Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 10, 2021

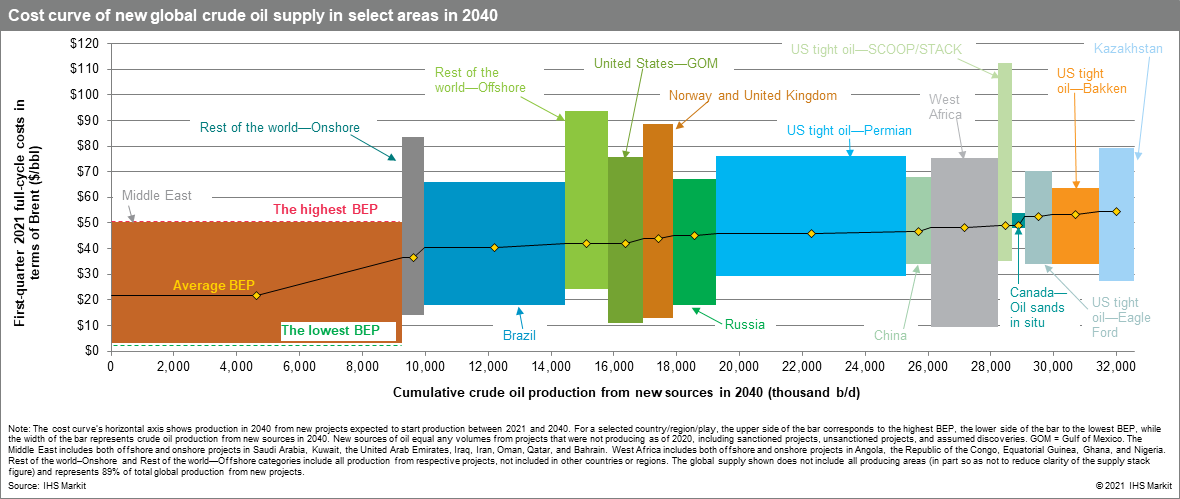

Global crude oil cost curve shows 90% of projects through 2040 breaking even below $50/bbl

EXECUTIVE SUMMARY

- The COVID-19 pandemic and the energy transition will

reduce long-term oil demand levels and accelerate the period at

which it peaks. Crude oil demand was reset at a lower

level following a 10 MMb/d decline in 2020. In our new long-term

outlook, crude oil demand continues to grow to 2033, peaking at

about 81 MMb/d, which is 5.2 MMb/d lower and four years earlier

than the peak we foresaw in our outlook from 2020. Efficiency

trends, alternative fuels and drivetrains, government policies, and

changing demographics limit the need for fossil petroleum-based

products. As these trends accelerate, crude oil demand will decline

to about 80 MMb/d by 2040 (approximately the same level as 2019

pre-pandemic levels).

- Most sources of global crude oil supply projected until

2040 can break even below $50/bbl Brent in constant 2020 dollar

terms. Almost 90% of the average annual crude oil

production from new sources globally in 2040 breaks even below

$50/bbl Brent, while 44% breaks even at prices of $40/bbl or below.

However, we expect that both conventional and tight oil projects

that break even at $50/bbl and above will still be needed to meet

demand and offset base declines.

- The Middle East and US tight oil account for about half

of global average annual crude oil production from new sources in

2040, but the Middle East continues to enjoy the lowest average

break-even prices (BEPs). The average weighted Middle East

BEP is about $22/bbl Brent, whereas the average US Permian well

requires about $46/bbl Brent. The overall global supply stack

remains relatively flat, with the majority of supply expected to

break even between $40/bbl and $50/bbl.

- Some volumes of oil supply that break even at prices

higher than $50/bbl will still be produced. The oil price

environment will not be linear; rather, oil prices will cycle above

and below the long-term averages we have projected. There will be

projects that investors bring to life when prices are higher than

average. Moreover, the economics of some projects to be brought

onstream will only be known in retrospect, such as wells that do

not perform as well as expected after they have been

completed.

- Upstream investment shifts away from greenfield megaprojects. As oil demand growth decelerates and the energy transition accelerates, an investment shift is under way in new upstream projects. Upstream operators have shifted from expensive, large-scale, single-project investments to small- or medium-scale onshore and subsea tieback projects, and those with multiphase expansion opportunities with economical break-even prices are expected to fill in the majority of new source conventional crude oil production over the next two decades.

Key Changes from last year

- Average BEPs for US tight oil plays have decreased owing to

many factors, including a higher assumed price received for natural

gas (from $1.50/Mcf to $3.00/Mcf, Henry Hub basis), productivity

increases in some oil plays, and lower capex per well due to the

COVID-19 impact on rig and frac crew counts.

- In terms of new conventional offshore production, the curve now

includes low-cost Guyana offshore with a BEP of $38/bbl. BEPs are

lower for India (a $14/bbl decrease) and China (a $11/bbl

decrease). These decreases are partially offset by higher BEPs for

Vietnam (a $6/bbl increase), as well as Kazakhstan, Nigeria, and

Thailand (a $5/bbl increase for each).

- For conventional onshore projects, two regions have materially lower BEPs—China and India (decreases of $11/bbl and $9/bbl, respectively)—owing to more precise cost data obtained for these projects. All other onshore projects have higher BEPs.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-crude-oil-curve-shows-projects-break-even-through-2040.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-crude-oil-curve-shows-projects-break-even-through-2040.html&text=Global+crude+oil+cost+curve+shows+90%25+of+projects+through+2040+breaking+even+below+%2450%2fbbl+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-crude-oil-curve-shows-projects-break-even-through-2040.html","enabled":true},{"name":"email","url":"?subject=Global crude oil cost curve shows 90% of projects through 2040 breaking even below $50/bbl | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-crude-oil-curve-shows-projects-break-even-through-2040.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+crude+oil+cost+curve+shows+90%25+of+projects+through+2040+breaking+even+below+%2450%2fbbl+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fglobal-crude-oil-curve-shows-projects-break-even-through-2040.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}