Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 11, 2021

The future of ethane as a global commodity

Ethane is a by-product that can be produced from refinery off-gas or from natural gas processing, with its demand driven by a single end use—as feedstock at steam crackers for ethylene production. When ethane has no end-use market, it is typically left in the off-gas or the natural gas stream and burned for its thermal value. This is because there is an expense associated with separating the ethane from the other components of its source stream, and only where a market exists to provide incentive to undertake this process will producers consider recovering the ethane as a purity product. Consequently, the intrinsic value of ethane is often unclear, and ethane pricing mechanisms vary widely around the world.

Over the past decade, rapid unconventional oil and gas development in the United States has resulted in significantly increased ethane availability. Much of this ethane was initially left unrecovered because there was no demand for it. Increased ethane rejection reduced ethane prices to parity with natural gas, incentivizing a wave of investment in both domestic consumption and exports. Several international buyers import US ethane to fill the void left by dwindling domestic ethane supply, while others take advantage of the lower cost of US ethane to diversify and make additional investments to accommodate the more economical feedstock.

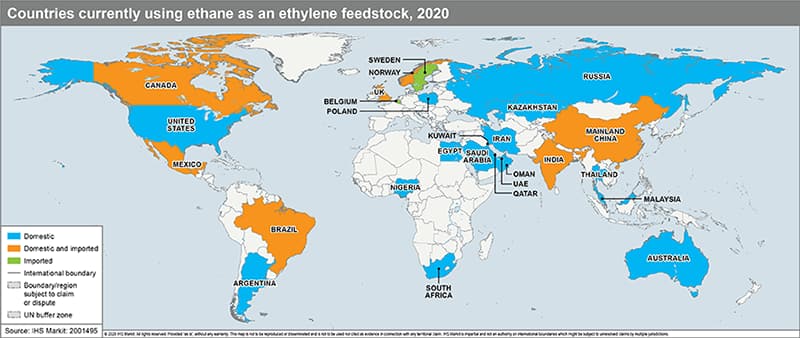

Figure 1

As shown in Figure 1, in 2020 there were 26 countries using ethane, either from domestic sources, or based on imported sources (almost exclusively from the United States). In our view, there are three types of players that might consider importing US ethane:

- Those currently cracking domestically produced ethane, thus having the potential to diversify supply or crack more ethane

- Steam crackers using other feedstocks that could potentially be reconfigured to use ethane

- Countries that are short in ethylene and willing to invest in greenfield projects to use ethane as a new feedstock

Some existing importers such as China are likely to continue to expand their use of ethane as a feedstock, and most of this incremental supply will need to be imported. Looking beyond existing importers, more than a dozen other countries also use ethane as part of their ethylene feedstock. Many of these countries are in the Middle East and Commonwealth of Independent States (CIS), where vast local oil and gas resources limit the need for US imports.

Several other countries could consider US ethane, however, either for supply diversity or to crack more ethane thanks to favorable economics. For example, declining ethane supply in Europe could eventually lead to expansion of US imports there. Both Borealis in Sweden and Total in Belgium currently have contracts with Equinor to provide ethane feedstock, but US ethane might find its way into Belgium as Norwegian oil and gas production matures. In particular, if INEOS moves forward with its proposed newbuild ethane cracker in Antwerp, supply would almost certainly come primarily from the United States.

In Asia, Thailand and Malaysia currently use ethane from domestically produced natural gas or refinery off-gas. However, stagnant to declining domestic gas production may lead both countries to reconsider their options. In the long term, it is also possible that Africa could begin to build a more robust petrochemical sector, and some of this could be based on imported ethane.

Gain greater insight into global and regional ethane and NGL markets with IHS Markit Midstream Oil and NGLs research. Learn more here.

Fernando Covas, Executive Director, Midstream Oil & NGL Research and Consulting, IHS Markit

Keefer Douglas, Director, Midstream Oil and NGLs Research and Consulting, IHS Markit

Yanyu He, Ph.D, Executive Director, Natural Gas Liquids (NGL) Research and Consulting

Posted 11 February 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffuture-of-ethane-as-a-global-commodity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffuture-of-ethane-as-a-global-commodity.html&text=The+future+of+ethane+as+a+global+commodity+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffuture-of-ethane-as-a-global-commodity.html","enabled":true},{"name":"email","url":"?subject=The future of ethane as a global commodity | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffuture-of-ethane-as-a-global-commodity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+future+of+ethane+as+a+global+commodity+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2ffuture-of-ethane-as-a-global-commodity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}