Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 15, 2020

Heuristic assessments of LMP understate arbitrage margins for energy storage

When evaluating potential project sites early in the development cycle, energy storage developers are faced with a difficult question: how to forecast or characterize the Locational Marginal Price (LMP) that will determine the energy arbitrage margins of the asset. Arbitrage margins are dependent on the intraday LMP spread and require a forecast methodology that captures both the zonal price spread and the volatility of the LMP basis, the difference between the zonal price and the price at the interconnection bus.

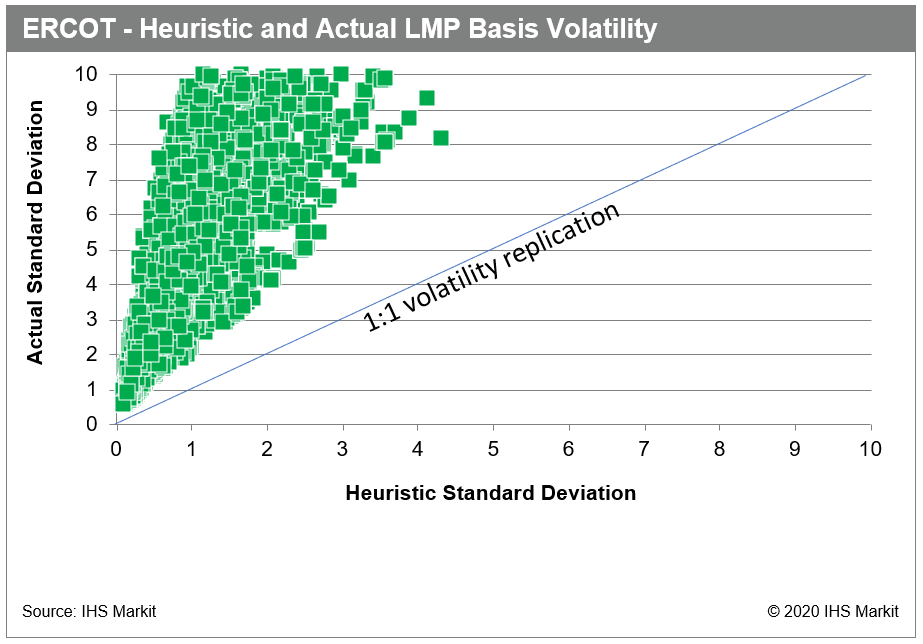

The cost and time required to calibrate a long-term nodal dispatch model across hundreds or thousands of nodes makes it impractical for early stage prospecting activities, so developers typically default to using hourly zone or hub price forecasts supplemented with crude heuristic assessments of LMP basis constructed using historical data. Commonly used heuristics include straight averages, peak/off-peak averages, peak/off-peak by season averages, or month-hour averages. Constructing these heuristics from historical data is still a manual process, an analyst needs to review the available historical LMP basis data and select only the data that they believe represents the current state of the grid surrounding the node. Large generators coming online nearby or transmission upgrades can dramatically shift the LMP basis at a node. The principal limitation of even the best heuristics is that they understate the volatility of LMP basis and necessarily understate the value captured by energy storage arbitrage scheduling.

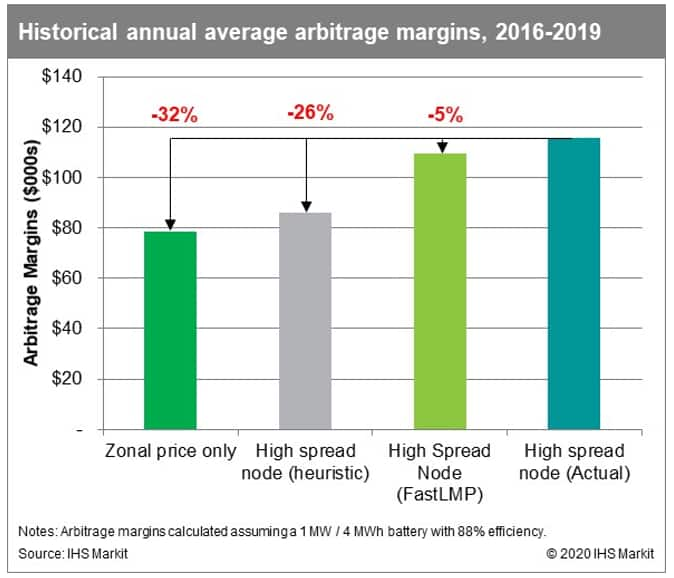

Applying the best performing heuristic, month-hour, against a historical period for a high spread node in ERCOT-South allows us to understand the magnitude of the impact that these methods have on assessing arbitrage margins. Margins calculated using a heuristic are understated by 26%, only slightly better than those calculated using zonal price alone (32%). FastLMP, IHS Markit's package of statistical and machine learning models, is able to get within 5% of the actual arbitrage margins for this bus.

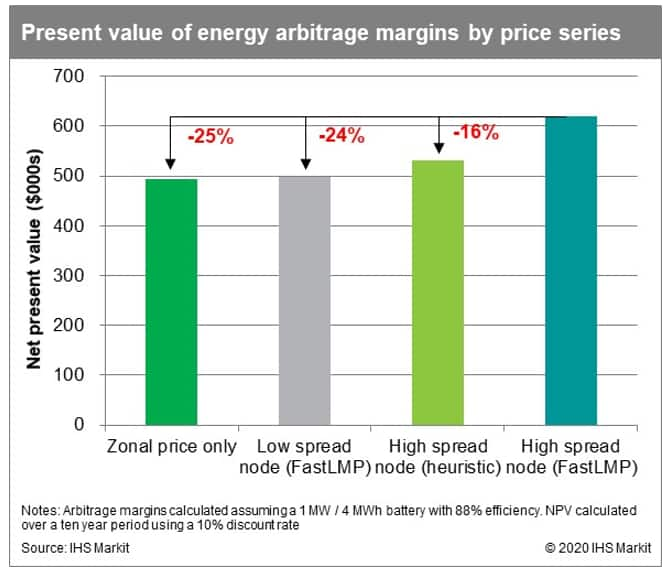

Extending the analysis to include a node just a few miles away with a much lower spread, and examining the forecast rather than the historical period, reveals the wide gap between the margins forecasted by FastLMP and those calculated using a heuristic or zonal price series. The difference between low and high spread nodes also illustrates the importance of site selection—identifying the right location for a storage project can increase arbitrage margins substantially. FastLMP expedites and facilitates this identification process.

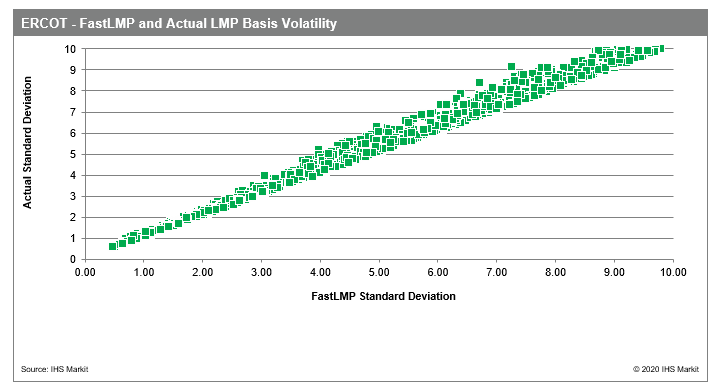

FastLMP is able to replicate the volatility of LMP basis at a node better than any heuristic or single model, while simultaneously reducing absolute error, by selecting from a bundle of statistical models that identify relationships between LMP basis and fundamental market variables like wind, load, delivered natural gas prices, and price differences among neighboring zones within a power market. FastLMP also has a stochastic layer that strips outage events that can distort heuristics and reinjects them into the forecast considering sign, duration, magnitude, and chronological variables. FastLMP relies on IHS Markit forecasts of these fundamental variables to extend these trends into the forecast.

To learn more about how FastLMP can improve your rapid analysis of storage or renewables projects, download our full case study, "FastLMP: A mixed model approach for battery storage project site evaluation in ERCOT."

Duncan Anderson, Senior Research Analyst at IHS Markit, focuses on the development and operation of market simulation, big data, and advanced analytical models for the North American Power Analytics team.

Barclay Gibbs, Senior Director of Power and Renewables at IHS Markit, specializes in power market analysis, due diligence, and regulatory advisory for the North American Power and Renewables team.

Sam Huntington, Associate Director with the Gas, Power, and Energy Futures team at IHS Markit, focuses on energy storage and power market fundamentals.

Posted on 15 September 2020

Learn more about FastLMP in our in-demand webinar:

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fheuristic-assessments-of-lmp-understate-arbitrage-margins-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fheuristic-assessments-of-lmp-understate-arbitrage-margins-.html&text=Heuristic+assessments+of+LMP+understate+arbitrage+margins+for+energy+storage+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fheuristic-assessments-of-lmp-understate-arbitrage-margins-.html","enabled":true},{"name":"email","url":"?subject=Heuristic assessments of LMP understate arbitrage margins for energy storage | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fheuristic-assessments-of-lmp-understate-arbitrage-margins-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Heuristic+assessments+of+LMP+understate+arbitrage+margins+for+energy+storage+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fheuristic-assessments-of-lmp-understate-arbitrage-margins-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}