Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 10, 2019

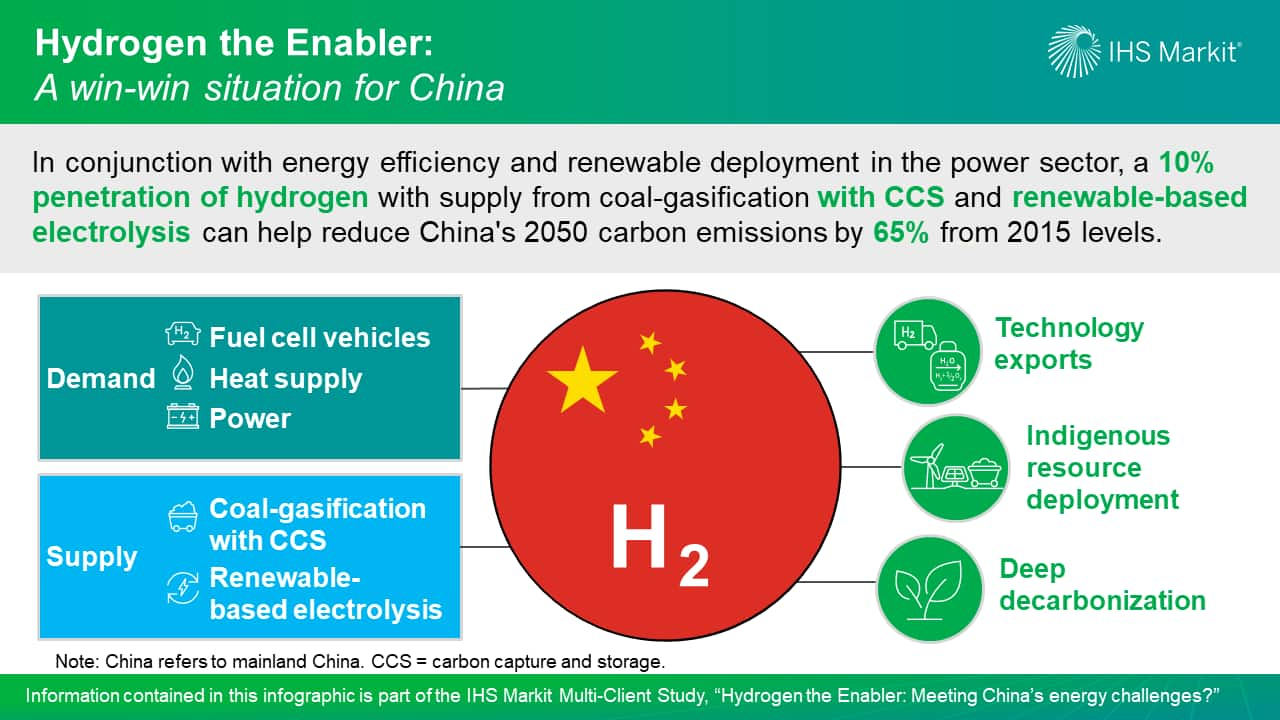

Hydrogen as an energy carrier: A win-win situation for China for technology exports, indigenous resource deployment, and deep decarbonization

On 21 November 2019, IHS Markit delivered the second workshop for the "Hydrogen the Enabler: Meeting China's Energy Challenge?" multi-client study. Following up on the first workshop discussing current hydrogen market development in China and hydrogen production, transportation, and storage cost outlooks by technology, the second workshop focused on the potential penetration of hydrogen in key energy consuming sectors and the implications on China and the global market.

This marks the completion of the three part series by IHS Markit studying hydrogen as an energy carrier—first on Europe, then California, and now China, pushing the frontier of research on the global energy market in a low carbon world. During our work, we have also established a community of over 50 companies across the value chain to share insights and progress in this new area of market development. The reseach and community will continue through the IHS Markit Hydrogen and Renewable Gas Forum that will provide insights into developments in hydrogen and renewable gas globally.

Our study found that on the supply side, the economics of large-scale centralized hydrogen production are more favorable than local distributed production. Low carbon hydrogen can be delivered to the demand centers in coastal China for $2.3/kg, now by coal gasification without carbon capture and storage (CCS) and in the future by coal gasification with CCS or renewable-based electrolysis, thanks to technology advancement and economies of scale. Both of the low-carbon supply options—coal gasification with CCS and renewable-based electrolysis—are essential to meet demand in a future when hydrogen takes a significant share of the energy sector. If global hydrogen development results in foreign low-cost sources of hydrogen, China could also take an advantage to supplement domestic production with imports.

On the demand side, hydrogen could reach 10% of 2050 final energy, with growth acceleration in 2030 and beyond. This level of hydrogen penetration is consistent with what China Hydrogen Alliance, the leading organization to coordinate hydrogen development as an energy carrier in China, sets as a target for 2050. In conjunction with energy efficiency and renewable deployment in the power sector, this level of penetration of hydrogen with supply from coal-gasification with CCS and renewable based electrolysis can reduce China's 2050 carbon emissions by 65% from 2015 levels.

Current Chinese policies are focused almost entirely on the transport sector to develop new technologies across the fuel cell value chain. As a result, fuel cell electric vehicles have the potential to become a cost competitive option, particularly for heavy-duty vehicles. We expect full cell heavy-duty trucks to represent about half of the fleet by 2050. As supply becomes more readily available, policies will likely look to the industrial and later residential and commercial heat sector to consume more hydrogen and displace some of the traditional fuel sources. Local conditions for power system management can also be optimized by using hydrogen in association with variable renewables.

The implications on energy supply could be significant. With the rising share of hydrogen in the energy mix, China's natural gas demand could peak by 2043 with imports ceasing a few years later. Oil demand is expected to fall by 11% by 2050 compared with the IHS Markit Autonomy scenario without hydrogen penetration. On the other hand, the development of CCS for hydrogen could lead to a large-scale retrofitting of CCS in the power sector, raising the use of coal in power generation.

In addition to realizing the dual goals of deep decarbonization and indigenous energy resource deployment over imports, hydrogen as an energy carrier could also help China achieve its technology export ambitions. These new technologies range far and wide from electrolysis hydrogen production and CCS to the entire fuel cell value chain and the potential of low-carbon greenfield steel production.

Find out more about the future of hydrogen in China's energy mix in our multi-client study, "Hydrogen the Enabler: Meeting China's Energy Challenge?", https://ihsmarkit.com/products/hydrogen-facilitator-china-energy-needs.html .

Jenny Yang is the Research Manager of the Greater China Gas, Power, and Energy Futures service and a key member of the IHS Markit Hydrogen team.

Posted 10 December 2019

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhydrogen-as-an-energy-carrier-winwin-situation-for-china.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhydrogen-as-an-energy-carrier-winwin-situation-for-china.html&text=Hydrogen+as+an+energy+carrier%3a+A+win-win+situation+for+China+for+technology+exports%2c+indigenous+resource+deployment%2c+and+deep+decarbonization+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhydrogen-as-an-energy-carrier-winwin-situation-for-china.html","enabled":true},{"name":"email","url":"?subject=Hydrogen as an energy carrier: A win-win situation for China for technology exports, indigenous resource deployment, and deep decarbonization | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhydrogen-as-an-energy-carrier-winwin-situation-for-china.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Hydrogen+as+an+energy+carrier%3a+A+win-win+situation+for+China+for+technology+exports%2c+indigenous+resource+deployment%2c+and+deep+decarbonization+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhydrogen-as-an-energy-carrier-winwin-situation-for-china.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}