Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 25, 2020

Ghosts from summers past: Rolling blackouts return to California’s power market

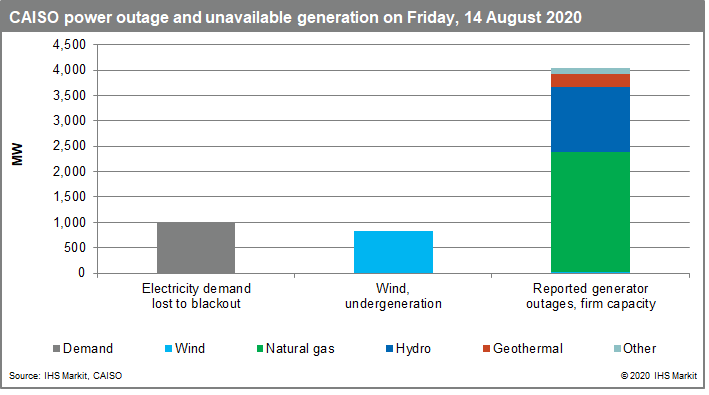

Rolling blackouts returned to the California Independent System Operator (CAISO) on Friday, 14 August, for the first time since the 2001 energy crisis. More than 400,000 customers lost electricity between approximately 6:40 pm and 8:40 pm, equivalent to 1,000 MW of load. Another blackout occurred the next day but only 500 MW of load was lost for 20 minutes—between 6:30 pm and 6:50 pm. CAISO warns that tight power supply and hot weather could lead to power outages again later this summer.

The Friday electricity shortage took almost everyone by surprise. Hot weather pushed power demand to its highest year-to-date point, but not atypically so. Peak demand that day was 46,268 MW and was very similar to what occurred in 2018, despite what a Stage 3 Emergency might imply.

Instead, peak net load was the challenge. Net load is electricity demand less renewable generation and it must be met with dispatchable generation (for example, natural gas and batteries). Peak net load was 39,485 MW at 7 pm and might have gone as high as 40,485 MW prior to the rolling blackouts; however, it was not unprecedented. Peak net load was over 4,000 MW higher in 2017 and blackouts did not occur then.

Ultimately, the causes of the blackouts were on the supply side of the power market. The dependability of renewable capacity, in this case wind, during critical hours will likely be re-examined by policymakers and the grid operator. Although sophisticated simulations are used to determine what amount of renewables are likely to be available during tight supply hours, the events of 14 August may provide additional data that can be used to improve future evaluations.

Resource adequacy policy and its incentive structure for dispatchable generation may also be reviewed. According to a CAISO report, 5 GW of power plants were unavailable when the grid operator only needed 1 GW of incremental supply to keep the lights on. Natural gas units physically located in CAISO were the largest type of generation unavailable, amounting to about 6% of total gas capacity physically located in the market. However, this level of gas outages is not abnormal—roughly twice as much was offline on the peak net load day in 2018. Some hydroelectric capacity and generators located outside CAISO were also unavailable when grid operators needed them on 14 August.

Looking forward, California will likely continue transitioning to lower carbon power supply and address reliability issues along the way. Policymakers can look to eastern US power markets, particularly PJM, for lessons learned about generator outages. In addition, CAISO's resource adequacy position will be strengthened in the coming years by greater battery build. Ultimately, lessons learned from CAISO's 14-15 August blackouts could help other grid operators avoid a similar event, thereby supporting the global transition to lower carbon power supply.

IHS Markit closely monitors the global energy transition, publishing data, key insights and market analysis. Learn more about our research.

Wade Shafer is a Director at IHS Markit.

Posted 25 August 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fghosts-from-summers-past-rolling-blackouts-return-to-californi.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fghosts-from-summers-past-rolling-blackouts-return-to-californi.html&text=Ghosts+from+summers+past%3a+Rolling+blackouts+return+to+California%e2%80%99s+power+market+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fghosts-from-summers-past-rolling-blackouts-return-to-californi.html","enabled":true},{"name":"email","url":"?subject=Ghosts from summers past: Rolling blackouts return to California’s power market | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fghosts-from-summers-past-rolling-blackouts-return-to-californi.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Ghosts+from+summers+past%3a+Rolling+blackouts+return+to+California%e2%80%99s+power+market+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fghosts-from-summers-past-rolling-blackouts-return-to-californi.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}