Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 07, 2020

Global lubricants demand also poised to take a hit

The ongoing COVID-19 pandemic is truly an all-encompassing event, with no corner of the globe or sector of the economy escaping unscathed. Lubricants are no exception, though there is nuance to the story.

Approximately 61% of global inland lubricants demand (excluding international marine lubricants) is accounted for by the transportation sector; that is, the lubrication of engines and parts within cars, trucks, planes, boats, and other moving vehicles. Not unsurprisingly, demand from this sector is quite vulnerable in the near-term since the movement of people and goods is being hammered by government lockdown measures and social distancing. Moreover, transport sector lubricants consumption is expected to fall faster than transport fuels demand as economic pressures will lead many vehicle owners to delay oil changes, stretching drain intervals beyond usual levels. Specifically, IHS Markit expects an approximately 10% decline in global motor fuels demand this year, but a nearly 14% drop in transport sector lubricants consumption.

The remaining 39% of inland lubricants demand is associated with industrial or commercial activity; think factories or other heavy manufacturing plants. Consumption here will also decline as COVID-19 crimps broader economic activity the world over. However, preliminary projections suggest that the rate of decline will be far less - around 3% in 2020 - than that for transport sector lubricants.

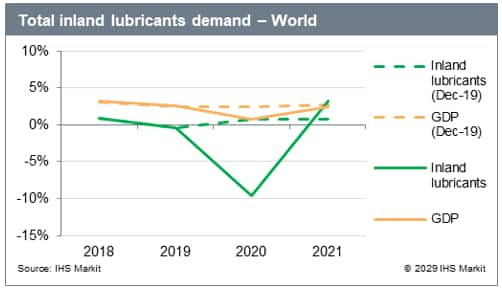

Figure 1: Total inland lubricants demand - World

All this adds up to an approximately 9.5% decrease in global inland lubricants consumption this year. For comparison, demand destruction during the Great Recession peaked at just 7.2% in 2009. Truly, as with all things COVID-19, this is an unprecedented time for the global lubricants sector.

A full assessment of the corresponding impacts on the base oil sector will be available in August 2020 via the annual base oil supply/demand balance update from the Global Base Oils Service.

Rob Smith is a Director of the Global Fuel Retail group at IHS Markit.

Posted 07 April 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-lubricants-demand-also-poised-to-take-a-hit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-lubricants-demand-also-poised-to-take-a-hit.html&text=Global+lubricants+demand+also+poised+to+take+a+hit+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-lubricants-demand-also-poised-to-take-a-hit.html","enabled":true},{"name":"email","url":"?subject=Global lubricants demand also poised to take a hit | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-lubricants-demand-also-poised-to-take-a-hit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+lubricants+demand+also+poised+to+take+a+hit+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-lubricants-demand-also-poised-to-take-a-hit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}