Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 31, 2017

Mexico's energy reforms begin to pay off

The recent news of a major discovery and a planned fast-tracked development in the Sureste Basin comes as a validation both of Mexico's celebrated energy reforms and its ability to adapt to changing market forces. When reporting on the potentially world class Zama discovery, Talos Energy CEO Tim Duncan commented that the discovery represents exactly what the Mexican government hoped to achieve with the reforms: new capital and participants leading to new resources and higher revenues. Along the same lines, when Eni announced an increased reserve estimate and plans for an accelerated development plan of the Amoca field, CEO Claudio Descalzi commented that the company hopes to be the first foreign investor to establish an operated, commercial field in Mexico, marking what he termed would be the first tangible success of the energy reforms. Although it may now appear all but assured that Mexico's energy reforms will lead to increased production and a more robust energy sector overall, for a time that outlook was far from certain, as Mexico's first bid round was very nearly derailed by the crash in oil prices.

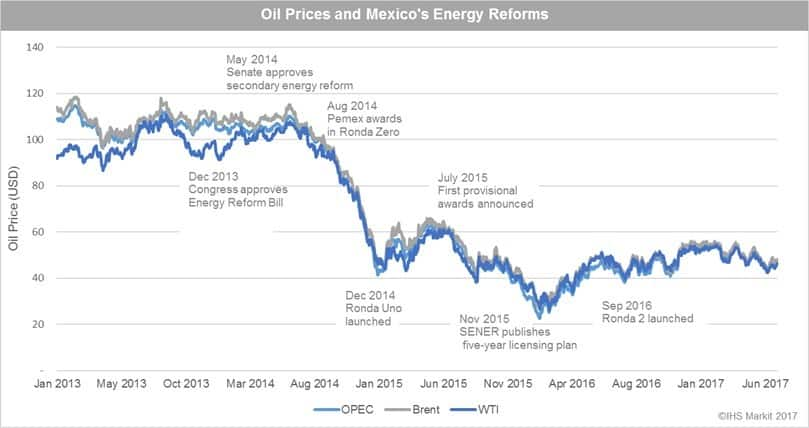

Figure 1: Oil prices and Mexico's energy reforms

When Mexico initiated its historic energy reforms in early 2013, it was against a backdrop of flagging production (oil volumes dropped from a peak of 3.4 MMb/d in 2004 to around 2.5 MMb/d in 2013), poor performance from state-owned oil giant Pemex and steadily rising oil prices. When President Pena Nieto made a speech calling for the opening of Mexico's long-closed energy sector on 17 March 2013, oil prices were averaging USD 93 per barrel, and would rise above USD 100 per barrel later in the same year. The first wave of constitutional amendments passed in December 2013, allowing foreign companies to enter the upstream sector and ending the 75-year Pemex monopoly, followed by further, secondary legislation in mid-2014. Ronda Zero saw the assignment of 83% of proved and probable (2P) resources to Pemex, but with total proved resources estimated at 13 Bboe (as of end-2014), the remaining resources were expected to be more than sufficient to attract industry attention. However, in between the beginning of energy reforms and the launch of the first tranche of Ronda Uno, the oil price began its plunge, reaching what was at the time, a low point of USD 55 a barrel in December 2014. As a result, despite the high anticipation leading up to the Ronda Uno offering, initial industry attention failed to meet expectations, as the majority of operators began to pull back from new investments, slashing capital expenditure and focusing on the development of lower risk assets. Ultimately however, the two agencies primarily responsible for the promotion and regulation of the upstream sector, the Comision Nacional de Hidrocarburos (CNH) and the Secretaria de Energia (SENER) proved adept at adjusting financial requirements, contract terms and bidding rules in response to criticism and requests from stakeholders, which resulted in increased industry interest after an initially disappointing rate of participation. However, as the government take from both fields detailed below is expected to be 83% - 90% of profits, including tax and royalties, it is also clear that the agencies have retained control over the nations considerable resources.

Among the awards following Ronda Uno were Block 7 and Area 1 (Amoca-Mizton-Tecoalli A & B), both in the Sureste Basin, which were awarded to Talos Energy and Eni, respectively. Talos won the rights to the 465 sq km Block 7 in July 2015, and almost exactly two years later, announced the Zama 1 discovery, which is among the first offshore exploration wells drilled by a private company since the reforms went into effect. The well has exceeded pre-drill estimates, encountering a contiguous gross oil-bearing interval of over 335 m, with 170 200 m of net oil pay in Upper Miocene sandstones with no oil water contact. Initial tests indicate API gravities of 28° - 30°. Although Talos has not yet reached the planned total depth of 4,200 m, it has already determined that the structure could extend into the neighbouring block AE-0005, operated by Pemex. In-place resources for the discovery could be as high as 1.4 2.0 Bbbl. Talos noted that while it is eager to begin appraisal, it has no immediate plans for well testing. Instead, the company will focus on calibrating the well with existing geologic data to identify optimal follow-up drilling locations. The well is located some 60 km offshore Dos Bocas in the state of Tabasco in water depths of 166 m. Talos operates Block 7 with 35% interest, partnered with Sierra (40%) and Premier (25%). Of note, the consortium also operates Block 2 in the Sureste Basin off the coast of Veracruz.

Eni was awarded the Area 1 (Amoca-Mizton-Tecoalli A & B) PSC in the Campeche Bay in November 2015. As highly-contested 67 sq km block already contains three discoveries, Enis exploration programme called for four appraisal wells, two of which would focus on the Amoca discovery. Both have been successful, but the completion of the Amoca 3 appraisal well has prompted Eni to both raise its resource estimates for the Amoca discovery to 1 Bboe and move towards a fast-tracked development plan for the find. Amoca 3 was drilled some 1.5 km from the Amoca 1 discovery well and 3 km from the Amoca 2 appraisal, in water depths of 27 m. The well reached a total depth of 4,300 m and encountered some 410 m of net oil pay of 25° - 27° API gravity in high-quality Pliocene sandstones, proving significant oil levels in the Orca and Cinco Presidentes formations. During a subsequent production test, a 45 m section of the Cinco Presidentes sequence flowed 6,000 b/d of 25° API oil. Eni now calculates Area 1 to contain total in-place resources of 1.3 Bbbl (of which 90% is oil) and is already working on an accelerated development plan which could see production in early 2019 and peak volumes of 30 50 Mb/d. The company also plans to complete its appraisal wells on the Mizton and Tecoalli discoveries, so the field resources of the block could be increased still further.

In light of the newly confirmed resources, and highlighting its continued flexibility in the face of changing circumstances, the Mexican authorities have opted to delay the bid submittal date for its current deepwater auction (Ronda 2.4) by a month, pushing it back from December to end-January 2018. The first deepwater bid round, held in December 2016, saw participation from majors including CNOOC, Total, Chevron and Statoil, and while it was already expected that the upcoming round would see high levels of participation from important industry players, the latest proof from Eni and Talos will likely serve to heighten the competition for Mexico's prolific offshore acreage.

Find similar technical content in our International Energy Letter. Read more Mexico data and insight on our Mexico resource portal.

Amanda Nelson is a Senior Technical Research Analyst at IHS Markit.

Posted 31 July 2017

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexicos-energy-reforms-begin-to-pay-off.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexicos-energy-reforms-begin-to-pay-off.html&text=Mexico%27s+energy+reforms+begin+to+pay+off","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexicos-energy-reforms-begin-to-pay-off.html","enabled":true},{"name":"email","url":"?subject=Mexico's energy reforms begin to pay off&body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexicos-energy-reforms-begin-to-pay-off.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mexico%27s+energy+reforms+begin+to+pay+off http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexicos-energy-reforms-begin-to-pay-off.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}