Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 21, 2021

India promotes renewable procurement through open access

Comments on India's draft electricity rules for promoting renewable energy through green energy open access, 2021

Background

On 16th August 2021, India's Ministry of Power published draft electricity rules for promoting renewable energy through open access. The draft rules apply to renewable generators and consumers selling and buying electricity though open access including self-generation, electricity exchange, and bi-lateral contracts.

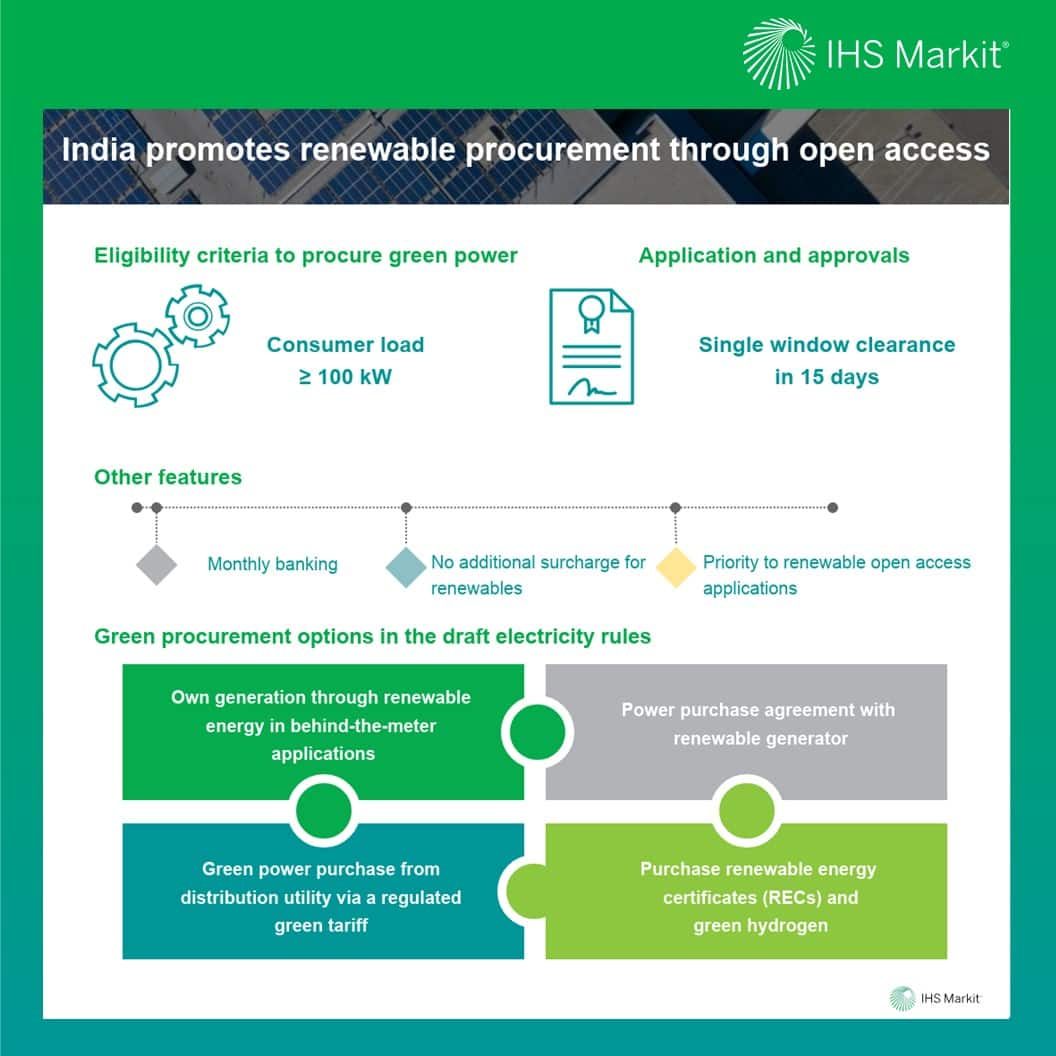

Key features of green energy open access rules are as below:

- Eligibility criteria - The draft rules include consumers with a load of 100 kW or more to be eligible for buying renewable power through open access. Most states at present have the minimum eligibility criteria for sanctioned load set at 1 MW or above. Bringing down the load requirement will help in increasing the renewable demand while giving additional options to smaller consumers to buy green power.

- Modes to meet the renewable purchase obligation (RPO)

- The draft rules stipulate having uniform RPO for all

obligated consumers including distribution utilities, open access

consumers and captive consumers. The obligated entities have the

following options to meet RPO:

- Self-generation from renewables in behind-the-meter applications

- Entering into a PPA with a renewable developer

- Green power procurement through distribution utility at a regulated green tariff

- Purchase renewable energy certificates (RECs)

- Purchase green hydrogen, etc.

- Approvals and nodal agency - A single window clearance mechanism with a central nodal agency is proposed. All applications for green open access to be approved within 15 days. Currently the approval process and timelines vary by state and contract duration.

- Banking - Banking of unutilized electricity up to 10% of total consumption from renewable projects to be allowed and settlement to happen monthly. At present, banking regulations vary by state with some states moving to not allow banking facility for open access projects.

- Regulatory charges - The draft rules stipulate limiting the cross-subsidy surcharge (CSS) and removing the additional surcharge (AS) for renewable open access. Forum of regulators to decide a common methodology for calculation of open access charges.

IHS Markit comments and feedback

Following are a few comments, suggestions, and questions submitted by IHS Markit for the consideration of the ministry of power:

1. Eligibility for Green open access

- The draft rules define 'entity' as a consumer with a 100 kW or above load. It is not clear from the rules, however, whether these entities will have a mandatory renewable purchase obligation, or they will be allowed open access from green sources on a voluntary basis? If a mandatory RPO is going to be applied to all OA consumers above 100kW load, the change of eligibility criteria from 1 MW at present to 100 kW will require an amendment of the Electricity Act. Is it proposed to the cabinet for approval as well?

- The rule on green energy open access states that 'that only Consumers who have contracted demand/sanctioned load of hundred kW and above shall be eligible to take power through green energy open access. There shall be no limit of supply of power for the captive consumers taking power under green energy open access.' Will sanctioned load limit apply to captive consumers as well?

2. RPO target and compliance

- The draft rules say that the RPO target is proposed to be uniform for all obligated consumers. Does this mean a uniform RPO as defined at the national level?

- For meeting RPO through own generation from renewables, no capacity limit is mentioned for behind-the-meter applications. This will require amendment to the state-level policies for net-metering/behind-the-meter rooftop PV projects.

- The rules do not mention net-metering and on-site captive projects for meeting RPO as one of the options for procuring renewable power.

- The draft rules say that in case consumer buys green power from

distribution utility, it will count for the RPO compliance of the

distribution utility. It is not clear, whether in that case

- the consumer buys additional renewable through other modes to meet RPO, or

- RPO for the open access/captive consumer can be settled through purchase from distribution utility till the RPO target limit and any additional procurement will be settled as the RPO compliance of distribution utility

- In case of purchase of green hydrogen to meet RPO, how will the monitoring, compliance and verification of green hydrogen supplied and consumed happen? Currently, there is no target for green hydrogen RPO, will a separate green hydrogen target be announced?

3. Application process and requirements

- The rules propose a central nodal agency for the open access applications for renewable energy procurement. We suggest that all procurement including of conventional power through open access should be provided the single window clearance facility through a central nodal agency facilitating administrative approvals to relax the administrative requirements of all open access consumers.

4. Banking

- The draft rules state "The quantum of banked energy by the green open access consumers shall not be more than ten percentage of the total annual consumption of electricity from the Distribution licensee by the consumers." What happens in case the consumer is procuring its 100% electricity requirement through open access and how will banking work in such a case? Also, should the limit of 10% of total demand or generation of the consumer/renewable project instead of "total consumption from distribution licensee"?

- Will all the state regulations pertaining to banking, commercial settlement rules regarding time-block, duration and deemed purchase price, stand void when these rules come into effect?

5. Cross subsidy surcharge

- The draft rules mention that cross subsidy surcharge shall not be increased, more than 50% of the surcharge at the time of approval, for 12 years from date of commissioning of the renewable plant. What methodology has been used to arrive at this limit? Why not provide 25 years limit as based on the lifetime of the projects?

Learn more about our Asia Pacific energy research with a climate and sustainability focus.

Ankita Chauhan is a senior renewable analyst on the Climate and Sustainability team at IHS Markit, covering research and analysis for Indian and South Asian markets.

Posted 21 September 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findia-promotes-renewable-procurement-through-open-access.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findia-promotes-renewable-procurement-through-open-access.html&text=India+promotes+renewable+procurement+through+open+access++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findia-promotes-renewable-procurement-through-open-access.html","enabled":true},{"name":"email","url":"?subject=India promotes renewable procurement through open access | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findia-promotes-renewable-procurement-through-open-access.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=India+promotes+renewable+procurement+through+open+access++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2findia-promotes-renewable-procurement-through-open-access.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}