Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

POINTLOGIC NEWS

Jan 03, 2020

New Study by Global Energy Institute Puts Impact of Fracking Ban at $7.1 Trillion Over Four Years

A ban on fracking in the US would quadruple the price of natural gas, double the cost of crude oil, and cost the economy $7.1 trillion in the four years from 2021 through 2025, said the Global Energy Institute (GEI), an arm of the US Chamber of Commerce.

This latest GEI study complements a study released last month on the impact of a “keep it in the ground” ban on oil and gas production, as GEI looks at the possible economic impact if the full policy proposals of some leading Democratic Party candidates for president are enacted.

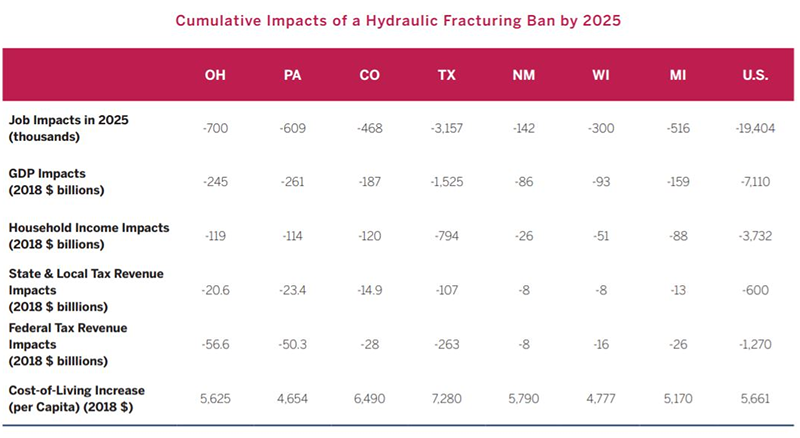

“A ban on fracking in the United States would be catastrophic for our economy. Our analysis shows that if such a ban were imposed in 2021, by 2025 it would eliminate 19 million jobs and reduce U.S. Gross Domestic Product (GDP) by $7.1 trillion,” GEI said in its report on December 18.

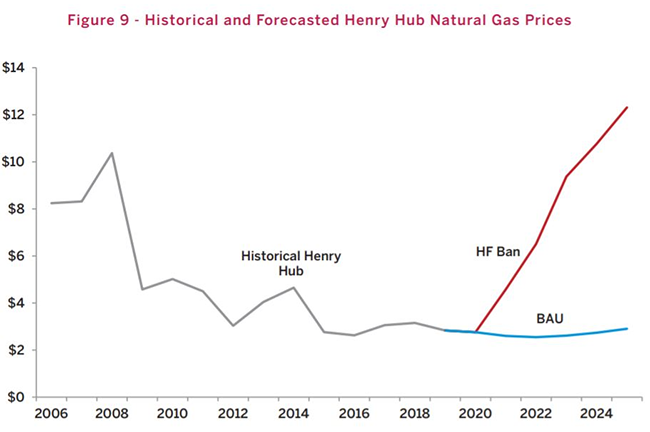

“Tax revenue at the local, state, and federal levels would decline by nearly a combined $1.9 trillion, as the ban cuts off a critical source of funding for schools, first responders, infrastructure, and other critical public services,” GEI said. “Energy prices would also skyrocket under a fracking ban. Natural gas prices would leap by 324 percent, causing household energy bills to more than quadruple.”

A fracking ban also would undermine US energy security and trade balance, as well as limit global supply of natural gas, which has been displacing coal in many consuming nations, GEI said. “Since 2005, the increased use of natural gas has helped reduce U.S. carbon dioxide emissions by more than 2.8 billion metric tons, roughly the equivalent of annual emissions from Australia, Brazil, Canada, France, Germany, and the United Kingdom combined,” it said.

Supply impact

The study is based on what GEI calls conservative assumptions. These include the continued use of hydraulic fracturing in non-tight oil and gas plays, and a 23.7% annual decline rate for existing shale plays. GEI also assumes a drop in gas exports to Mexico, and increase in gas imports from Canada, and a shift from LNG exporting to LNG importing—all designed to close the supply/demand gap that would occur as shale gas is phased out.

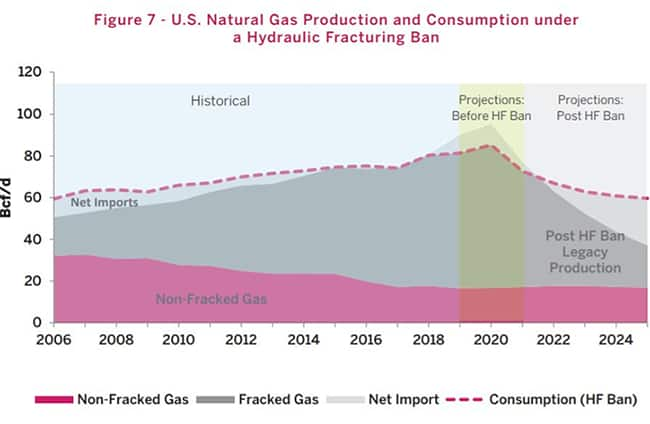

“Currently, shale production is about 50.5 Bcf/d or 62 percent of U.S. production. Under a hydraulic fracturing ban, production from existing sources would drop significantly due to the field production decline rates. Similarly, natural gas production from tight gas formations would drop quickly as well, since they rely on hydraulic fracturing to generate production,” GEI said.

With gas in tighter supply (see 1st graph below), prices would soar to $12/MMBtu by 2025 (2nd graph).

Economic impact

With supply for gas and oil constricted, energy prices would rise dramatically. In addition to $12/MMBtu gas, GEI says that West Intermediate crude would reach about $130/bbl by 2025, or more than double today’s price and nearly double the forecast out to 2025.

“In 2025, the U.S. would lose around 19 million jobs and $2.3 trillion in GDP. For comparison, this is roughly three times the economic impact of the Great Recession of the late 2010s,” GEI said. “Disallowing hydraulic fracturing would shrink the size of the U.S. energy industry and eliminate its ability to cushion the economy against large swings in prices. A ban on hydraulic fracturing would essentially be the worst of both worlds – low production as if prices were low, while the rest of the economy (in the form of millions of households and businesses) struggles to adapt to a doubling of oil prices and quadrupling of natural gas prices,” it said.

The economic results for the nation and for key energy-producing states (as well as two, Michigan and Wisconsin, which are considered to be close in the 2020 election) is shown below.

Reprinted from PointLogic News. For more natural gas news from IHS Markit, visit the PointLogic website.

Kevin Adler is an Editorial Director, Natural Gas, at IHS Markit.

Posted 03 January 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnew-study-puts-impact-of-fracking-ban.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnew-study-puts-impact-of-fracking-ban.html&text=New+Study+Puts+Impact+of+Fracking+Ban+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnew-study-puts-impact-of-fracking-ban.html","enabled":true},{"name":"email","url":"?subject=New Study Puts Impact of Fracking Ban | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnew-study-puts-impact-of-fracking-ban.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+Study+Puts+Impact+of+Fracking+Ban+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnew-study-puts-impact-of-fracking-ban.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}