Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 08, 2018

Falling further from the tree: Oil and gas corporate venture activity shifts away from core E&P technologies

Over the past decade, oil and gas players have increasingly pursued open innovation strategies to complement internal research and development activities. Corporate venture investing is one such form of technology sourcing that allows companies to access innovation developed by start-ups. As companies seek more cost-efficient technology sourcing models and look to cast a wider net for new ideas and solutions, corporate venture capital investing has emerged as a key element of the industry's overall approach to technology development.

After the demonstrated success of this investment vehicle for sourcing new E&P technologies developed outside their organizations, companies are now increasingly leveraging it to access technologies developed outside the oil and gas sector entirely, such as digital, clean energy, and mobility. With these technologies having growing relevance to upstream operations and/or a firm's long-term strategic aspirations, many corporate venture groups are emphasizing them over core E&P applications that now represent only a small component of the industry's overall corporate venture investment activity.

IHS Markit tracks investment activity by oil and gas corporate venture capital groups via a database that provides details of all portfolio investments from January 1998 through June 2018. Data collected include the name of the start-up, oil and gas sector investor(s), start-up location, technology category, investment round, and funding amount (when available). Tracking corporate venture investment activity provides a window into emerging industry technology trends, including

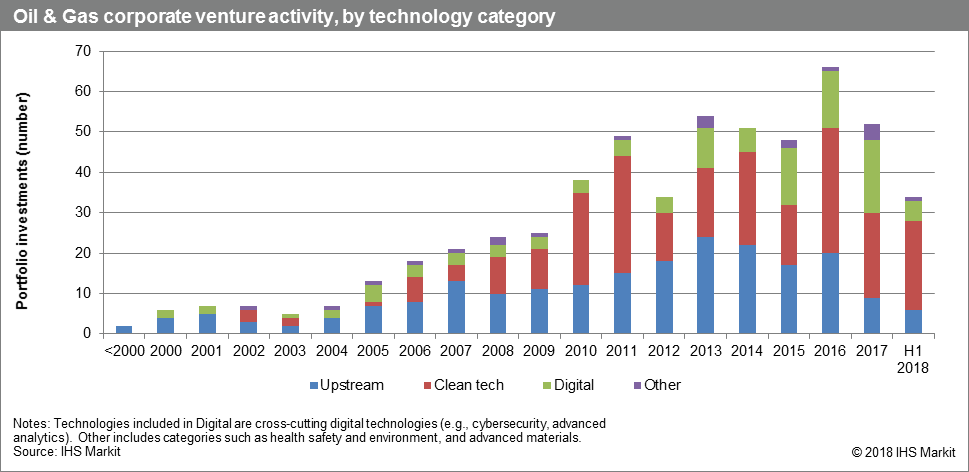

- Corporate venturing continues to be a key source of technology development for oil and gas firms. Oil and gas corporate venture groups participated in 34 new rounds of start-up funding during the first half of 2018, compared with 30 and 35 investments during the first halves of 2017 and 2016, respectively.

- Corporate venture capital is facilitating the energy transition. During this same period, oil and gas corporate venture activity has pivoted from a focus on digital technology (decreasing from 43% of investments in the first half of 2017 to 18% in the first half of 2018) to clean energy (increasing from 38% of investments in the first half of 2017 to 65% in the first half of 2018). Since 2016, IHS Markit has likewise documented the formation of two clean tech-dedicated oil and gas industry corporate venture investment funds (Equinor Energy Ventures and Chevron Future Energy Fund).

- E&P technologies are no longer the primary focus of

oil and gas corporate venture activity. In 2017,

investment in start-ups developing core upstream technologies fell

below 20% of the industry's overall investment activity (9 out of

52 investments). Continuing this trend, upstream investments

constituted only 18% of activity during the first half of 2018 (6

out of 34 investments), and recent investment activity suggests

this fraction will decrease further through to the end of the year.

This development stands out, especially since as recently as 2012

upstream investments represented 53% of overall oil and gas

corporate venture activity (18 out of 34 investments).

Figure 1: Oil & gas corporate venture activity

Learn more about IHS Markit's Upstream Technology and Innovation Service.

Carolyn Seto is a Research Director in the Upstream Technology and Innovation Group at IHS Markit.

Posted 8 November 2018

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-and-gas-corporate-venture-activity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-and-gas-corporate-venture-activity.html&text=Falling+further+from+the+tree%3a+Oil+and+gas+corporate+venture+activity+shifts+away+from+core+E%26P+technologies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-and-gas-corporate-venture-activity.html","enabled":true},{"name":"email","url":"?subject=Falling further from the tree: Oil and gas corporate venture activity shifts away from core E&P technologies | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-and-gas-corporate-venture-activity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Falling+further+from+the+tree%3a+Oil+and+gas+corporate+venture+activity+shifts+away+from+core+E%26P+technologies+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2foil-and-gas-corporate-venture-activity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}