Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 29, 2021

Keeping us warm this winter: Oil demand rises to bridge the gap while natural gas price soars

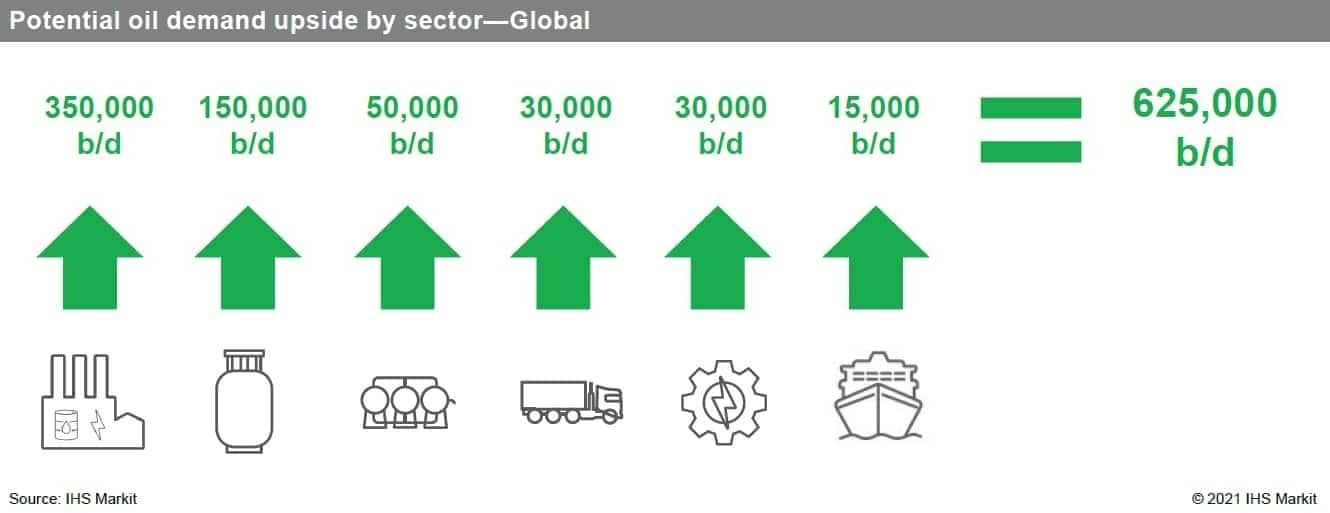

As natural gas prices climb higher and with relief not forthcoming on the supply side, consumers are switching to cheaper alternatives. Besides a switch to coal, the oil complex has a role to play in providing an alternative to gas. IHS Markit has assessed the potential upside to oil demand this winter at 0.6 MMb/d, comprising almost entirely refined products, with additional crude oil burn expected to be marginal and limited to consumption of sweet grades within some Japanese power stations.

- Fuel oil has largest demand upside, as power stations and

refineries could consume an additional 0.3 MMb/d, predominantly in

Asia, and to a lesser extent in Europe and Latin America. We also

expect ships with dual-fuel capability to minimize LNG use down to

their contractual minimum, providing upside to marine bunker fuel

oil.

- Light products—LPG and naphtha—find an upside demand

from the industrial sector, including refineries and petrochemical

plants, potentially adding 0.2 MMb/d to winter demand.

- The upside for middle distillates demand is less than 0.1

MMb/d, primarily from a potential uptick in power generation

consumption in Southeast Asia and lower utilization of mainland

China's sizable natural gas-fueled truck fleet.

- If all viable substitution mechanisms are activated

simultaneously, the upside could rise further from 0.6 MMb/d to be

closer to 0.8 MMb/d.

- That said, global oil demand is set to remain well below

prepandemic levels. Bearish risks remain as we enter winter, and

the specter of COVID-19-related containment reemerges.

- We expect refineries with exposure to current spot prices to

reoptimize their operations and minimize natural gas intake to the

extent possible, calling on incremental LPG and fuel oil for their

energy needs. We expect that they will adjust unit severities,

while managing hydrotreater runs as a trade-off between sweet-sour

product spreads and hydrogen costs.

- The winner from a price perspective would be crude oil, as this sizable demand upside may add to the structural stock draws. On the products side, we expect LPG and fuel oil cracks to benefit most from this natural gas bull run.

Global potential oil demand upside by sector

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-demand-rises-while-natural-gas-price-soars.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-demand-rises-while-natural-gas-price-soars.html&text=Oil+demand+rises+to+bridge+the+gap+while+natural+gas+price+soars+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-demand-rises-while-natural-gas-price-soars.html","enabled":true},{"name":"email","url":"?subject=Oil demand rises to bridge the gap while natural gas price soars | S&P Global&body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-demand-rises-while-natural-gas-price-soars.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Oil+demand+rises+to+bridge+the+gap+while+natural+gas+price+soars+%7c+S%26P+Global http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-demand-rises-while-natural-gas-price-soars.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}