Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ARTICLES & REPORTS

Jan 12, 2021

North Sea service companies continue to struggle, but “green” shoots offer some relief

The latest IHS Markit North Sea Industry Trends report states that North Sea operators and service companies specifically were already reeling going into 2020, and the ongoing difficulties caused by COVID-19 have only exacerbated the situation going into 2021.

Despite the introduction of a COVID vaccine into the European market in late 2020, the economic consequences from the pandemic during most of last year have been ongoing and substantial, if differentiated by individual countries' mitigation strategy:

- Hit hard by the COVID-19 pandemic, the UK economy is expected to contract 11% in 2020. Inflation is expected to remain low owing to low energy prices and depressed levels of consumer spending.

- The Norwegian economy's outlook improved since the last publication: IHS Markit's assessment now stands at -3.8% before expanding by 2.5% in 2021 (a slight pullback from the previously expected 2.9%). Whereas oil and gas investments are expected to take a heavy hit owing to the low commodity price environment, the Norwegian government and central bank have announced fiscal and monetary actions to mitigate the impacts of COVID-19.

- In the first nine months of 2020, the Dutch economy was the best performer in Western Europe, with GDP down just 3% year over year.

- The Danish economy has performed well relative to its peers, with a contraction of only 3.8% for the first three quarters of 2020; IHS Markit expects a contraction of roughly 3.7% for the full year. Denmark is conducting the most COVID-19 tests per capita in Europe, and the government quickly implemented measures to mitigate the economic effects of the pandemic.

- IHS Markit expects the German economy to contract nearly 5.6% in 2020 owing to deteriorating economic conditions resulting from a second round of European COVID infections; rising infection counts toward the end of 2020 are likely to impact future, revised assessments.

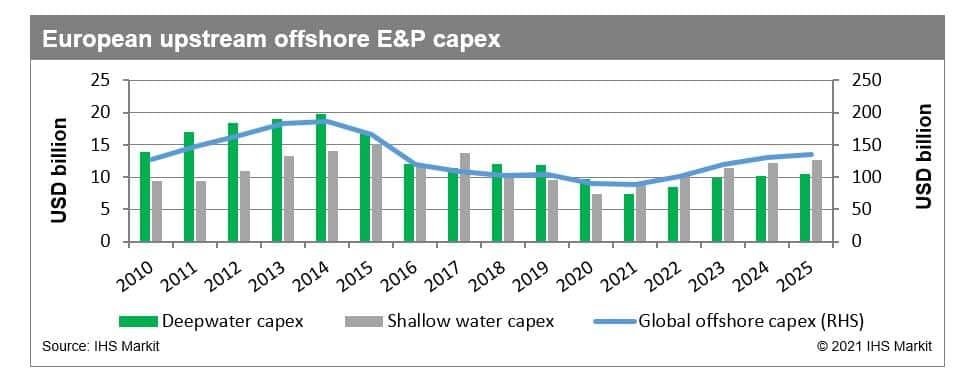

The depressed economic state has lowered demand for oil & gas, and oil prices. Reflective of these conditions, we have revised our global offshore E&P spending assessments downward for 2020. This year, however, saw an upward revision owing to hopes of a widely available vaccine by summer, and 2021 is indeed expected to be the start of an upswing going out to 2025, though spending is not projected to recover to the previous high level of 2014.

Given the high levels of regulations and associated cost, the North Sea is at particular risk of commodity price fluctuations and associated capex cuts, since the most expensive barrels and projects will be the first under the microscope when operators reevaluate their portfolios. Perhaps in acknowledgement of this dynamic, several developments this quarter indicate that Europe sees a future with an energy mix that incorporates more than just oil and gas, as well as mitigates the footprint of those legacy energy sources:

- Denmark canceled its licensing round and pledged to cease oil and gas production by 2050.

- In response to an increase in offshore wind activity, IHS Markit has expanded its FieldsBase database to capture such projects globally; in Germany, most of the new projects added since the last North Sea Industry Trends report in fact are for offshore wind.

- Certain contractors mentioned in this report have entered into agreements to study applications of carbon capture, utilization, and sequestration.

With slack capacity in supply chains for oil and gas work, these additional avenues explored by operators could mean benefits for the environment as well as contractors' bottom lines; notably, up to 50% of remotely operated vehicle (ROV) work for instance is now for offshore wind projects. These "green" shoots will not bring activity back to historically high levels (at least not in the near-term), but it may allow some service companies to hang on long enough to see a second wave of demand for their work, still energy-related but not necessarily for legacy oil & gas projects.

For more information on the IHS Markit North Sea Industry Trends report, IHS Markit's Upstream Cost and Technology group, IHS Markit FieldsBase, or IHS Markit's offshore wind research, please contact James Blanchard.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-sea-service-companies-continue-to-struggle.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-sea-service-companies-continue-to-struggle.html&text=North+Sea+service+companies+continue+to+struggle%2c+but+%e2%80%9cgreen%e2%80%9d+shoots+offer+some+relief+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-sea-service-companies-continue-to-struggle.html","enabled":true},{"name":"email","url":"?subject=North Sea service companies continue to struggle, but “green” shoots offer some relief | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-sea-service-companies-continue-to-struggle.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=North+Sea+service+companies+continue+to+struggle%2c+but+%e2%80%9cgreen%e2%80%9d+shoots+offer+some+relief+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-sea-service-companies-continue-to-struggle.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}