Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 16, 2019

Larger turbines and offshore wind boost 2018 global wind turbine orders

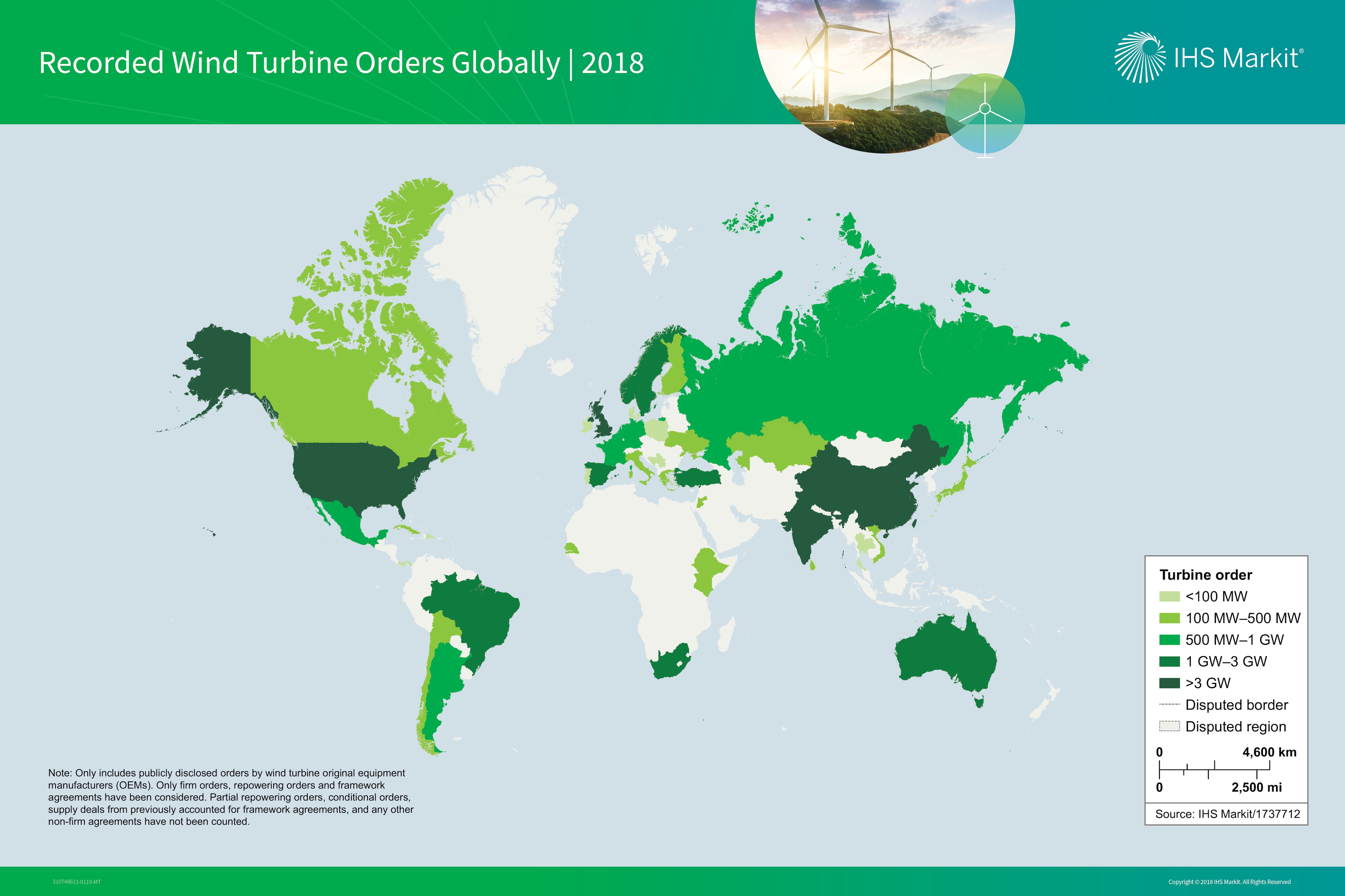

IHS Markit recorded 39 GW of publicly declared wind turbine orders globally in 2018, up 28% from the previous year. In total, orders were placed for three hundred projects to be supplied with over ten thousand turbines by twenty-one turbine manufacturers.

Offshore wind orders boosted Europe to the top spot in 2018. The Asia Pacific region dropped to second place amid a decline in recorded orders from China and India, to some extent counterbalanced by the momentum of the Australian market. Orders from North America more than doubled last year strongly influenced by the scheduled phase-out of the U.S. Production Tax Credit (PTC) and resulting expansion plans of the country's major developers. Together, Latin America and the Africa/Middle East region grew their orders by 69% to 5.5 GW in 2018, as the regions' largest markets Brazil and South Africa recovered after a slump in 2017.

Figure 1: Recorded Wind

Turbine Orders Globally | 2018

Figure 1: Recorded Wind

Turbine Orders Globally | 2018

Danish manufacturer Vestas took the leading spot in 2018 with nearly one-fourth of the total ordered capacity closely followed by Siemens Gamesa. GE derived most of its orders from framework agreements signed in the U.S., in contrast with the top two players who catered to a global customer base. Nordex jumped to fourth place growing its orders threefold in 2018 and benefiting from the popularity of its ACCIONA Windpower technology portfolio in Latin America and the Africa/Middle East region. The top five was completed by MHI Vestas Offshore Wind riding high on its success in the U.K. and Netherlands, further complemented by its new technology portfolio.

A global shift towards larger turbines was observed in 2018. Last year turbines rated above 3 MW accounted for over two-thirds of the total order intake, with rotor diameters also increasing to over 120 meters. Growing project development in medium to low wind sites coupled with falling auction prices in major markets has catalyzed this trend with demand for turbines rated between 2 - 3 MW now concentrated in only a handful of markets including India, China and the United States. Turbine manufacturers have responded strongly to this trend with multiple announcements in 2018/19 for onshore turbines rated between 4 - 5 MW, and offshore turbines rated between 10 - 12 MW.

IHS Markit closely tracks wind turbine orders globally and publishes data and key insights in its Global Announced Wind Turbine Order Tracker report on a half-yearly basis. For more information on recorded orders please visit our global power and renewables page.

Indra Mukherjee is a Global Wind Power Analyst for IHS Markit

16 May 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flarger-turbines-and-offshore-wind.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flarger-turbines-and-offshore-wind.html&text=Larger+turbines+and+offshore+wind+boost+2018+global+wind+turbine+orders+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flarger-turbines-and-offshore-wind.html","enabled":true},{"name":"email","url":"?subject=Larger turbines and offshore wind boost 2018 global wind turbine orders | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flarger-turbines-and-offshore-wind.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Larger+turbines+and+offshore+wind+boost+2018+global+wind+turbine+orders+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2flarger-turbines-and-offshore-wind.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}