Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 16, 2021

North American Abandonment and Decommissioning Woes

Introduction

The reality of shortfalls in funds to cover decommissioning and abandonment may not be topping the list of concerns of governments in the current climate but it is undoubtedly on there. The US federal government is being faced with the fact that these obligations often simply cannot, or will not, be met by the parties who should be responsible for them and is taking action to address this.

Fragility of current abandonment provisions

An ongoing bankruptcy case has highlighted the fragility of the current abandonment provisions. Fieldwood are filing for bankruptcy and part of the proposed plans are that they will effectively give up some Outer Continental Shelf (OCS) oil and gas leases. Unsurprisingly, this is raising the hackles of other OCS operators. US law provides that where a company which is liable for abandonment costs cannot meet them then the Government can call on predecessor lessees to do so. This provision is codified in Title 30, Part 556.170 of the Code of Federal Regulations which provides that an assignor remains liable for all obligations, monetary and non-monetary, that accrued in connection with the lease during the period in which it owned it. On the one hand the provisions of the US law seem on the face of it fair: the idea that a lessee who assigns a lease has no responsibility for its clean up seems to place too large a burden on the final lessee. On the other hand, though, the idea that that final lessee may simply walk away from its obligations also raises questions of equity.

Fairly minimal legislation in place

In fairness, the system in place does try to ensure that lessees

who have held a lease provide funds for the costs associated

therewith by way of a bond, required at the time the lease is

signed. Simple then right - if each lessee provides such a bond

then the obligations will be met? Not so, unfortunately. In

reality, the legislation in place is fairly minimal; 30 CFR 556.900

provides () that only a USD 50,000 bond is required upon issuance

(or assignment) of an oil and / or gas lease to ensure compliance.

While this figure is clearly well short of typical abandonment

costs, the legislation offers more: 30 CFR 556.901 provides that an

additional bond will be required (before development and

production) in the sum of USD 500,000 and that this bond amount can

be set at a higher amount where this is necessary. Again, though

what appears to be an easy solution has not proved to be so. It has

been reported that the Bureau of Ocean Energy Management (BOEM)

does not usually require this additional funding. Reasons for this

lack of demand can (per 30 CFR 556.904) include: a company (i)

being viewed as financially stable enough to meet all obligations

(or projected to be so based on holdings / reserves), (ii) having

reliably met obligations, or (iii) having a good record of

compliance with lease terms.

Of course, though, regardless of apparent stability and

reliability, no company is exempt from the possibility of financial

straits. In order to deal with such situations a proactive approach

is advocated by the current Administration. The changes we expect

to see are either a reintroduction of Notice to Lessees NTL 2016-1,

which was issued in 2016 and then rescinded under President Trump's

administration, or a new notice with similar provisions.

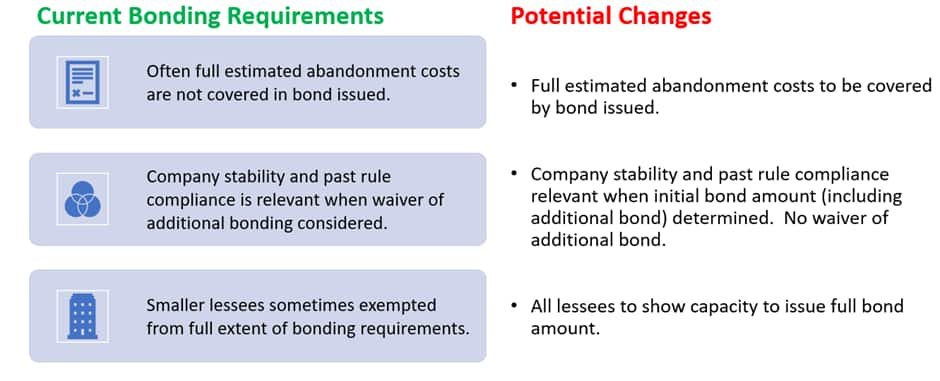

Potential Changes

The most important change we anticipate would be that the bond

required would be far more substantial, waivers from additional

bonding requirements would be no more. We could lay out all the

reasons why the government would implement this rule but really any

question of "why" feels like a rhetorical one. Also anticipated is

a rule that where there are co-lessees, they would all have to show

they are financially able to meet the full bond requirement. The

rationale behind this rule change stems from concern that where

smaller companies are not required to show capability of issuing

the full bond, then the obligation falls on a larger co-lessee. The

bond though may end up falling short then, since that larger

company could be excused from providing the additional bond for one

of the exemptions listed above. This sort of double exemption

clearly jeopardizes the likelihood of abandonment obligations being

properly met.

As regards the bond amount being set, we also anticipate some

changes: NTL 2016-1 provided for a strengthened assessment of a

company's ability to meet obligations under the lease to determine

the bond amount required. This pro-active approach would look at

e.g., a company's past compliance when working in the OCS right

from the outset of the bonding process. This is a big change to the

current method where that behavior may be looked at only as a

mitigating factor in the question of whether additional bonding is

required at all.

Are the anticipated changes welcome?

I think this question, like many depends on perspective: For the

average American taxpayer, then yes of course ensuring those

companies who operate have the funds for clean-up is welcome. For

the lessees themselves the answer may be more nuanced. Larger

companies may be disappointed to lose the status that seems to have

come from being "a major", an assumption of financial stability

which has allowed them to outlay less in bonds has likely been a

major benefit. However, it's possible that, more valuable than that

initial saving, is the reassurance that your fellow lessees are

also able to meet their share of the costs and that your status

will not so readily render you as the "last man standing".

What may newly "stretch" some smaller companies is the requirement

of capacity to provide the full bond (even if their share of the

costs will in fact be less). However, we understand that the BOEM

is likely to take a pragmatic approach to this with an acceptance

of a plan for how the abandonment costs should be split between all

the relevant parties. The takeaway there may be then the need for

smaller companies to be proactive in reaching out to co and past

lessees to apportion responsibility.

Conclusion

In fact, the takeaway for all lessees may be to take the same proactive approach the government seems to be aiming for: be aware of upcoming liabilities as regards each lease; know who you are in bed with for those liabilities and the stake each of you holds and, possibly most importantly, figure out what concessions will be given by the BOEM as they transition from a fairly lessee friendly bonding process to one which undoubtedly raises the stakes.

Screen upstream opportunities and above-ground risk with PEPS from IHS Markit.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-abandonment-and-decommissioning-woes.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-abandonment-and-decommissioning-woes.html&text=North+American+Abandonment+and+Decommissioning+Woes+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-abandonment-and-decommissioning-woes.html","enabled":true},{"name":"email","url":"?subject=North American Abandonment and Decommissioning Woes | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-abandonment-and-decommissioning-woes.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=North+American+Abandonment+and+Decommissioning+Woes+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnorth-american-abandonment-and-decommissioning-woes.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}