Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 02, 2020

Onshore wind turbine manufacturers navigating a challenging business environment

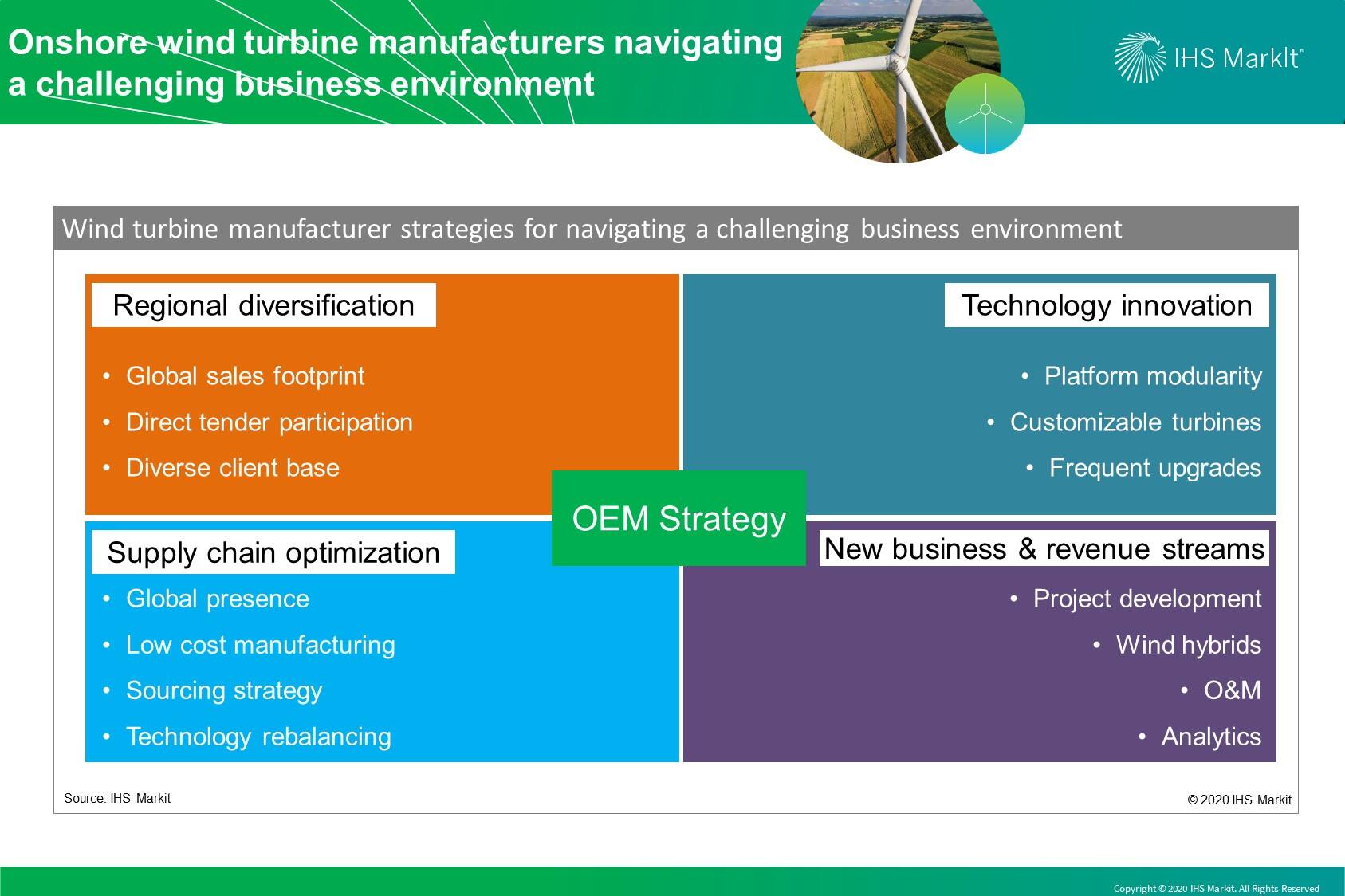

Even as onshore wind additions grew to reach a four year high of 56 GW in 2019, the turbine supply landscape consolidated further around a handful of original equipment manufacturers (OEMs). By the end of last year, the five largest OEMs had delivered roughly 65% of the world's onshore wind installed base and, with few exceptions, continue to dominate future orderbooks as well. However, challenging market conditions characterized by auction driven pressure to reduce LCOEs and increasing competition with both conventional and competing clean energy technologies are putting the onshore wind manufacturers under a lot of pressure. To solidify their market leadership, the five largest OEMs are relying on the following strategic levers:

- Regional diversification: Globally spread out

supply footprints have enabled major OEMs to hedge demand risks in

any single market, some of whom have established a presence in over

80 countries as of year-end 2019. However, Mainland Chinese OEMs

enjoy strong orderbooks despite having little to no international

presence on account of the domestic market size.

- Technology innovation and product modularity:

Instead of a one-size-fits-all strategy, OEMs are focusing on

delivering site optimized turbines requiring them to step up the

pace of product innovation while maintaining broad product

portfolios. Modular platform architecture has helped them enhance

customizability, shorten time to market, and innovate at low

costs.

- Supply chain optimization: Manufacturing

presence of OEMs is reshuffling in response to a variety of factors

including local content requirements, cost pressures, demand

bottlenecks, and changing technology needs. Manufacturing

strategies are also evolving in favor of increasing outsourcing as

manufacturers try to keep themselves nimble and minimize market

entry and exit costs to maintain agility in a very dynamic and

diversified market.

- New businesses and revenue streams: Cost pressures have narrowed turbine margins forcing OEMs to hunt for a path back to profitability. To achieve this goal, suppliers will focus on growing their more profitable services (O&M) business, boosting margins on turbine sales through platform modularity and supply chain optimization, and creating new revenue streams including analytics driven services and project development.

Figure 1: Onshore wind turbine manufacturers navigating a

challenging business environment

For more information and analysis on the wind power market, please visit our Global Power and Renewables and Clean Energy Technology pages.

Indra Mukherjee is an Analyst for Gas, Power, and Energy Futures at IHS Markit.

Posted 02 June 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fonshore-wind-turbine-manufacturers-challenging-environment.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fonshore-wind-turbine-manufacturers-challenging-environment.html&text=Onshore+wind+turbine+manufacturers+navigating+a+challenging+business+environment+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fonshore-wind-turbine-manufacturers-challenging-environment.html","enabled":true},{"name":"email","url":"?subject=Onshore wind turbine manufacturers navigating a challenging business environment | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fonshore-wind-turbine-manufacturers-challenging-environment.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Onshore+wind+turbine+manufacturers+navigating+a+challenging+business+environment+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fonshore-wind-turbine-manufacturers-challenging-environment.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}