Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 08, 2021

How will China’s gas storage development alter LNG import seasonality?

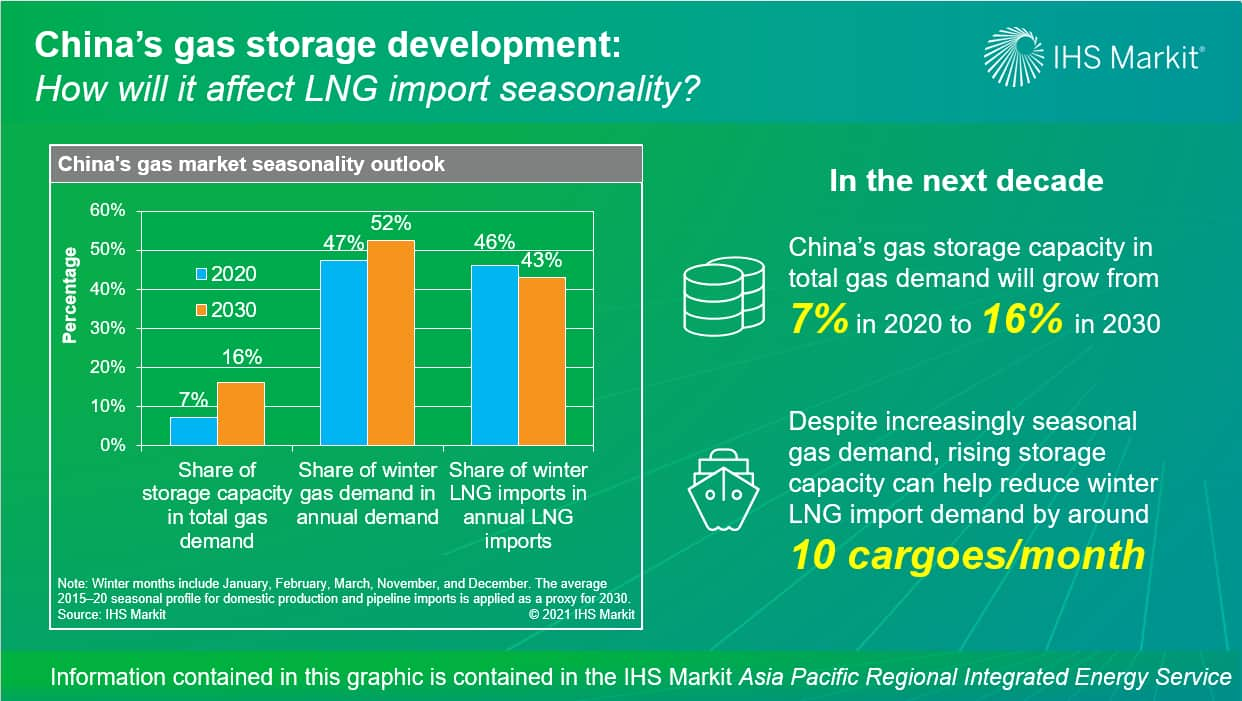

Inadequate gas storage and increasingly pronounced demand seasonality have led to a chronic problem of winter gas supply constraint for China. Although storage capacity has improved significantly in the last few years both in absolute term and in share of total demand, effective storage capacity was still less than 7% by the end of 2020, far below a typical level in the developed markets. For winter supply, China resorts to other options such as curtailing gas consumption, skewing domestic gas production, and relying on LNG imports. China's average LNG import volumes in the peak months of November, December, and January could be more than 30% above that in a typical summer month. This leaves China exposed to risks of winter spot price spikes.

Recent policies have put gas storage capacity on the top of the priority list. Companies—especially the national oil companies and the national pipeline company—are aggressively developing storage capacity. China's largest gas supplier PetroChina announced a plan to build six regional underground storage bases by constructing 23 new underground storage facilities and expanding 10 existing facilities for total working capacity of 41 Bcm by 2030, leveraging its vast oil and gas upstream resources in the domestic market. Compared with PetroChina, Sinopec, and CNOOC have much fewer depleted fields to develop underground storage facilities but are also planning underground storage expansions. Sinopec aims to develop 10 Bcm working capacity at the Zhongyuan oil field in Henan and will conduct a feasibility study for storage projects at the Shengli oil field in Shandong. CNOOC is looking at converting legacy offshore gas fields in South China Sea into storage.

Along the coastline, China is also expanding LNG receiving capacity and tank storage at receiving terminals. As of February 2021, there is 8.7 Bcm of gas equivalent tank storage capacity under construction and scheduled to come online by 2025. Even more capacity is in the planning phase. By 2030, terminal tank storage capacity can quadruple to reach 24.5 Bcm of gas equivalent.

Based on project development plans, China's gas storage capacity may reach 16% of total demand by 2030. Of all storage facilities, underground storage working capacity will account for the largest share with 51 Bcm in 2030, followed by tank storage at LNG terminals at 25 Bcm.

Rising gas storage capacity will alleviate the winter supply issue. The share of winter LNG imports in annual LNG import volumes may decrease from 45% during 2016-20 to 43% in 2030. This would represent 0.65 million metric tons or 10 cargoes of lower LNG procurement demand than otherwise in each winter month, potential reducing China's spot demand in the winter market. It will have wider implications for LNG spot prices in northeast Asia.

Learn more about our coverage of the Asia Pacific energy market from our Asia Pacific Regional Integrated Energy Service.

Xiao Lu is an associate director covering Greater China's gas and LNG analysis.

Posted 8 March 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-will-chinas-gas-storage-development-alter-lng-import.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-will-chinas-gas-storage-development-alter-lng-import.html&text=How+will+China%e2%80%99s+gas+storage+development+alter+LNG+import+seasonality%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-will-chinas-gas-storage-development-alter-lng-import.html","enabled":true},{"name":"email","url":"?subject=How will China’s gas storage development alter LNG import seasonality? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-will-chinas-gas-storage-development-alter-lng-import.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=How+will+China%e2%80%99s+gas+storage+development+alter+LNG+import+seasonality%3f+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-will-chinas-gas-storage-development-alter-lng-import.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}