Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 14, 2019

Operators cautious spending plans will slow down activity in North America the first quarter of 2019

North American drilling activity will have a "vigilant" start as a result of the collapse in crude oil prices at the end of 2018, regional pipeline constraints and operators' renewed focus on capital discipline.

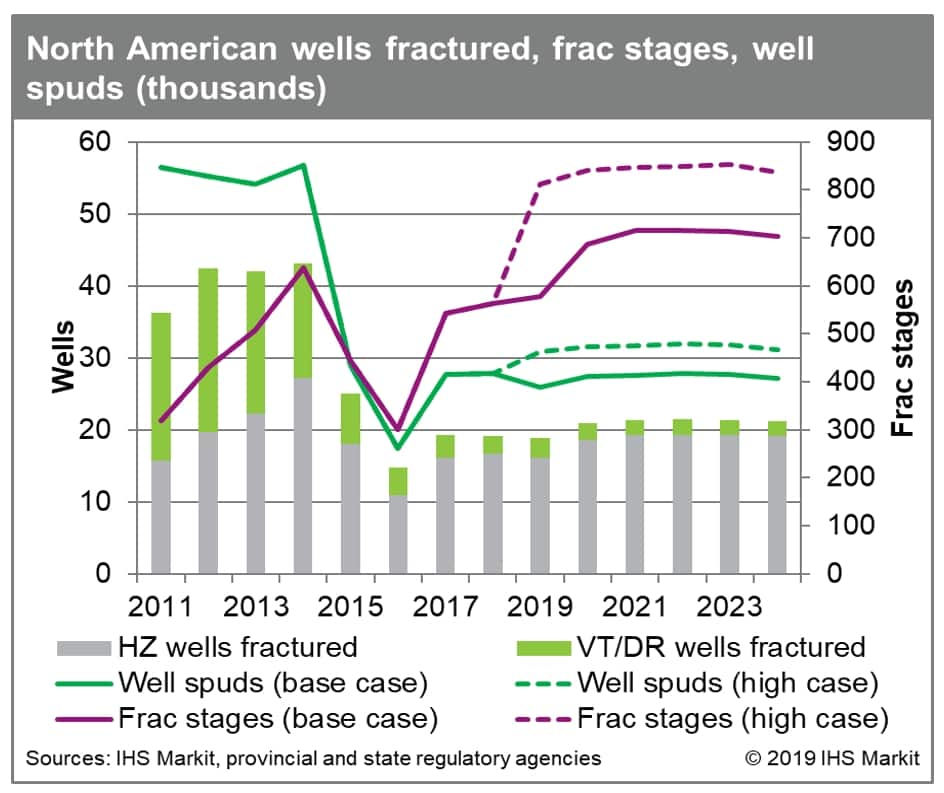

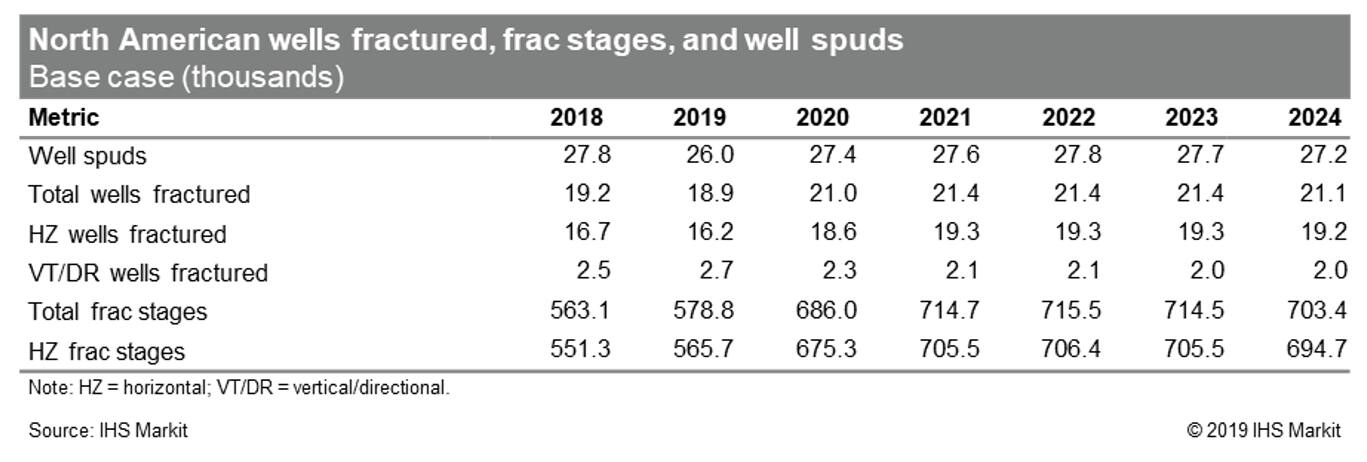

IHS Markit forecasts about 26,000 spuds for North America in 2019, down 6% from 2018. However, we estimate about 27,200 spuds in 2024, an overall increase of 5% with US spuds representing 74% of the overall market in 2019. Additionally, IHS Markit's analysis concluded that wells fractured in North America are expected to decrease by 2% in 2019 and are mainly driven by the decrease in Canadian wells fractured, as US wells fractured are expected to stay flat.

With prices hovering around the critical $50/bbl WTI, spending cuts are looking increasingly likely. Canadian E&P companies are expected to enact a higher reduction in capital spending than their US peers as the Canadian upstream sector is weaker than the US'. Indeed, the uncertainty with pipelines and facilities construction in Canada, along with operators' access to capital, government's curtailment of production, and the potential increase in regulatory requirements (Bill C-69) could strongly affect the country's activity outlook.

For United States, the 2019 outlook remains positive even with the slow start in Q1. US production is still expected to grow as the addition of thousands of new wells in 2018 are now on the steepest slope of their decline curves. Additionally, wells fractured are expected to stay flat despite the drop in well spuds resulting from the strong drilled but uncompleted (DUC) inventory built in 2018. This inventory provides a source of capital-efficient supply for operators incentivizing the conversion of DUC into producing wells.

The Canadian activity outlook is expected to stay flat during 2019 as producers' plans are designed to maintain production levels and maximize free cash flow. The running theme in Canada is that of uncertainty. In particular, the possible increase in regulatory requirements proposed by the Canadian government could strongly affect the activity outlook.

In summary, although the beginning of the year will be slow for the drilling and completions market in North America, as pipeline capacity increases in the US towards the second half of the year and developments in Canada run their course, we expect 2019 to end on an upwards note.

IHS Markit's Onshore Services & Materials team's recent WellIQ report for the first quarter of 2019 tracks the drilling and completions activity for onshore operations in North America. The report is available in its entirety on Connect™ for Onshore Services & Materials clients.

Learn more about our coverage of the onshore materials market.

Paola Perez Pena is a Principal Research Analyst at IHS

Markit.

Posted on 14 February 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foperators-cautious-will-slow-down-activity-in-north-america.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foperators-cautious-will-slow-down-activity-in-north-america.html&text=Operators+cautious+spending+plans+will+slow+down+activity+in+North+America+the+first+quarter+of+2019+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foperators-cautious-will-slow-down-activity-in-north-america.html","enabled":true},{"name":"email","url":"?subject=Operators cautious spending plans will slow down activity in North America the first quarter of 2019 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foperators-cautious-will-slow-down-activity-in-north-america.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Operators+cautious+spending+plans+will+slow+down+activity+in+North+America+the+first+quarter+of+2019+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foperators-cautious-will-slow-down-activity-in-north-america.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}