Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 31, 2020

India’s onshore wind supply chain realigns with market realities

India has a pipeline of over 10 GW of auctioned onshore wind projects in different stages of development. This pipeline reflects an excellent opportunity for wind turbine manufacturers competing for a share of the Indian market. However, the policy transition and uncertainty in India has resulted in several turbine vendors struggling to align themselves with the changing market realities. The current policy environment is marred by very low auction prices which has compressed the profit margins of suppliers. Furthermore, installation delays due to administrative challenges have resulted in a sector slow down, idling manufacturing capacity for key suppliers. These challenges, coupled with the shift in demand towards larger high-yield turbines suited for India's wind resource profile, are set to change the future of the onshore wind supply chain in the country.

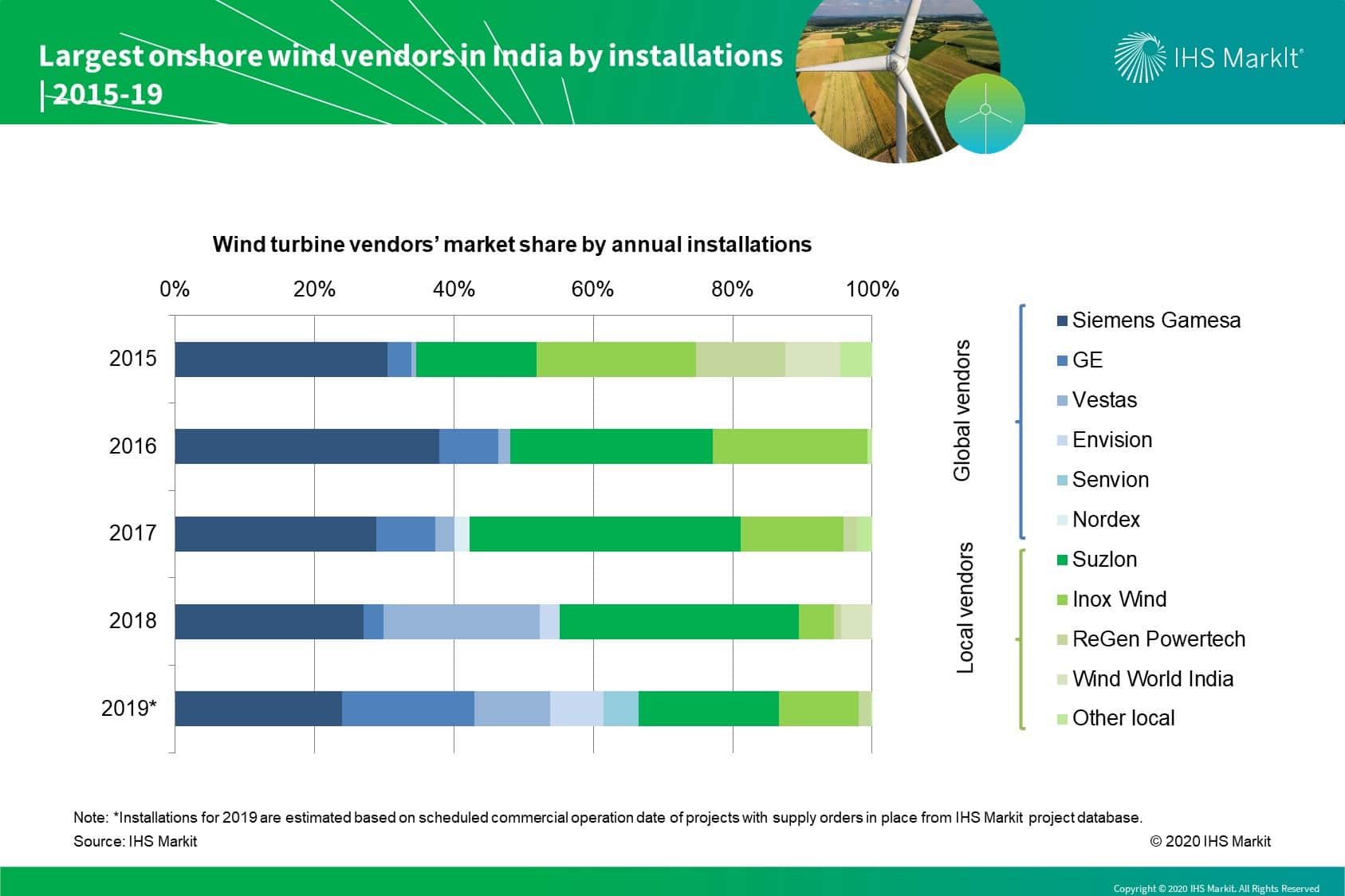

Figure 1: Largest onshore wind vendors in India by

installations | 2015 - 19

India's two largest local turbine vendors - Inox Wind and Suzlon have been badly hit by the slowdown in installations. Execution delays have stalled revenue realization and increased debt burden, adding uncertainty about these companies' ability to execute orders. Other small local vendors have either closed or cut down their operations, owing mainly to the increasing fiscal duress. These factors indicate that the vendors heavily dependent on the local demand may not outlive the current market slowdown.

The Indian market is predominantly supplied by 2.X MW turbines, with an expected transition toward the 3.X MW products. Major vendors in the Indian market have traditionally relied on turbines with larger swept area coupled with higher hub heights within the 2-3 MW range to boost yield. With the influx of foreign original equipment manufacturers, the technology accessible to India now ranges from 2.X MW to 5.X MW. As India retains its focus on decreasing costs and increasing yield, the move toward larger, more site-specific turbines seems inevitable, making it tough for local players to keep up as their portfolios are exclusively focused on sub-3 MW turbines.

The financial stress of local companies creates an opportunity for global turbine vendors to grab the market share by offering India-specific solutions. IHS Markit expects that global players including Siemens Gamesa, Vestas, General Electric, Nordex Acciona, and Envision will not only be able to sail through the current slowdown, but they will even benefit from it as the market consolidates in favor of global players.

Learn more about our coverage of the India power and renewables market.

Ankita Chauhan is a Senior Analyst covering South Asia

renewable market for IHS Markit.

Indra Mukherjee is a Senior Analyst covering Global onshore

wind markets for IHS Markit.

Posted 31 January 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-onshore-wind-supply-chain-realigns-with-market-realities.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-onshore-wind-supply-chain-realigns-with-market-realities.html&text=India%e2%80%99s+onshore+wind+supply+chain+realigns+with+market+realities+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-onshore-wind-supply-chain-realigns-with-market-realities.html","enabled":true},{"name":"email","url":"?subject=India’s onshore wind supply chain realigns with market realities | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-onshore-wind-supply-chain-realigns-with-market-realities.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=India%e2%80%99s+onshore+wind+supply+chain+realigns+with+market+realities+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findias-onshore-wind-supply-chain-realigns-with-market-realities.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}