Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 25, 2024

Mind the gap - Chinese leading power companies’ evolving overseas strategies

The Third Belt and Road Forum held recently celebrated the 10th year anniversary since China firstly put forward Belt and Road Initiative (BRI) as a national strategy in 2013. How have Chinese leading power companies, mainly state-owned, developed their overseas' strategies over the past decade following the guidance under BRI?

More recently, China has released some more policies signals during COP28 to push forward Chinese power sector activities overseas. Will these change Chinese power companies' overseas strategies in the future?

S&P Global Commodity Insights reviewed Chinese leading power companies' historical investments and provisions of energy services activities abroad, and analyzed the trends, drivers, leading players' behaviors and their preferences on markets and technology types. Chinese leading power companies guided by multidimensional domestic policies will continue to expand their footprints outside China, but with a more cautious mindset focusing on core business and markets overseas with a more complex investment environment.

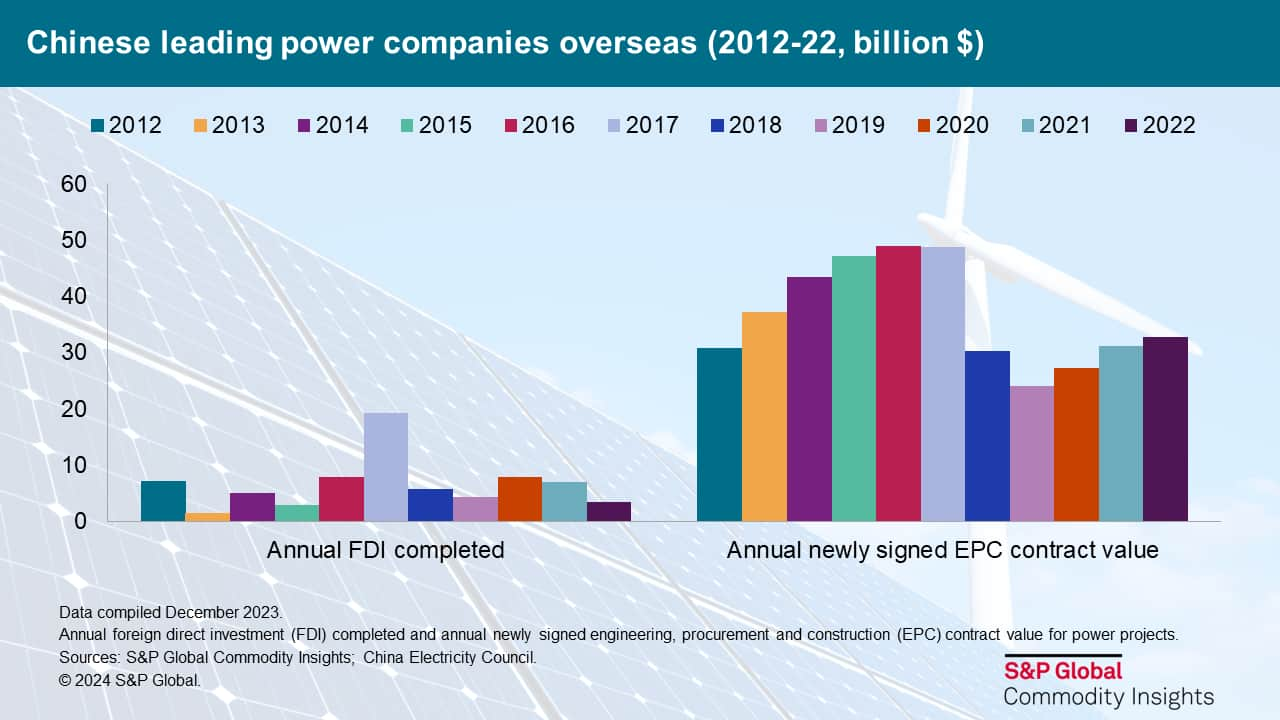

So far, stimulated by the Chinese government's "Go-Out" strategy and the BRI, leading Chinese power companies have significantly expanded their presence globally throughout the power value chain. Compound annual growth rates in overall direct investment value overseas and the accumulated value of signed engineering, procurement and construction (EPC) contracts grew by 11% and 27%, respectively, from 2013 to 2022 — although not always on a fast track, especially after the peak in 2017.

Along the way, policies and investment climates in international markets shifted, requiring adjustments to market entry strategies and opportunity screening for international exploration. As Chinese power companies continue to explore following the national guidance, these companies are likely to share similar trend moving forward, although geographical preferences and comfort levels across technologies vary considerably across the competitive landscape.

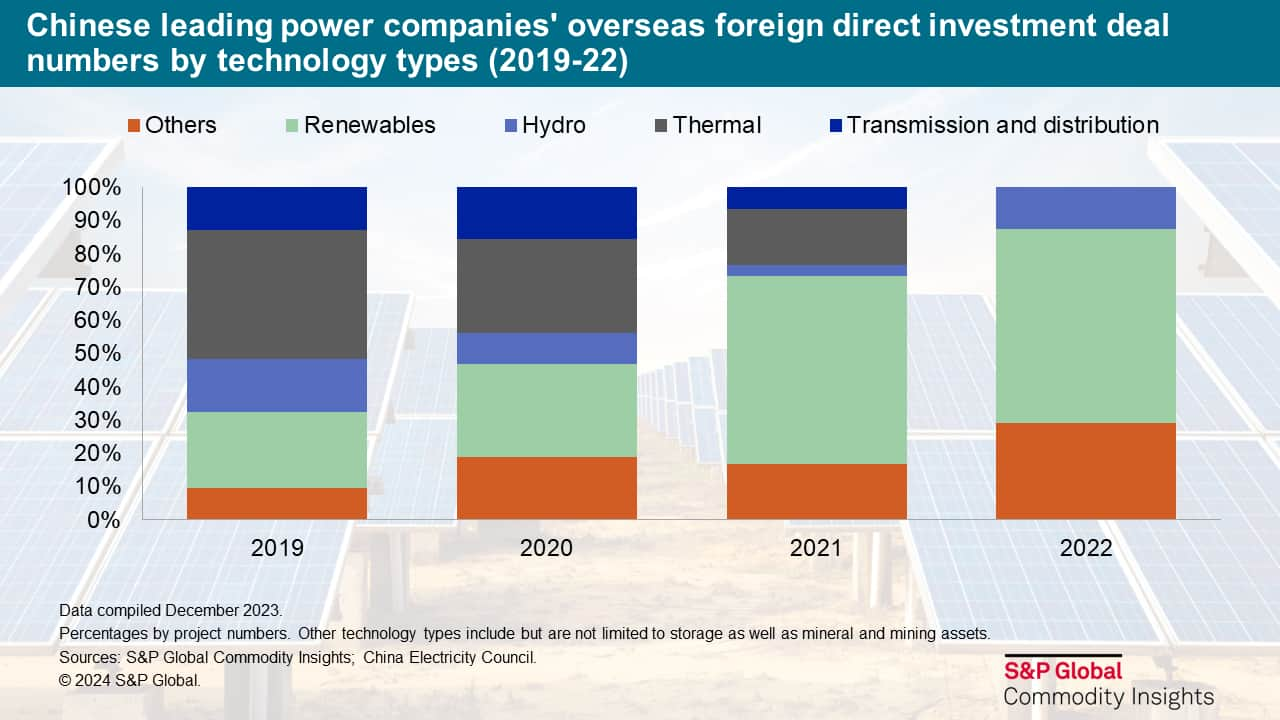

Green energy remains front and center

As China pushes toward a net-zero target, green energy, such as renewable energy and other low-emission technologies, is also becoming the focus for international investment. For newly signed EPC contracts overseas, renewables continue to be a large part of their business, as well as substations and transmission, which support the energy transition in general.

Chinese power companies are more active in Asia and with markets with either a stable business environment or close diplomatic partnership for different opportunities

Over the past decade, Asia has been the most popular destination for Chinese activities internationally. Among the disclosed overseas investments by leading Chinese power companies during the past four years, 60% of deal numbers were in Asia. Europe followed as the second-most active destination for direct investments, with 13% of investment deals in the past four years, while Africa is a priority destination for construction-focused activities. With regards to foreign direct investment (FDI), countries that not only fall under the BRI but are also in a close diplomatic relationship with China attracted more greenfield investments.

Looking forward, activity overseas is expected to continue at a cautious pace

On the one hand, China's BRI policy roadmap and its power companies' successful domestic track record have offered an opportunity for its experienced players along the value chain to explore more international opportunities. On the other hand, multidimensional domestic policies including capital controls, stricter scrutiny on business performance of the overseas assets and governance risks, combined with the more challenging investment environment in most global power markets, tips the risk-reward balance favoring core markets and business segments.

Thus, companies are likely to "play it safe" by sticking with their core business or previously known areas, while following China's overall strategy to favor clean energy investments, especially in countries where China has closer partnerships. Greenfield investments in countries with close ties and lower political risks will become a preferred option compared to acquisitions, as there is a potential for greater value when partnering with other Chinese suppliers across the value chain to go abroad at the development phase. In addition, EPC services will likely continue to be more active than FDI given the less time exposed to project risk.

Other contributors: Bing Han, Chengyao Peng, Chris DeLucia, Etienne Gabel, Lara Dong, Timothy Stephure, & Lisa Pearl

If you are interested in learning more about our Asia-Pacific gas, power and renewables coverage, please click here.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmind-the-gap-chinese-leading-power-companies-evolving-overseas.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmind-the-gap-chinese-leading-power-companies-evolving-overseas.html&text=Mind+the+gap+-+Chinese+leading+power+companies%e2%80%99+evolving+overseas+strategies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmind-the-gap-chinese-leading-power-companies-evolving-overseas.html","enabled":true},{"name":"email","url":"?subject=Mind the gap - Chinese leading power companies’ evolving overseas strategies | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmind-the-gap-chinese-leading-power-companies-evolving-overseas.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mind+the+gap+-+Chinese+leading+power+companies%e2%80%99+evolving+overseas+strategies+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmind-the-gap-chinese-leading-power-companies-evolving-overseas.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}