Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 10, 2021

Modest Canadian 2021 gas production outlook suggests stable prices, even without workaround for pipeline bottlenecks

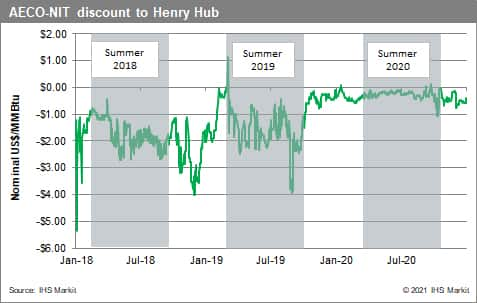

After the Canada Energy Regulator (CER) in February denied requests to extend TC Energy's temporary service protocol (TSP), which was conceived as a short-term fix for AECO-NIT gas price volatility, the market fretted over the threat of a return to the volatile pricing blowouts of 2018 and 2019, in which AECO-NIT traded negative on multiple occasions.

Fueling that anxiety was a delayed timeline for much-anticipated expansions on TC Energy's Nova Gas Transmission (NGTL) system, a project designed to add capacity to a system vulnerable to bottlenecks.

But our view of Canadian gas production and its likely trajectory over the next 12 months may ease the operational pressure that drove the price drops of the recent past.

When the TSP was conceived, it was billed as a temporary change to NGTL's maintenance disruption policy, set to take effect in the October-2019 and summer-2020 (April-October 2020) injection seasons. In general terms, TC Energy swapped the priority given to firm transmission (FT) flows and interruptible transmission (IT) flows. If a planned maintenance outage was expected to disrupt gas flows on NGTL, the TSP would prioritize IT flows to storage sites at the expense of FT flows such as receipts (or supply) on the system.

NGTL's previous maintenance disruption policy reduced IT flows first, keeping FT volumes whole, following the standard logic that the costlier and more reliable firm contracts should be prioritized. In 2018 and 2019, this policy resulted in an oversupply of gas on NGTL during maintenance outages. When operational restrictions were required, receipts (supply) flowing onto the pipeline system were kept whole, but storage injections (demand) were interrupted. Given the practical constraints on access to storage facilities arising from this contractual hierarchy and that other routes to demand or export markets were either full or congested themselves, AECO-NIT prices cratered to the point of negative prices on some days.

The Alberta provincial government took note. Concern for loss in royalty revenue and financial health on the part of local natural gas producers accelerated ongoing consultations between shippers and TC Energy, culminating in the TSP. The acceptance of the TSP was, in part, due to the expectation that it would be replaced with a more permanent storage solution upon expiry, such as the proposed NGTL 2021 expansions, (collectively called NOVA Gas Transmission Ltd. [NGTL] 2021).

With the addition of 1.45 Bcf/d of capacity to the East Gate border of the system at Empress, Alberta (achieved by debottlenecking capacity upstream of that border), all that was needed was a near-term solution to the anticipated price volatility, hence the TSP.

NGTL 2021 was subject to a prolonged regulatory review prior to its ultimate approval, delaying the expansions by nearly a year. Restrictions designed to mitigate the transmission of COVID-19 in 2020 had the consequence of postponing in-person consultations between stakeholders and the federal governing body tasked with approving the project - the Governor in Council.

Interestingly, basis discounts between AECO-NIT and Henry Hub narrowed during the summer of 2020, and no extreme widening of basis occurred during the period. These prices seem to suggest that the TSP was successfully at work, but in fact it was not invoked in summer 2020.

Access to storage capacity in western Canada also clearly improved, and western Canadian injection volumes nearly doubled, rising from 0.8 Bcf/d in summer 2019 to nearly 1.5 Bcf/d in summer 2020.

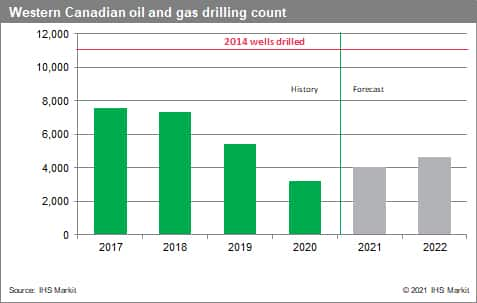

Anemic production relative to prior years can explain the lack of price volatility and improved storage capacity, at least in part. Canadian production averaged just 15.45 Bcf/d in 2020, down from 15.7 Bcf/d in 2019 and 16.2 Bcf/d in 2018.

Canadian production will struggle because of the record-low level of drilling of 2020, with a very modest recovery expected in 2021.

As such, we expect shippers to have unimpeded pipeline access to storage facilities during 2021 maintenance outages. This means that even without an extension of the TSP and a delayed timeline for NGTL 2021 expansions, we're unlikely to see a repeat of the 2018/2019 price volatility during maintenance outages.

Posted 10 June 2021 by:

Ian Archer, Director, Climate and Sustainability

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmodest-canadian-2021-gas-production-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmodest-canadian-2021-gas-production-outlook.html&text=Modest+Canadian+2021+gas+production+outlook+suggests+stable+prices%2c+even+without+workaround+for+pipeline+bottlenecks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmodest-canadian-2021-gas-production-outlook.html","enabled":true},{"name":"email","url":"?subject=Modest Canadian 2021 gas production outlook suggests stable prices, even without workaround for pipeline bottlenecks | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmodest-canadian-2021-gas-production-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Modest+Canadian+2021+gas+production+outlook+suggests+stable+prices%2c+even+without+workaround+for+pipeline+bottlenecks+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmodest-canadian-2021-gas-production-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}