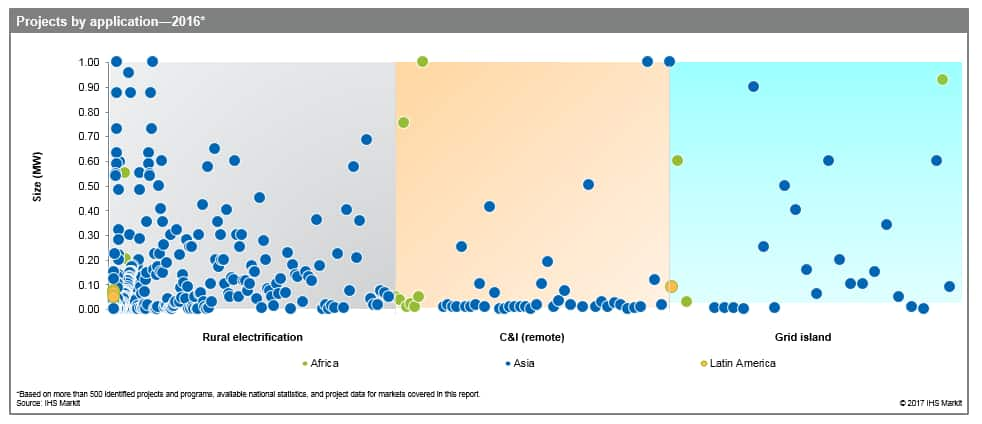

- IHS Markit has identified more than 500 projects and initiatives across emerging Asia, Africa, and Latin America.

- A pipeline of projects is currently being developed, mostly in markets where pilot projects have already been implemented. Opportunities for green microgrids are twofold: greenfield renewables (and hybrid) systems and inclusion of a renewable component in existing systems currently relying on fossil fuels (mostly diesel).

The expansion of the central network to remote areas has been the main focus of government strategies to increase electricity access. However, the extent of the investment, the difficulty in reaching certain areas in large countries with highly dispersed populations, and declining technology costs for renewable options have allowed the emergence of interim solutions to the electrification problem.

- In Africa, national policies for rural electrification have been the main driver for implementing renewables and hybrid microgrids in areas not served by the central network. Electricity concession areas are a common policy option to drive private investments in identified sites by the government or rural electrification agencies (see Mali). A number of countries (e.g., Tanzania) have also introduced subsidies to help project financing, set up a standardized tariff system for renewable-based microgrids, and applied tax exemptions for renewables equipment such as solar panels. The lack of clarity in regulation, mainly around integration/interconnection options of the microgrid to the central grid when the latter reaches the site, is considered one of the key challenges for private investors in the region.

- In Asia, India offers the biggest opportunities for microgrid investments. Microgrids are part of India's national strategy to achieve universal electricity access with a specific microgrid contribution of 500 MW by 2022. This ambition is supported by a central financial assistance of 30% of cost available for projects located in rural areas. Southeast Asian countries have historically shown a high dependence on grant-based financing models with limited private sector participation. However, aggressive grid expansion plans in Myanmar and the recent launch of a microgrid policy in Indonesia to incentivize private sector participation are expected to considerably bolster capacity additions in the future.

- In Latin America, investment growth is limited owing to high electrification rates across the region. Scattered opportunities were identified in Central America and in remote areas in countries such as Brazil, where regulation specifically considers renewable microgrid options under rural electrification policies.

Microgrid projects are financed mainly through multilateral funds in support of government-driven rural electrification programs. Local agencies are generally in charge of channeling these funds-along with government funds-to dedicated projects and aligning individual initiatives to the overall national target.

- Multilateral institutions offer financial support programs focusing on initiatives that generally aim to increase electricity access or specifically target the implementation of renewable-based microgrids.

Renewable microgrid economics are relatively attractive thanks to lower operating costs, despite higher up-front investments needed to develop and build projects. The range of revenues for hybrid solutions varies highly depending on various parameters; India offers the lowest tariffs per megawatt-hour for hybrid microgrid options.

- The required capital investment for renewable-based microgrids is generally higher than diesel-based microgrids because renewable systems are more capital intensive on a unit cost basis and require a storage solution to limit power outages. However, fuel costs significantly raise the operation costs of a diesel generator, and this is reflected in competitive levelized costs of electricity (LCOEs) for hybrid systems with a large renewables component.

- Several factors affect the LCOEs of a microgrid and determine the relative competitiveness of the different options. The choice of technology mix in a hybrid system is crucial when assessing the cost of power supply solutions for clusters of customers connected to the same microgrid. Availability of local resources will influence the design and performance of the system, hence the cost per megawatt-hour incurred. The size of a microgrid, daily load shape, and share of commercial customers as well as the required level of reliability also have a significant impact on the design of a microgrid and its LCOE. The presence of a commercial anchor load is also crucial owing to the unpredictable level of income in rural areas and limited consumption among residential customers.

Figure 1: Microgrids up to 1 MW of capacity account for 90% of total number of projects

Learn more about our power market insights and analysis.

Silvia Macri is a Senior Research Analyst with IHS Markit.

Posted 27 October 2017

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fopportunity-for-renewable-energy-microgrids-in-emerging-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fopportunity-for-renewable-energy-microgrids-in-emerging-markets.html&text=Opportunity+for+renewable+energy+microgrids+in+emerging+markets","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fopportunity-for-renewable-energy-microgrids-in-emerging-markets.html","enabled":true},{"name":"email","url":"?subject=Opportunity for renewable energy microgrids in emerging markets&body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fopportunity-for-renewable-energy-microgrids-in-emerging-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Opportunity+for+renewable+energy+microgrids+in+emerging+markets http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fopportunity-for-renewable-energy-microgrids-in-emerging-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}