Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 16, 2020

How data alchemy is changing the energy industry

A paradigm shift is occurring in the energy industry, as the weakening economy and current market slowdown continues to air uncertainty. Lower oil prices, challenging investment environments, cost reductions, and the diversification of energy resources are current knowns. But in a volatile market, conditions can change quickly. The ability to make critical decisions, before your competition does, requires agility. Digitalization and digital innovation are now fundamental requirements to contend with these profound changes - using predictive analytics to better anticipate the future, real-time data insights to drive better decisions, and the integration of artificial intelligence, machine learning, and automation to take advantage of every possible increment of cost and speed.

Energy market participants are becoming increasingly sophisticated. They are looking for technologies and accelerated analytics solutions that drive efficiencies, improve outcomes, and reduce risk. The greatest transformational potential for digitalization is its ability to break down boundaries between energy sectors and silos, increasing flexibility and enabling integration across the entire energy value chain. As Clive Humby famously stated: "Data is the new oil. It's valuable, but if unrefined can not really be used. It has to be changed into gas, plastic, chemicals, etc. to create a valuable entity that drives profitable activity; so data must be broken down, analyzed for it to have value."

As digital transformation continues to evolve in energy, innovative technologies are revolutionizing the ability to leverage petabytes of data. New rapid computational environments enable the integration of data science, analytics, and location intelligence for accelerated, interactive "speed of thought" and decision support.

Graphics processing units (GPUs) are the main driver in accelerated analytics (also known as GPU analytics). GPUs harness the massive parallelism of high-performance computing in order to accelerate processing-intensive operations in data science. The gaming industry is powered by GPUs. In the era of growing AI and machine learning, incorporating the computing power of GPUs is vital for processing and extracting insights from a continuous flow of energy datasets, which contain billions of data points, with lightning speed and accuracy. The amount of data being generated every year across the energy ecosystem is beyond "big data" - it's "mega data." The majority of mega data analytics used in the energy industry today involves some measure of geospatial and spatiotemporal data (measuring location and time). Interactive spatiotemporal analytics enable scalable visualizations and high performance unparalleled by existing business intelligence tools.

The velocity, volume, and diversity of data brought together for

interactive analytics now can drive additional value from

historical data. It also can enable imbedded models for real-time

data interrogation, yielding previously unseen insights. Merging

telematics data from cell phones and smart cars (using location

intelligence and real time movement), unrelated data streams from

across multiple business verticals, and weather data, companies can

enhance overall business intelligence and critical decision-making

in ways that were not possible even a few years ago. Hurricanes are

a great example. The ability to track weather in real time is

critical when natural disasters threaten downstream infrastructures

and supply chains. Forecasting tools, algorithms, historical data

embedded with geospatial analysis, and 4D geospatial analytics

leverage the dimensions of time and space for more accurate

predictive analytics - because understanding the past enables

better foresight into the future.

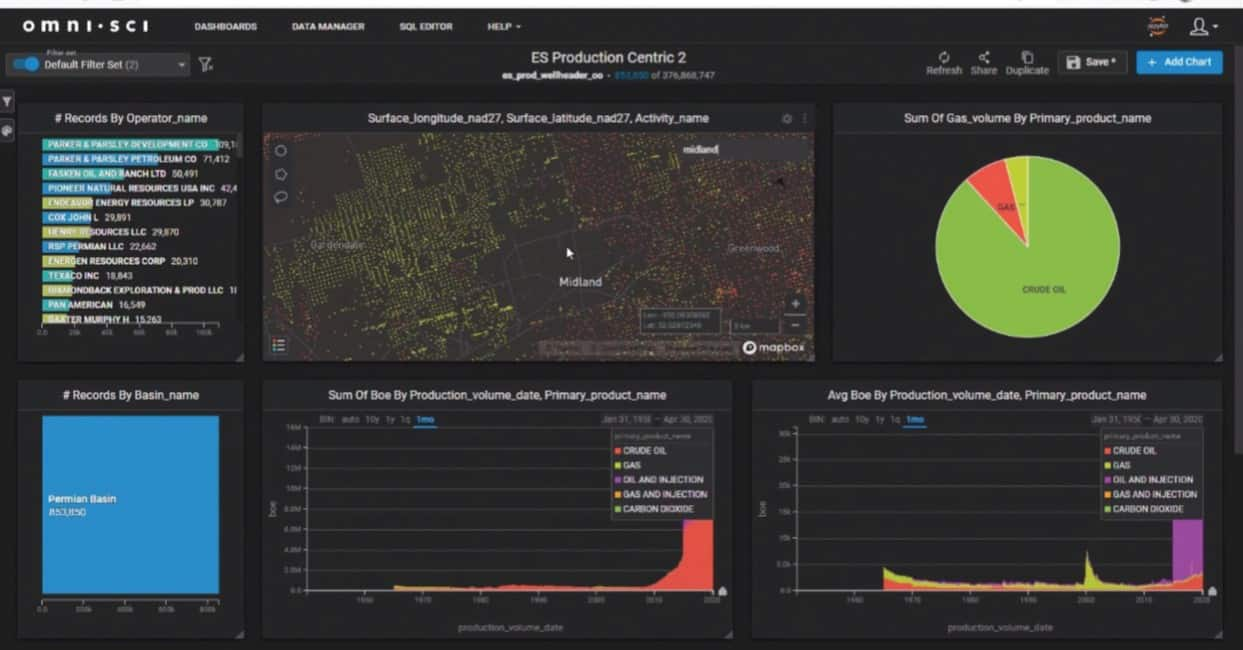

Below are two examples of how IHS Markit is leveraging data

science, accelerated analytics, and location intelligence from a

macro- to micro-level, providing detailed insight and new value

from existing data assets.

Break-even analysis and well economics

Data requirements:

- Imbedded break-even model, cost model, well-spacing models, and graded acreage algorithms

- Nationwide US well and production data

- Detailed US completion data

- US directional survey/trajectory dataResults enable analysts to understand the average weighted break-even point for an entire state, by play, section, operator, and well. It offers the ability to run different models and analytics scenarios, and analysts can leverage embedded algorithms and models to grade acreage by peak rate, break even, cost, quintiles, spacing, or any other chosen metric.

Risk analysis with multivariate analytics: Leveraging almost 400 million data points interactively

Data requirements:

- US well and production data

- Commodity price

- Break-even model, cost model

- Detailed completion and frac data, including stagesand completion design

- Decline curve analysis and forecasting model Results allow analysts to instantly see the effect of completion changes over time (such as fracturing stage count). They can understand the relevant commodity price environment (e.g. West Texas Intermediate crude) and effects on productivity performance. Users can quickly perform operator benchmarking for asset evaluation with scenario analysis through time and space.

Beyond enabling an unprecedented scale and predictability of outcomes, accelerated analytics can also help organizations and stakeholders develop a greater understanding of data and its true intrinsic value. Many data efforts are descriptive and diagnostic in nature, focusing primarily on what happened and why things happened the way they did. These are important points, but they only tell part of the story. Predictive analytics broaden the approach by answering why it happened and "what if," so outcomes can be weighted against probable certainty.

Every day, every hour, and every minute, energy participants make decisions with wide-ranging implications that require the ability to see in real time the interconnected factors that impact their organizations. When mega data assets are leveraged together, companies require a holistic approach to understand the "connected enterprise" and reap exponential benefits from the convergence of automation, communications, and information technology across digital oilfields, pipelines, and refineries. Accessing and monitoring assets from upstream, midstream, and downstream operations - and merging disparate oilfield data into actionable information - is necessary for companies to remain competitive. As the energy landscape fluctuates and transitions, energy companies require new intelligence with a wider picture and a deeper focus.

Digital transformation initiatives currently present both opportunities and challenges for the oil and gas industry where a low-price environment makes managing costs, timelines and operational efficiency crucial to success. IHS Markit provides strategies to meet digital transformation needs across asset teams and resource lifecycles. Find out more: Digital Transformation in Upstream Energy

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-data-alchemy-is-changing-the-energy-industry.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-data-alchemy-is-changing-the-energy-industry.html&text=How+data+alchemy+is+changing+the+energy+industry+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-data-alchemy-is-changing-the-energy-industry.html","enabled":true},{"name":"email","url":"?subject=How data alchemy is changing the energy industry | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-data-alchemy-is-changing-the-energy-industry.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=How+data+alchemy+is+changing+the+energy+industry+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-data-alchemy-is-changing-the-energy-industry.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}