Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 22, 2020

How can African governments drive a hydrocarbon sector rebound from the COVID-19 crisis?

The impacts of the coronavirus disease 2019 (COVID-19) crisis on Sub-Saharan Africa's upstream hydrocarbon sector will be broad and deep, and after the crisis, African governments and regulators face the challenge of seizing the opportunities presented by an upstream investment rebound.

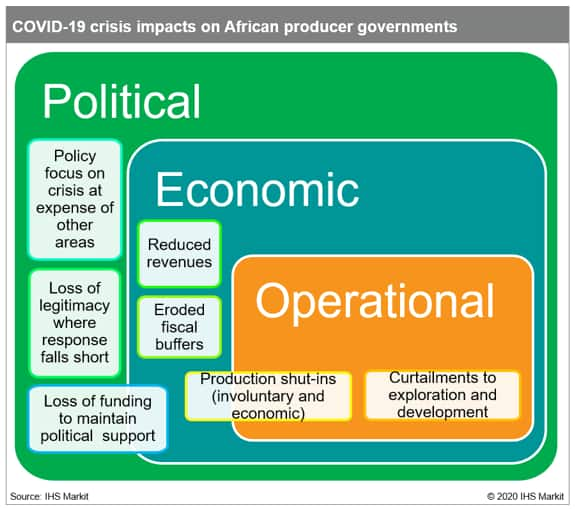

Political and economic risks intensify

Crude-dependent African producers - still grappling with

the effects of the 2014 crude price fall - are again facing

substantial economic and fiscal challenges amid dwindling crude

demand and low prices. The COVID-19 crisis and related recessions

across Africa are likely to cause humanitarian challenges and

societal impacts that could linger for years, which will undermine

regional and country-level stability and exacerbate

hydrocarbon-sector above-ground risks from frontiers to mature

producers.

Figure 1: COVID-19 crisis impacts on African producer

governments

Operational disruptions set to spread

The spread of the COVID-19 virus in Sub-Saharan Africa is

at a relatively early stage, but more substantial

hydrocarbon-sector operational disruption is likely as the outbreak

evolves because of restrictions on, and shortages of, staff and

interruptions to supply chains. This could limit both exploration

and development drilling, negatively affecting production across

the near, medium, and long term. Moreover, market oversupply, high

operating costs amid low prices, and the lack of regional storage

could drive near-term production shut-ins at the highest cost

African projects, compounding the expected reduction in government

revenues.

Foreign upstream investment

Sub-Saharan African countries are generally highly reliant

on foreign upstream investors, making them more vulnerable as

companies seek to reduce capital spending amid the crisis. Riskier

and higher-cost unsanctioned African upstream projects will face

delay, while partnership risks related to financially stressed

smaller E&P companies and national oil companies (NOCs) will

increase, in turn influencing the majors' appetite to progress

projects.

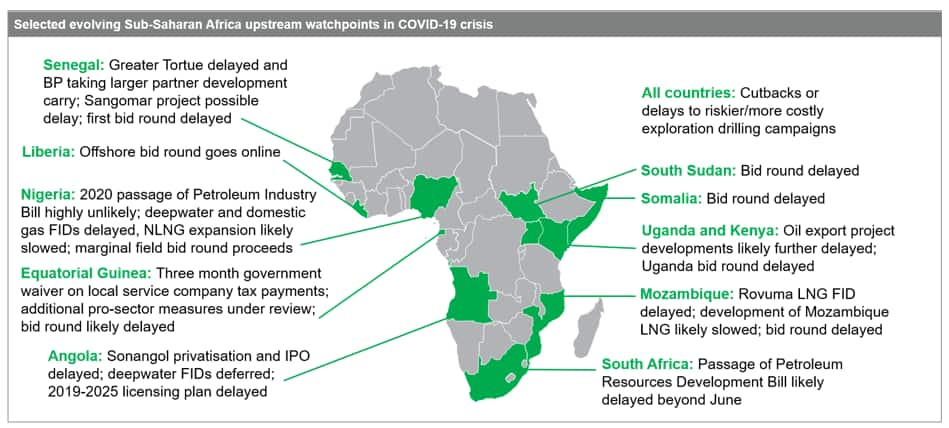

Figure 2: Selected evolving Sub-Saharan Africa upstream

watchpoints in COVID-19 crisis

Implications for government decision-making

The administrative and decision-making capacity of African

governments is likely to be stretched by the near-term impacts of

the COVID-19 crisis, which means that expected key hydrocarbon

sector legislation and reforms are unlikely to proceed as planned

in countries such as Nigeria and South Africa. Expected 2020 bid

round launches in South Sudan and Somalia have been delayed - with

delays also likely to planned rounds in Angola and Mozambique -

while ongoing rounds in Gabon, Senegal and Somalia have been

extended.

Reduced capex spending, delayed bid rounds, and slower reforms will negatively affect medium-to-long term hydrocarbon output and state revenues, but - as with previous down-cycles - countries are eventually likely to respond with improved fiscal terms and new incentives for foreign firms to revive upstream investment. However, the speed at which they do so is likely to vary significantly across countries. It took over three years for Angola to respond to the 2014 oil price collapse, similarly Gabon, while Nigeria is yet to fully implement fiscal changes and sector reforms proposed since before 2010.

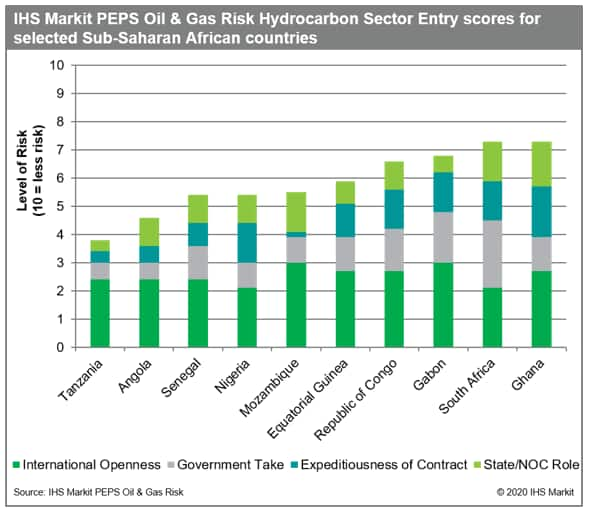

Figure 3: IHS Markit PEPS Oil & Gas Risk Hydrocarbon Sector

Entry scores for selected Sub-Saharan African countries

Harnessing the investment rebound

When the post-crisis rebound does come, African countries

will face even greater competition for capital, with upstream

investors' balance sheets significantly weakened and

hydrocarbon-sector investment set to remain under pressure from

climate-change concerns driving the energy transition. Simply put,

there is likely to be less exploration, by fewer companies, across

fewer basins.

These challenges will behove Sub-Saharan African countries to take early, pragmatic policy and fiscal actions to maintain their global upstream competitiveness, while offering a stable, facilitating contractual and regulatory environment. At the same time, regulators will need to proactively seek and constructively engage with the upstream investors financially and technically best suited to timely commercialisation of their country's resource base.

Screen upstream opportunities and above-ground risk with one tool: PEPS

IHS Markit experts are available for consultation on the industries and subjects they specialize in. Meetings are virtual and can be tailored to focus on your areas of inquiry. Book a consultation with Roderick Bruce.

Roderick Bruce is a Research and Analysis Associate Director at IHS Markit.

Posted 22 April 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-can-african-governments-drive-a-hydrocarbon-sector-rebound.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-can-african-governments-drive-a-hydrocarbon-sector-rebound.html&text=How+can+African+governments+drive+a+hydrocarbon+sector+rebound+from+the+COVID-19+crisis%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-can-african-governments-drive-a-hydrocarbon-sector-rebound.html","enabled":true},{"name":"email","url":"?subject=How can African governments drive a hydrocarbon sector rebound from the COVID-19 crisis? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-can-african-governments-drive-a-hydrocarbon-sector-rebound.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=How+can+African+governments+drive+a+hydrocarbon+sector+rebound+from+the+COVID-19+crisis%3f+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fhow-can-african-governments-drive-a-hydrocarbon-sector-rebound.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}