Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 03, 2020

Article: ICCO trims global cocoa deficit slightly for 2019/20

This article is taken from our IEG Vu platform dated 01/06/20.

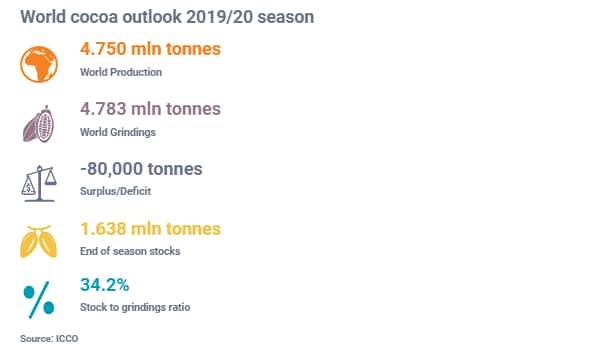

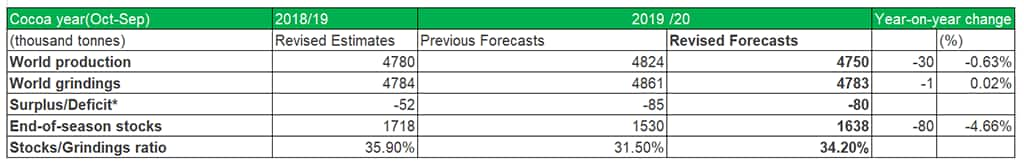

In its recent forecast for the 2019/20 season, the International Cocoa Organization (ICCO) has placed global cocoa supplies at an 80,000-tonne deficit, slightly lower than previously estimated.

The ICCO now points to a cocoa deficit of 80,000 tonnes compared to its previous 85,000 tonnes for the 2019/20 season, with world demand for beans still expected to outstrip supply during the current season.

Total statistical stocks are therefore anticipated to reach 1.638 million tonnes, which is equivalent to 34.2% of projected annual grindings in 2019/20, it said.

The ICCO also revised its forecast for production, which is now pegged at 4.750 mln tonnes, down by 74,000 tonnes compared to its previous outlook. This is owed to downgrades for Ivory Coast, Ghana and Peru, it added.

On the demand side, a downward adjustment revision was also made to the ICCO's estimate for world grindings to 4.783 mln tonnes (down by 78,000 tonnes) and the first annual drop since 2016. Downgraded volumes included; Ghana, Indonesia and Malaysia.

Revisions to 2018/19 estimates

Meanwhile, the ICCO also made revisions to its 2018/19 cocoa season numbers, adjusting cocoa production upwards by 35,000 tonnes to 4.780 mln tonnes, compared to its previous indication. This has led to a production deficit of 52,000 tonnes, from its previously pegged 107,000 tonnes.

The production adjustment was mainly due to revisions for cocoa output from Africa (up by 20,000 tonnes), Asia (up by 16, 000 tonnes) and a reduction of 1,000 tonnes for the Americas, it said.

Conversely, the ICCO's estimate for world grindings 2018/19 has been reduced by 21,000 tonnes to 4.784 mln tonnes. The reduction is distributed across Asia and Oceania (less 12,000 tonnes), Europe (less 9,000 tonnes), Africa (less 4,000 tonnes). For the Americas on the other hand, the estimate was revised upwards by 2,000 tonnes, said the ICCO.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ficco-trims-global-cocoa-deficit-slightly-for-201920.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ficco-trims-global-cocoa-deficit-slightly-for-201920.html&text=Article%3a+ICCO+trims+global+cocoa+deficit+slightly+for+2019%2f20+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ficco-trims-global-cocoa-deficit-slightly-for-201920.html","enabled":true},{"name":"email","url":"?subject=Article: ICCO trims global cocoa deficit slightly for 2019/20 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ficco-trims-global-cocoa-deficit-slightly-for-201920.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Article%3a+ICCO+trims+global+cocoa+deficit+slightly+for+2019%2f20+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ficco-trims-global-cocoa-deficit-slightly-for-201920.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}