Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 17, 2020

Mexico offshore investments to tumble 20%

Mexico took the spotlight in the midst of energy discussions during the OPEC + meeting, playing an important role in the conduct of the negotiations on cutting oil production. The country refused to cut 400kb / d of its production, a clear message in line with the current government's flag. Mexico's President Andres Manuel Lopez Obrador has pushed to ramp up output at Pemex since coming to power in 2018. But in many ways, the goal is proving be much more difficult to achieve than anticipated.

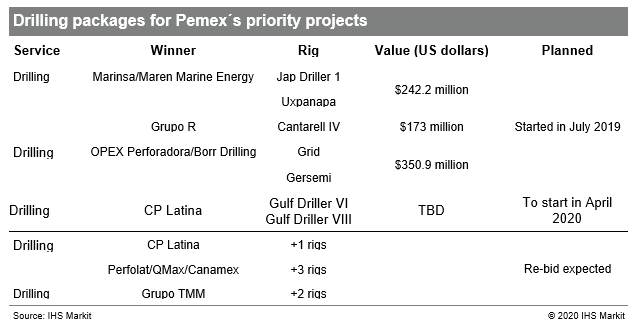

The Mexican national company represents 97% of the country's oil production, which basically comes from offshore fields. As a plan to resume production growth, Pemex prioritized the development of 18 offshore projects for 2020. However, the company is facing some issues with the contracts awarded to local companies with not enough experience in the business. The low prices of the contracts drew attention and Pemex "paid the bill". $1.7 billion distributed in construction and drilling contracts that are now facing delays in activities, with only 3 of the 17 scheduled wells actually being drilled. The companies failed to deliver 6 rigs and we expect a re-bid for this year. Priority plans that, together with IOCs' deepwater developments, could raise the level of production and increase investments in the country by strengthening the local supply chain are now at a dangerous risk.

Figure 1: Drilling packages for Pemex

The coronavirus pandemic and the oil price shock stirred the market. Pemex, facing financial and operational problems, is already suffering from delays in its projects, and more are to come. IOCs are reviewing their portfolios and cutting investments. Deepwater projects, which are in the embryonic stages of exploration, will take even longer to reach the first oil. Some international companies, which had already hired rigs for the exploratory program, have already postponed the start of activities. Murphy had a contract to start in late 2020 and changed the scheduled start date to the first quarter.

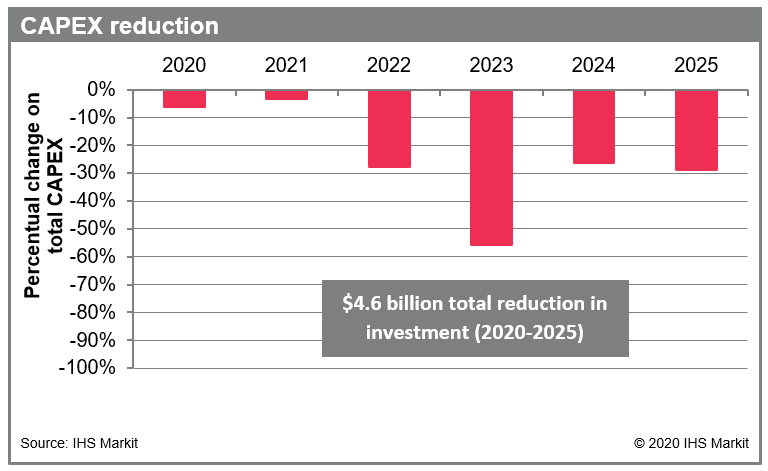

The ripple effect is a reduction on total investiments of 21% for the period of 2020 to 2025 when compared to values of before the crises, amounting to almost $ 5 billion. The fall in investments gain traction mainly after 2022 as both Pemex and the country have some economic relief with oil hedges (even if parcial) and tax reductions, for the next 2 years. IHS Markit estimates that demand for offshore equipment and services in Mexico will fall by an average of 14% in this same period, with a stronger effect on the OCTG sector, highly impacted by the delay on deepwater drilling activities, which requires more casing and tubing mileages.

Figure 2: CAPEX reduction

Renata Machado is a Senior Associate for the Energy Cost

and Technology team at IHS Markit.

Marcos Lepore is a Research Analyst for Oil and Gas Markets

at IHS Markit.

Posted 17 April 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexico-offshore-investments-to-tumble-20-percent.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexico-offshore-investments-to-tumble-20-percent.html&text=Mexico+offshore+investments+to+tumble+20%25++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexico-offshore-investments-to-tumble-20-percent.html","enabled":true},{"name":"email","url":"?subject=Mexico offshore investments to tumble 20% | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexico-offshore-investments-to-tumble-20-percent.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mexico+offshore+investments+to+tumble+20%25++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexico-offshore-investments-to-tumble-20-percent.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}