Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 25, 2020

Mexican OSV market: climbing in thin air

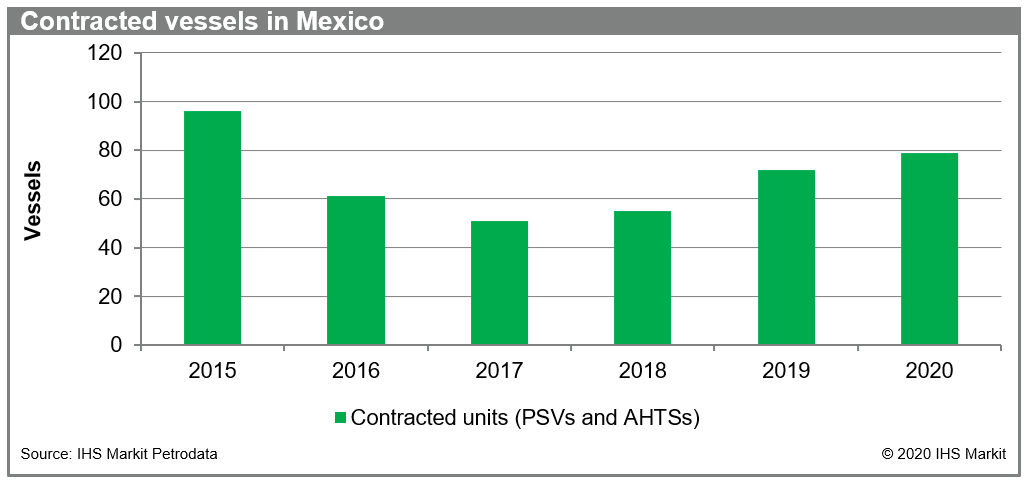

<span/>Mexican offshore logistics market has always been very dependent on Pemex, until recently the only producer and operator in the country. However, the company is no longer able to maintain the activity levels of the past years and the support vessels market was hit hard. Hiring levels for specialized boats such as PSVs and AHTSs have dropped by more than 30% for PSVs and more than 50% for AHTSs in the last 5 years.

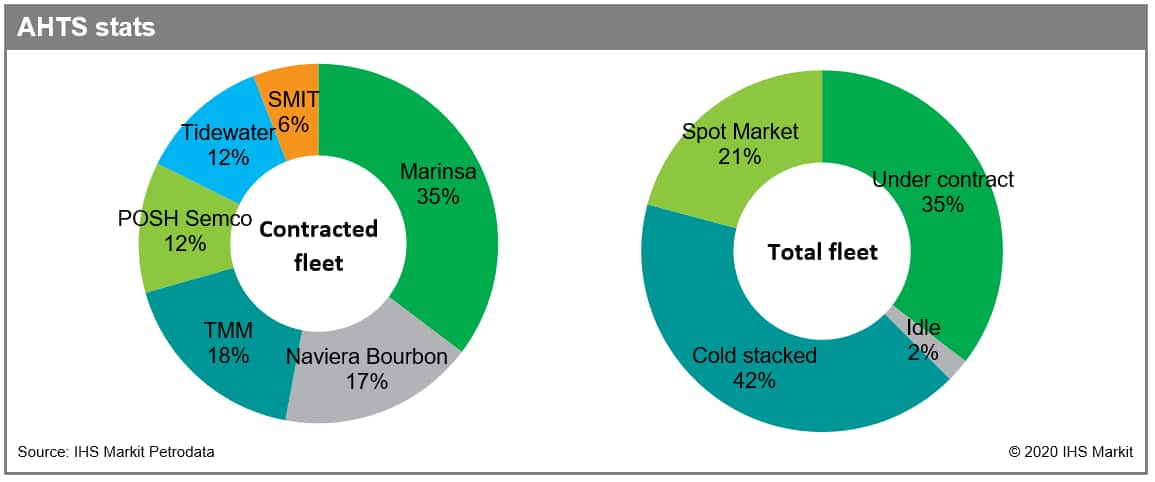

The situation seemed to improve in the beginning of 2020. Contracted PSV fleet finally reached 2015 levels, which was the last "big year" of offshore drilling activity in Mexico, although that of AHTSs remained in a tighter situation. Since Pemex decided to prioritize shallow water fields, IOCs movement into deepwater exploration has concentrated all hope for a further heating of AHTS market.

Figure 1: Contracted vessels in Mexico

Offshore exploratory activity, the main driver for the support vessels demand, was slumped for both Pemex and IOCs.

Pemex has been facing numerous problems in drilling its so-called "priority fields" in shallow water. The exploratory campaigns in these areas are still on hold and shows negligible levels of advance compared with those initially estimated.

IOCs, which were beginning to gain traction in their exploratory plans, had to review their portfolios in response of current crisis, and prioritize more secure investment areas, which is not the case of the new frontiers on Mexican deepwater.

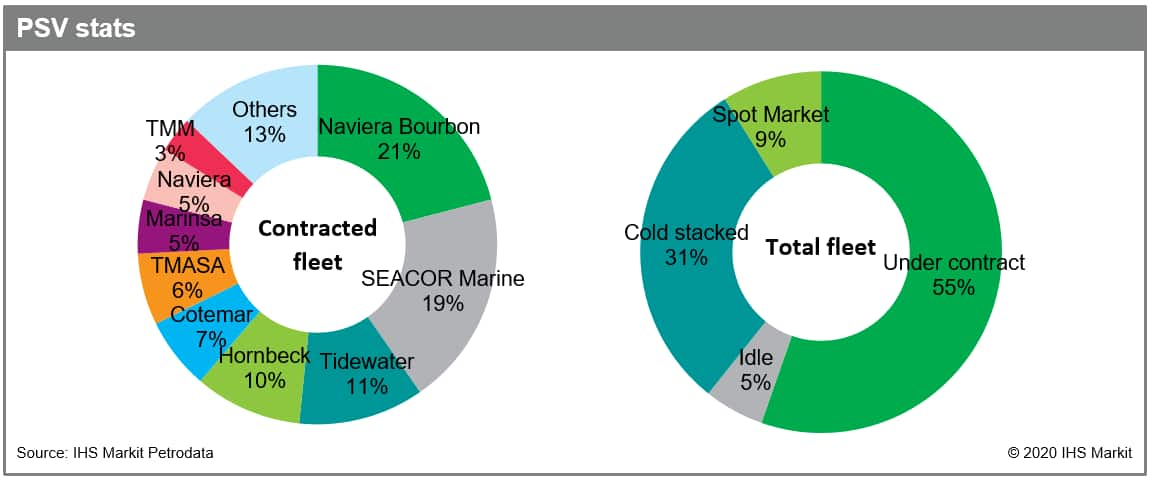

<span/>Pemex, which is responsible for more than 80% of OSV hired in the country, has announced, at the end of April, a cut of 1.66 billion dollars in capex, which represents 10% of the original programmed value for the year. In line with this cut, in early June, the company suspended contracts for numerous logistical vessels including PSVs, AHTSs, ROVs and others. Among the most affected companies are historical Pemex suppliers such as Naviera Bourbon, Tidewater and Marinsa. Unfortunately, this is not an unprecedented situation for the Mexican market. In 2016 and 2017, Pemex suspended contracts of the same nature alleging financial austerity but ended up reactivating them a year later. In those years, Pemex prioritized the suspension of contracts with 6 months or less to expire. If this situation recurs, the company currently has more than 50 contracts of PSVs and AHTSs in this condition, which could make them next targets.

The recovery has been hard for managers operating in the Mexican market past couple of years. Contracts traded already had a reduced profit margin, with very low day rates compared to world's average. Some companies, such as Bourbon Offshore, which owns Naviera Bourbon, had to renegotiate their liabilities. And just when the situation started to improve, they watch powerless a sharp drop in investments due to the worst financial and operational health crisis of their sole contractor. This combination jeopardizer the survival of several managers and put in idle the Mexican OSV market which appeared to be climbing its way back to the top.

Figure 2: PSV stats

Figure 3: AHTS stats

Marcos Lepore is a research analyst for the Cost and

Technology team at IHS Markit.

Renata Machado is a senior research analyst for

the Cost and Technology team at IHS Markit.

Posted 25 June 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexican-osv-market-climbing-in-thin-air.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexican-osv-market-climbing-in-thin-air.html&text=Mexican+OSV+market%3a+climbing+in+thin+air+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexican-osv-market-climbing-in-thin-air.html","enabled":true},{"name":"email","url":"?subject=Mexican OSV market: climbing in thin air | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexican-osv-market-climbing-in-thin-air.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Mexican+OSV+market%3a+climbing+in+thin+air+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fmexican-osv-market-climbing-in-thin-air.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}