Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 06, 2020

Impact of oil prices on Latin American Upstream Project Economics and Resources

In this price volatile environment, we should expect a number of key financial metrics such as the net present value (NPV) of an asset, the project breakeven and the Internal Rate of Return (IRR) to be moving targets. We did an analysis on the oil targeting projects in Latin America which had an FID date (assumed or announced) between 2020 and 2022 and the insights we gained were very interesting.

Key takeaways from our analysis are as follows:

- Oil reserves at risk of not being developed or pushed out into the future could touch 16 billion barrels at current commodity prices

- Development capital commitments are expected to be delayed, some related to pandemic impact

- Prolonged commodity pressure should start delaying free cash flows to the companies by years

- Competitively placed assets in countries such as Brazil and Guyana can start looking uneconomical at price stress continues

- Development capex reduction of 5% to 10% does not move the needle to bring back momentum in activity

- Costs across the value chain will need to be re-visited; operating expenditures will also be impacted

- Flexibility in readjusting government take might support commitment to part of investment plans announced prior to the crisis

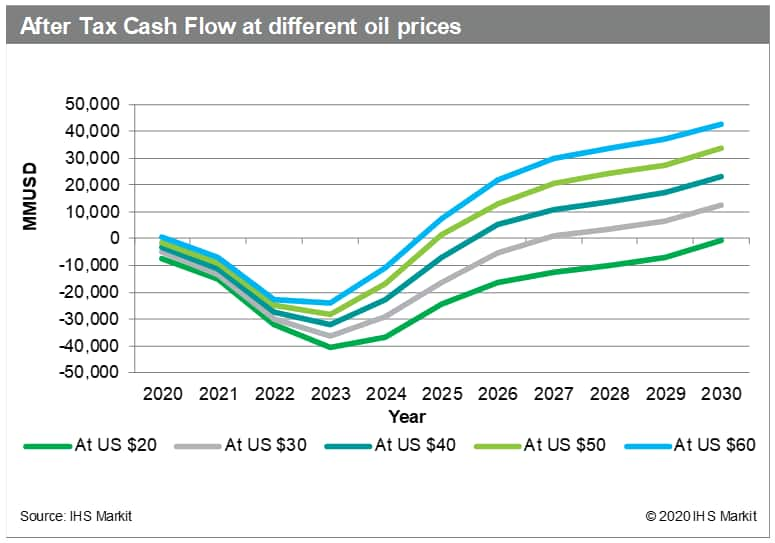

At $50/bbl, cash flow from this selection of assets to the end of the decade is approximately US$40 billion. That same set of assets cumulatively do not make money at an oil price of $30/bbl.

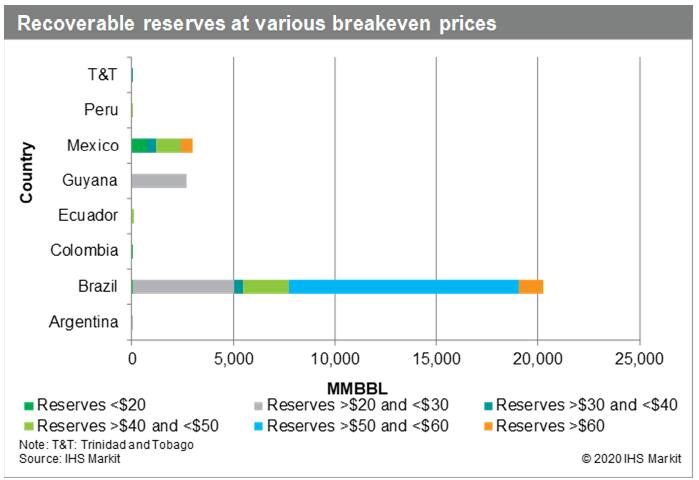

The recoverable reserves at risk of not being developed are led by Brazil, followed by Mexico. Within this selection of projects that we have analyzed, a total of 26 billion barrels of oil reserves was expected to be developed out of which close to 16 billion barrels of oil reserves have a breakeven of $40 or above - that is close to 60% of the total.

Figure 1: Recoverable reserves at various breakeven

prices

Figure 2: Recoverale reserves at various breakeven prices

(excluding Brazil)

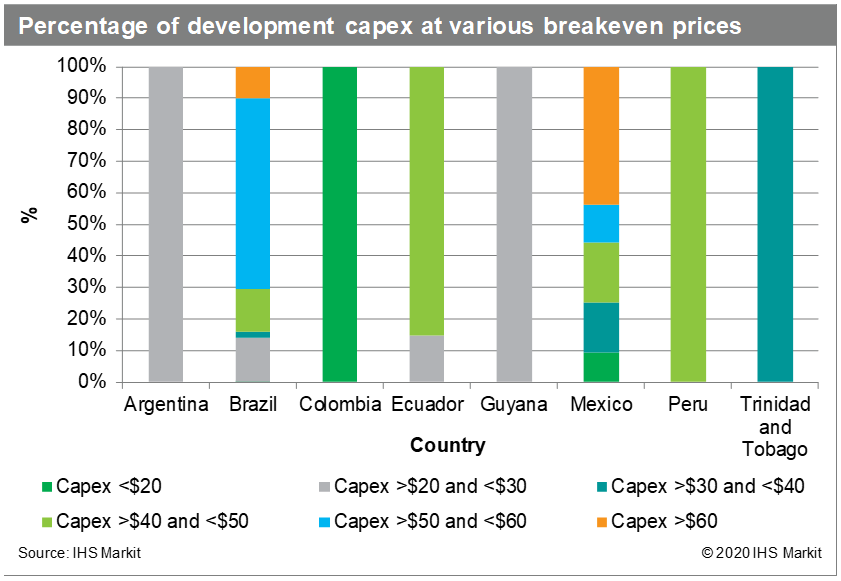

When the same set of assets are analysed to understand the impact on the capital investments, we find that close to US$65 billion could be put at risk of disappearing in the short term as projects get delayed. The country which will be impacted most would be Brazil. For these assets the cost of development is usually higher because of the water depth, the presence of contaminants such as high CO2 content, distance to coast and the fiscal terms. The pre-salt field reservoir is high pressure, high temperature, which leads to complexity in drilling and other technical aspects of project development.

Figure 3: Precentage of development capex at various breakeven

prices

At 20 dollars per barrel of oil price, it will take almost till the end of the decade for these projects to come back into the black and provide positive cash flows to the companies involved. At $50, the same projects were expected to reach positive cash flows in 5 years. That is a five-year delay.

Figure 4: After tax cash flow at different oil prices

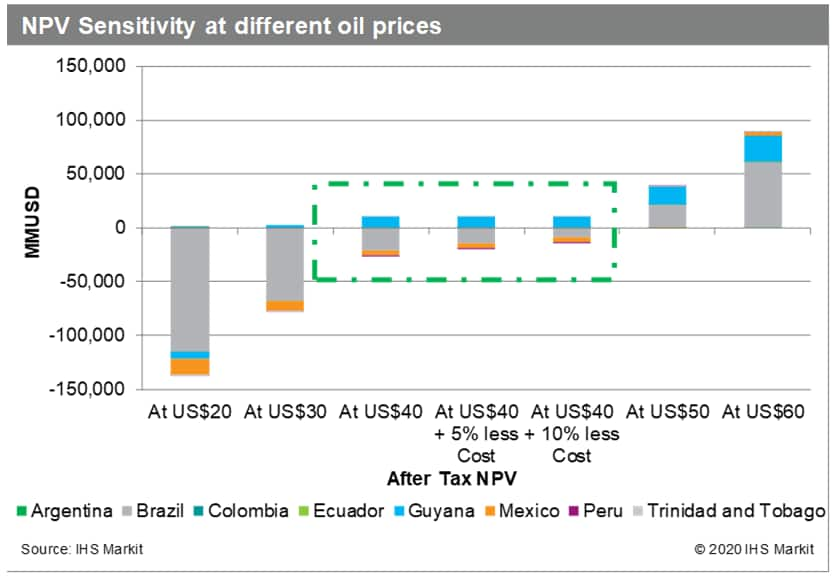

Aggressive cost cuts will be needed to revive activity in the region. Government support with measures such as reduction in government take could also help support the industry.

Aggressive capex reductions are necessary because, as per our analysis, reduction in capex of 5% to 10% will not really move the needle and make these any of these projects viable for investments. When we reduced the capex across the selected assets by 25% at US$40/bbl, we started to see the assets give a positive NPV across all the countries.

Figure 5: NPV Sensitivity at different oil prices

Siddhartha Sen is a Director for the Energy Research & Analysis team at IHS Markit.

Posted 06 April 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fimpact-of-oil-prices-on-latin-american-upstream-project.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fimpact-of-oil-prices-on-latin-american-upstream-project.html&text=Impact+of+oil+prices+on+Latin+American+Upstream+Project+Economics+and+Resources+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fimpact-of-oil-prices-on-latin-american-upstream-project.html","enabled":true},{"name":"email","url":"?subject=Impact of oil prices on Latin American Upstream Project Economics and Resources | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fimpact-of-oil-prices-on-latin-american-upstream-project.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Impact+of+oil+prices+on+Latin+American+Upstream+Project+Economics+and+Resources+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fimpact-of-oil-prices-on-latin-american-upstream-project.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}