Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 27, 2020

Oil and gas investments in clean tech startups accelerate the industrys energy transition

As the oil and gas industry transitions to a low-carbon future, companies are seeking to position themselves to succeed in this new and uncertain business environment. In some cases, they are building on existing core capabilities (e.g., developing and operating offshore wind farms), while in others they are entering entirely new business areas (e.g., hydrogen value chain). Occidental Petroleum's August 2019 investment in Cemvita Factory and its synthetic biology platform for carbon dioxide (CO2) utilization through its Oxy Low Carbon Ventures (OLCV) subsidiary represents another recently emerging path for the oil and gas industry to navigate the energy transition through ongoing support of advanced technology development.

Deep decarbonization technologies like CCUS are needed to meet future energy demand while at the same time managing greenhouse gas (GHG) emission levels. The Cemvita Factory investment highlights two interesting developments in the industry's approach to developing such capabilities in this area.

- Return to capital-intensive technology areas by corporate venture groups. CCUS technologies require large capital investments in industrial test facilities, pilot plants, and supply chains to technically and commercially de-risk the technology as it moves from the lab to commercial scale. While oil and gas corporate venture capital investments in CCUS technologies are by definition at nascent stages, large capital investments will need to follow to support technology commercialization.

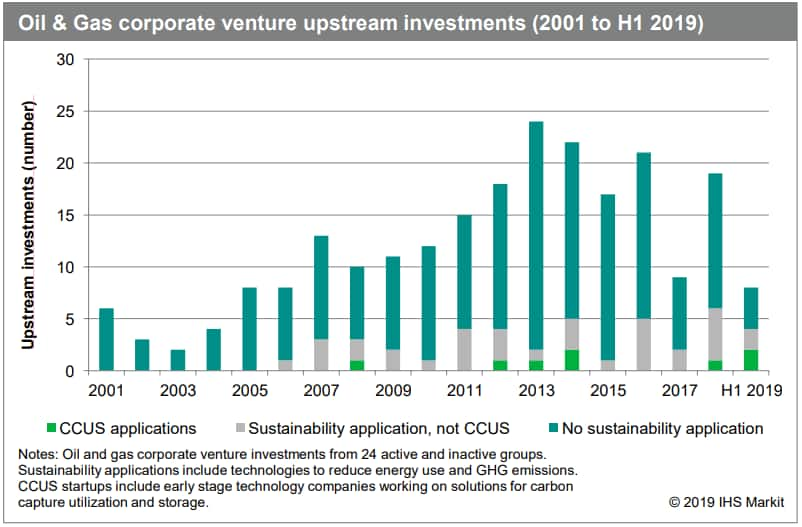

- Leverage startups to build the CCUS value chain. While CCUS technologies have been available for decades, industry adoption has been slow. Since the first commercial CCUS project in 1972, only 14 large-scale, integrated CCUS projects are now in operation. Recent corporate venture capital investments in CCUS startups (e.g., BP Ventures's 2019 investment in C-Capture) suggest a new approach by the oil and gas industry to accelerate technology development and uptake in this area (see Figure below).

IHS Markit will continue to track strategic investments in deep

decarbonization technologies like CCUS, especially since their

development will go a long way toward determining the pace and

success of the oil and gas industry's energy transition. Two

aspects to which IHS Markit will pay close attention are the role

corporate venture capital plays in advancing the low-carbon

innovation ecosystem and how the nature of oil industry investors'

technology development support evolves as their CCUS investments

scale.

Figure 1: Oil & Gas corporate venture upstream investments

(2001 to H1 2019)

Carolyn Seto is a Director for Upstream

Insight.

Judson Jacobs is an Executive Director for Upstream

Insight.

Posted 27 January 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-and-gas-investments-in-clean-tech-startups.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-and-gas-investments-in-clean-tech-startups.html&text=Oil+and+gas+investments+in+clean+tech+startups+accelerate+the+industry%e2%80%99s+energy+transition++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-and-gas-investments-in-clean-tech-startups.html","enabled":true},{"name":"email","url":"?subject=Oil and gas investments in clean tech startups accelerate the industry’s energy transition | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-and-gas-investments-in-clean-tech-startups.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Oil+and+gas+investments+in+clean+tech+startups+accelerate+the+industry%e2%80%99s+energy+transition++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-and-gas-investments-in-clean-tech-startups.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}