Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 16, 2017

New bid rounds in Poland – inventory of reservoirs in areas offered to revitalize exploration

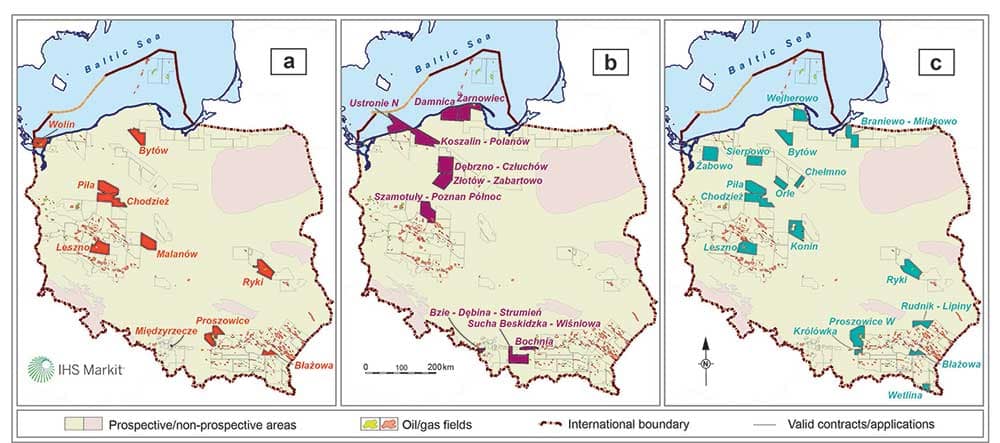

The Geological and Mining Law of Poland, effective since 1 January 2015, abolished previously-existing acreage granting schemes, notably the "open door" policy, and stipulates that a contract for exploration and production of hydrocarbons can only be awarded through a tender procedure. In accordance with the provisions, the Department of Geology and Geological Concessions at the Ministry of Environment - the country's sole authority managing hydrocarbon concessions - announced in June 2015 ten blocks for licensing in 2016 (Figure 1a). A year later, in June 2016, the authorities presented a further ten areas for tendering in 2017 (Figure 1b) and, in June 2017, an additional 17 areas for offering in 2018.

Figure 1: Map of Poland displaying the location of the blocks offered in 2016 tender call (a), as well as the areas proposed for tender in 2017 (b) and in 2018 (c). Correct as of July 2017.

All offered areas are located within the country's proven petroleum provinces: a) Baltic Basin (northern Poland), b) Polish Permian Basin with its basement (western/northwestern Poland) and c) Carpathian petroleum province (southern Poland). The targets of exploration in the Baltic Basin are related to the Early Palaeozoic petroleum plays, the Late Palaeozoic petroleum plays are found in western/northwestern Poland, while a variety of the Palaeozoic (sub-thrust)-Mesozoic-Tertiary petroleum plays are targeted in the Carpathian province. The hydrocarbon potential of these plays lies within a number of conventional targets and unconventional reservoirs (CBM, tight series, organic-rich mudstone ("shale") successions).

The following paragraphs present a brief outline of the said petroleum provinces, listing the principal reservoir horizon(s) targeted in a tendered block.

a) Baltic Basin

Exploration of the conventional targets in the Baltic Basin dates back to late 1960s. In the early 1970s, domestic company Polskie Górnictwo Naftowe i Gazownictwo (PGNiG) made a few small discoveries onshore, e.g. Żarnowiec oil field, while Petrobaltic was successful offshore. The pools were found in the Middle Cambrian siliciclastic units, but due to the area's inferred limited prospectivity, the onshore sector remained dormant. Recent study of Wójcicki et al. (2014) argues that the Cambrian series may hold tight gas potential of at least 1.3 Tcf. These prospective units are present in the Braniewo-Miłakowo, Damnica, Wejherowo and Żarnowiec blocks.

The recent surge of oil and gas production from unconventional reservoirs radically changed the view of the basin's hydrocarbon prospectivity. During 2007-2014, the Baltic Basin was perceived as one of Europe's most promising sectors for unconventional hydrocarbon exploration. Until 2010, operators of all sizes, from majors through to mid-size independents to niche players acquired acreage in the basin - valid contracts covered the entire area believed to be prospective.

The proposed areas Braniewo-Miłakowo, Bytów, Damnica, Wejherowo and Żarnowiec largely follow the limits of the contracts held a few years ago by operators exploring the Lower Palaeozoic organic-rich mudstones. The prospective intervals are found within the Upper Cambrian-Lower Ordovician Piasnica Formation, Middle-Upper Ordovician Sasino Formation and Lowermost Silurian Jantar Member (Paslek Formation). The wells drilled to assess these targets - e.g. Gapowo 1/ST1 (Bytów), Warblino 1/1H (Damnica), Lublewo 1/ST-1H (Żarnowiec) and the wells on Wejherowo - have all shown that the prospective successions are hydrocarbon-bearing and that the extraction of hydrocarbons is feasible. However, fracture stimulations and tests even in the horizontal sections failed to deliver commercial flow rates.

Due to unsuccessful efforts of unlocking the potential of the series and owing to rising uncertainty related to the country's changing legal/fiscal regime, virtually all active players pulled out from the area by mid-2015; domestic operator PGNiG ended its "shale" related drilling program in 2016.

b) Polish Permian Basin

The western part of Poland is underlain by the Polish Permian Basin and its basement succession. The area is recognized as one of the country's principal hydrocarbon provinces since the early 1960s. The area hosts the bulk of the hydrocarbons discovered in the country.

The petroleum systems recognised in the region are related to the Devonian, Carboniferous and Permian series. The Devonian strata along the limit of the East European Craton are preserved in the Pomerania and Lublin areas. The Carboniferous successions sub-crop over the bulk of the central and southern sectors of the basin. The hydrocarbon potential of this series relates primarily to the conventional and tight reservoirs (concept of methane gas extraction from Carboniferous organic-rich mudstones has yet to be proven). The overlying Permian (Rotliegend) sequence is characterized by sediments deposited in a divergent basin within the inherited Variscan basement structure. The prolific series, hosting substantial hydrocarbon accumulations in sandstones developed in the aeolian facies, is found within the upper part of the succession. The targets are primarily conventional, though recent exploration increasingly focuses on the low-porosity/low-permeability zones. The successive Zechstein series contain two productive calcareous horizons: Basal Limestone and Main Dolomite (holds one of Poland's biggest hydrocarbon fields found in the platform to toe-of-slope setting).

Fifteen areas selected for 2016-18 licensing lie within the Polish Permian Basin - Wolin, Żabowo, Ustronie N, Koszalin-Polanów, Sierpowo, Dębrzno-Człuchów, Złotów-Zabartowo, Chełmno, Orle, Piła, Chodzież, Szamotuły-Poznan Północ, Malanów, Konin and Leszno from northwest to southeast and south - with five of them tendered in 2016. The Wolin block overlies the northern shelf of the "Zechstein basin", with the Main Dolomite unit as the prime target of exploration. The Chodzież and Piła blocks occupy the central sector of the basin, a novel concept, as to-date exploration largely concentrated on its southern limit. The expected targets are in the Permian fluvial/alluvial deposits, (potentially) aeolian series and the underlying Carboniferous strata, all developed as conventional and/or unconventional reservoirs (the conventional potential is proven, with potential of the tight series still to-be-tested). The Malanów block spans the limit of the prolific aeolian strata, with the Leszno block located south of the Wolsztyn High and offering conventional exploration of the Carboniferous-Permian series.

Tenders planned for 2017/18 include 13 areas within the basin (the Piła, Chodzież and Leszno blocks are offered again). The tracts Ustronie N, Koszalin-Polanów, Dębrzno-Człuchów, Chełmno and Orle fall within the Pomerania petroleum province, where the targets are in the Devonian-Carboniferous-Permian series. The prospectivity of the region was positively tested with the recent well Bajerze 1 ("Tuchola trend"). The areas Żabowo, Sierpowo, Złotów-Zabartowo and Szamotuły-Poznan Północ fall into the northern sector of the basin and are offered to attest Rotligend siliciclastics, Zechstein carbonates and may also include the Carboniferous strata. The block Szamotuły-Poznan Północ is believed to have been selected to explore low-permeability/low-porosity Rotliegend sandstones northwest of the Siekierki gas accumulation successfully tested by the Trzek 1 and Krzesinki 1 wells.

The Konin block, located in the easternmost extension of the Polish Permian Basin, is tendered for the overlying Mesozoic (primarily Jurassic) succession.

c) Carpathian Hydrocarbon Province

The Carpathian hydrocarbon province combines the Outer Carpathian fold and thrust system, the Miocene foredeep and their respective basements. The province has been explored for oil and gas since the mid-19th century and remains one of the prime regions of activity for domestic operators.

The fold and thrust system is formed by a stack of thrust sheets (Skole/Sub-Silesian/Silesian/Dukla/Magura) with diverse Late Jurassic-Early Miocene stratigraphy and complex tectonics resulting from convergence processes that culminated in the Miocene times. The thrust system is emplaced over the European platform, consisting of the Palaeozoic-Miocene strata, and on the Miocene foredeep basin. The foredeep developed in response to northeastward migration of the peripheral depocentres ahead of the advancing orogenic wedge and was deposited on variable substratum (Paleaozoic through Palaeogene). The tectonic evolution of the province is responsible for highly diversified petroleum systems and for complex configuration of the reservoir series in a petroleum system; depending on the position within a thrust fold, the reservoirs are within the basement of the Outer Carpathians (Palaeozoic-Miocene), in the Outer Carpathian thrust system itself, and/or within the Miocene foreland basin and its basement.

Eleven areas designated for licensing in the 2016-18 rounds are located within the geographic limits of the Carpathian hydrocarbon province. Three blocks - Blażowa, Międzyrzecze and Proszowice - were tendered in 2016.

The blocks Bzie-Dębina-Strumień and Międzyrzecze within the Carpathian foredeep ahead of the Outer Carpathian overthrust, were offered for the Carboniferous targets below a thin Miocene cover. The Sucha Beskidzka-Wiśniowa block overlies the limit of the Magura and Silesian thrust units and the potential targets are multiple: Lower Cretaceous Lgota sandstones, the Upper Cretaceous-Lower Paleocene Istebna Beds, Upper Palaeocene-Middle Eocene Ciężkowice sandstones and the Oligocene-Miocene Krosno Beds within the Silesian thrust, with the Upper Cretaceous-Lower Paleocene Inoceramian Beds - equivalents to Godula and Istebna Beds - in the Magura thrust (notably, discoveries in the turbiditic sequences in the western sector of the Magura thrust have yet to be made). Additional potential could exist in the Devonian carbonates, productive in the Lachowice field. The Królówka and Bochnia blocks span the front of the Outer Carpathian overthrust and hold potential in the Miocene series, as well as in the Cretaceous, Upper Jurassic, Carboniferous (and Devonian?) sequences, all in the sub-thrust position. The Proszowice and (re-drafted) Proszowice W blocks hold operational targets in the substratum of the Carpathian foredeep: the Upper Jurassic (Oxfordian) carbonates and Lower Cretaceous (Cenomanian) sandstones, both units representing the reservoirs in the Grobla and Plawowice oil fields. The Rudnik-Lipiny area has targets in the Miocene series and in the basement (primarily Upper Jurassic-Cretaceous sequences). The Blazowa block, overlaying the Skole thrust in the eastern sector of the thrust system, has targets in the Miocene series, Upper Cretaceous-Palaeocene Inoceramian Beds and Oligocene Kliwa sandstones, with additional potential in the Carboniferous (and Devonian?) series in sub-thrust position. The prospectivity of the tract is attested by the nearby Husow-Albigowa-Krasne gas field. The exploration targets in the Wetlina block are in the clastic series of the Dukla-Silesian thrusts (lateral equivalents of the Godula, Lgota, Grodziszce sandstone units), found productive in the Wetlina gas field.

Tender call 2016

The areas selected for tendering in 2016 were released piecemeal: the procedures commenced on 23 June with the publication of the first two blocks - Blazowa, Międzyrzecze - in the EU Official Journal. Further announcements followed during the second half of 2016-early 2017: Bytow (1 July), Proszowice, Ryki (4 October), Wolin (8 October), Chodzież, Malanów (9 November) and, finally, Leszno and Piła (2 March 2017). The bid term in each case was 90 days, so the tender call for the last two blocks closed in May 2017.

As a result of Round 1, two contracts (Międzyrzecze and Malanów) were awarded to PGNiG and an offer was lodged for the Wolin area.

A rather limited pool of applicants participating in Round 1 is believed to be partly related to the process of mandatory pre-qualification prior to tender. A prerequisite since 2015, every entity interested in obtaining contract for hydrocarbon exploration and production in Poland, either as operator or a member of a consortium, has to undergo evaluation in terms of the firm's operational experience, financial strength and state security. Until May 2017, seven companies pre-qualified and are certified to attend a tender. Five of these companies are domestic players.

The Międzyrzecze contract secured for CBM exploration and exploitation opens a new chapter for PGNiG, which, according to its latest operational strategy, intends to be increasingly involved in extraction of methane gas from Carboniferous coal seams in the Upper Silesian Coal Basin. The block covers part of an area previously held by Dart Energy, where it drilled two CBM wells. As part of a new scientific program, PGNiG re-opened and fracture-stimulated one of the wells in late 2016/early 2017. The well was tested and is understood to have been successful.

Road ahead

The 2016-18 offerings are intended to stimulate interest in Poland's prospective acreage after the departure of many players dissatisfied by the outcome of unconventional exploration, uncertainty relating to changes in the country's legal and fiscal regime and the devastating results of the low oil price. On the face of it, it seems that offering new acreage is indeed steering attention of the explorers to "new" opportunities. Still, timing of the tender during a period of depressed commodity prices and stricken access to capital appears unfavourable.

The idea of bid-related arrangement as the sole method of awarding acreage for hydrocarbon purposes came under scrutiny during Round 1, as the process was recognized inconvenient. Consequently, the country's lawmakers are working to restitute the "open door" policy into the legal system. The Mining Law is under revision since late 2016 to become more business-oriented.

All the same, in August 2017, the first out of ten tenders in Round 2 is expected to be published in the EU Official Journal. To maintain momentum and to further attract players to the market that has a large population, increasing domestic energy demand and firm commodity prices, the authorities prepared the acreage inventory for 2018 (Round 3).

Learn about additional technical content delivered by our Global Exploration & Production Service.

Piotr Gawenda is a Technical Research Associate Director at IHS Markit.

Posted 17 October 2017

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnew-bid-rounds-in-poland-inventory-of-reservoirs-in-areas-offered-to-revitalize-exploration.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnew-bid-rounds-in-poland-inventory-of-reservoirs-in-areas-offered-to-revitalize-exploration.html&text=New+bid+rounds+in+Poland+%e2%80%93+inventory+of+reservoirs+in+areas+offered+to+revitalize+exploration","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnew-bid-rounds-in-poland-inventory-of-reservoirs-in-areas-offered-to-revitalize-exploration.html","enabled":true},{"name":"email","url":"?subject=New bid rounds in Poland – inventory of reservoirs in areas offered to revitalize exploration&body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnew-bid-rounds-in-poland-inventory-of-reservoirs-in-areas-offered-to-revitalize-exploration.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+bid+rounds+in+Poland+%e2%80%93+inventory+of+reservoirs+in+areas+offered+to+revitalize+exploration http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fnew-bid-rounds-in-poland-inventory-of-reservoirs-in-areas-offered-to-revitalize-exploration.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}