Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 09, 2020

Latin America’s offshore activity levels to see slippage as a result of COVID-19

As the COVID-19 pandemic continues its spread across the globe, the oil and gas industry has put into practice new procedures and processes to help mitigate potential infection to its workers. In our talks with O&G players, operators and contractors alike, we are hearing about increased port restrictions. Crew changes in every sector of the industry - rigs, vessels, production platforms - are becoming more difficult by the day and many ports are no longer permitting them.

Looking specifically at Latin America, Mexico has adopted a no crew change policy and will not allow shore leave. Most countries in Central and South America have adopted these policies too. Though most Brazilian ports have suspended shore leave and crew changes outright, some of its ports are still allowing crew members to go ashore in cases of medical emergency or following a 7-14-day quarantine period onboard the vessel. Despite mitigation measures, positive cases of COVID-19 are being reported offshore. On 2 April, a Transocean drillship worker tested positive offshore Brazil, sending 18 workers to shore for quarantining. While this is just one element of the greater crisis at play, this has direct impact on the labour supply chain, not to mention the physical and mental impact this is creating for workers at sea.

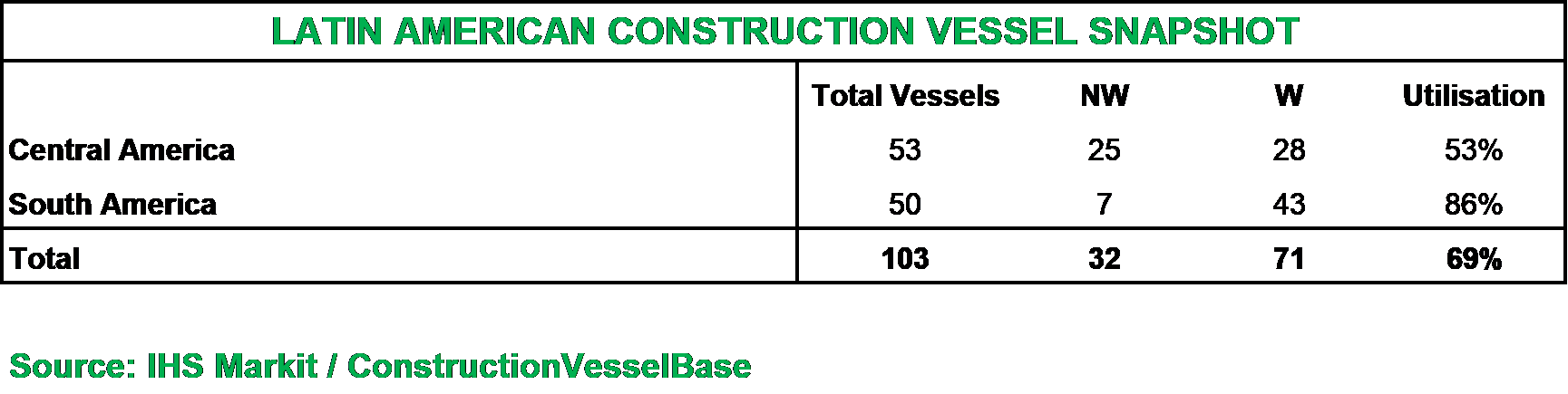

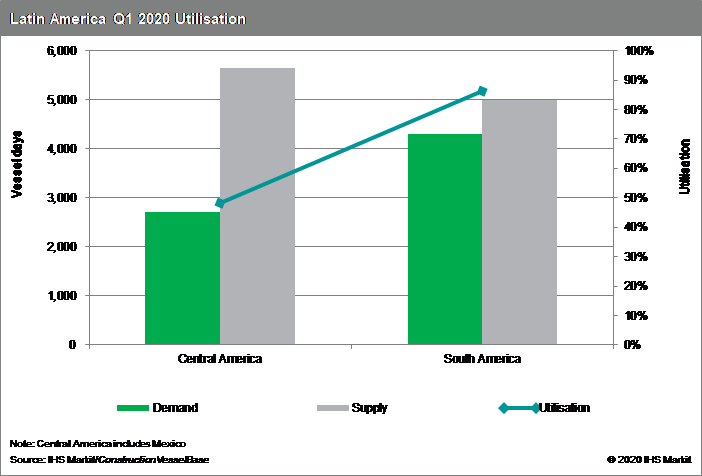

Examining activity levels in IHS Markit's web-based tool ConstructionVesselBase, Latin American vessels remain stable now. However, the dual decline in demand and price of oil, coupled with the Coronavirus pandemic, has already led to major cost reductions and project deferrals amongst operators and it is only a matter of time before it hits offshore construction activity hard. Construction vessel utilisation for Latin America, at the time of this writing, is substantial (Central America which includes Mexico at 53% and South America at 86%) and in line with rates the areas have maintained throughout the first quarter. Of the 71 vessels working in Latin America, the bulk are comprised of accommodation (15), pipelay (17), and ROV support (16).

Figure 1: Latin American construction vessel snapshot.

Figure 2: Latin America Q1 2019 utilization.

As work on projects under construction concludes (or faces delays due to the impact of COVID-19 on the supply chain) and new contracts remain unsigned, this work is expected to dry up. As a result, utilisation rates are anticipated to drop this second quarter. Likewise, day rates are expected to decline too as there becomes an oversupply of vessels and an insufficient pipeline of projects to keep them working. Unlike downturns in the past, relocating to a different market to seek work is not an option. The world over is facing the same set of problems and we are truly all in the same boat. 2020 is going to be a challenging year to say the least.

Heather Gardner is a Senior Field Development Analyst for IHS Markit's Petrodata team.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flatin-americas-offshore-activity-slip-covid19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flatin-americas-offshore-activity-slip-covid19.html&text=Latin+America%e2%80%99s+offshore+activity+levels+to+see+slippage+as+a+result+of+COVID-19+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flatin-americas-offshore-activity-slip-covid19.html","enabled":true},{"name":"email","url":"?subject=Latin America’s offshore activity levels to see slippage as a result of COVID-19 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flatin-americas-offshore-activity-slip-covid19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Latin+America%e2%80%99s+offshore+activity+levels+to+see+slippage+as+a+result+of+COVID-19+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flatin-americas-offshore-activity-slip-covid19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}