Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 09, 2019

Hydraulic fracturing counts take over from technical factors as main driver of hydraulic horsepower demand

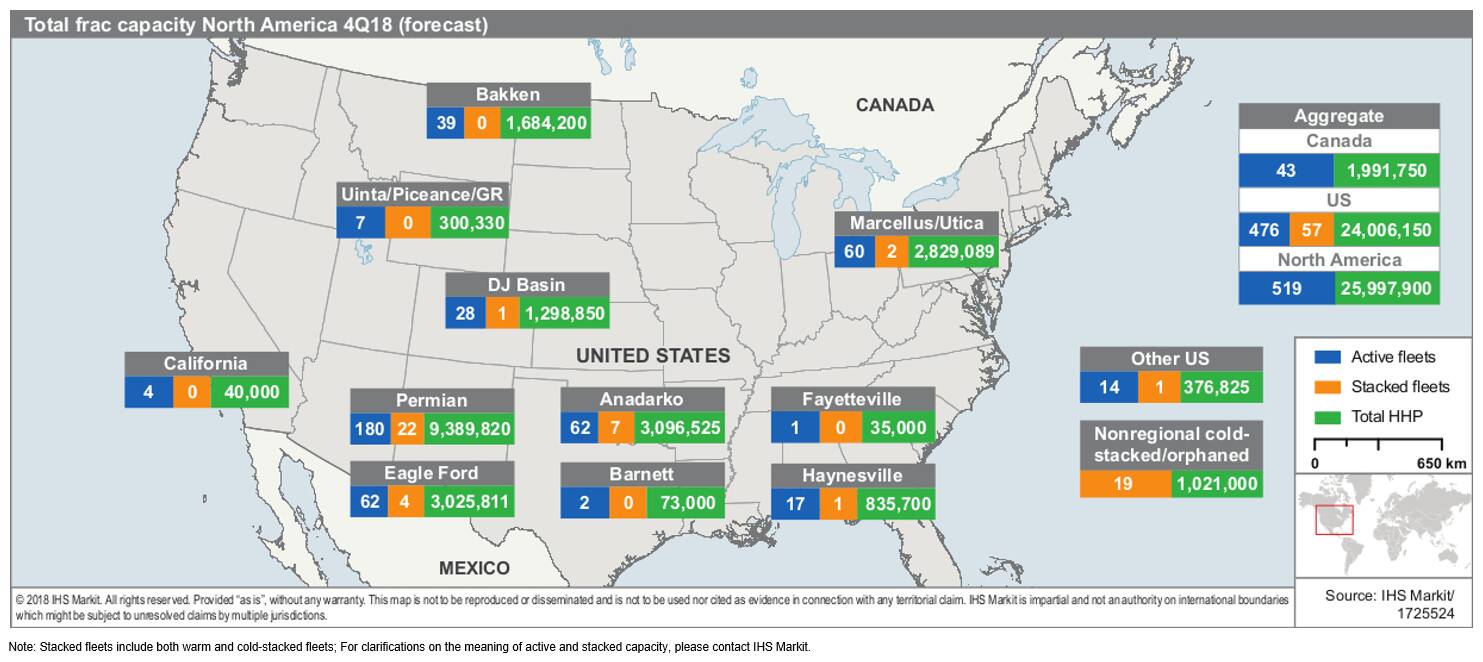

In a recent report, IHS Markit estimates the 2018-Q4 total fracturing capacity in North America at 26 million HHP, with heavy concentration in the Permian.

From a technical standpoint, the report shows that 2017 and 2018 saw increasing intensities around factors affecting hydraulic fracturing demand on a per-well basis, including lateral lengths, stages, fracturing water volume requirements, well depths, and proppant loading. However, preliminary IHS Markit data show that many factors could level off in the future. As a result, future hydraulic horsepower demand increases would be driven by market conditions affecting quarterly hydraulic fracturing counts, rather than technical factors at the well level.

Figure 1: Total frac capacity in North America 2018-Q4 (forecast)

These market conditions are at the root of a softening of utilization that began in the third quarter of 2018 and is expected to continue through the first half of 2019; operators will have pricing advantage during this time. This is expected to change, albeit temporarily, in the second half of 2019 as the backlog of drilling but uncompleted wells in the Permian begin to complete and fracturing demand increases.

For now, many suppliers experienced a softer than expected third quarter due to early budget exhaustion by operators, increasing competitive pricing, a saturated and eroded spot market, seasonality, a flattening of Permian demand, Permian takeaway constraints, improved frac efficiency, and excess capacity, with these factors being mentioned as current challenges on utilization.

Due to near-term flattening demand in the Permian, operators have adjusted their capital allocations, and areas such as the DJ basin and the Eagle Ford have accordingly seen increases in utilization.

Perhaps due to the transitional market conditions, 2018 saw noticeable acquisitions by pumping suppliers, including that of Pioneer's pumping services by ProPetro in November, RSI by Keane in July, and Tucker by STEP in February. The recent ProPetro acquisition will move the company from a top-10 supplier in the fourth quarter of 2018 to nearly top-5 by early 2019.

Learn more about our coverage of onshore materials, including proppant and water.

IHS Markit's Onshore Services & Materials team's recent PumpingIQ report for the fourth quarter of 2018 tracks the market size and horsepower supply for hydraulic fracturing operations in North America. The report is available in its entirety on Connect™ for Onshore Services & Materials clients.

David Vaucher is Associate Director, Research and Analysis at IHS Markit.

Posted 9 January 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhydraulic-fracturing-counts-take-over-from-technical-factors.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhydraulic-fracturing-counts-take-over-from-technical-factors.html&text=Hydraulic+fracturing+counts+take+over+from+technical+factors+as+main+driver+of+hydraulic+horsepower+demand+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhydraulic-fracturing-counts-take-over-from-technical-factors.html","enabled":true},{"name":"email","url":"?subject=Hydraulic fracturing counts take over from technical factors as main driver of hydraulic horsepower demand | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhydraulic-fracturing-counts-take-over-from-technical-factors.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Hydraulic+fracturing+counts+take+over+from+technical+factors+as+main+driver+of+hydraulic+horsepower+demand+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhydraulic-fracturing-counts-take-over-from-technical-factors.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}