Extraordinary price pressure continues in the oil markets. Is a price rally possible?

Key messages excerpted from the Global Crude Markets Short Term Outlook, August 2015

For a decline in US output to appreciably erode the global surplus, it would require sustained WTI, Cushing prices of $45/b or less for two successive quarters. This price threshold may decline further if costs continue to decline, sweet spot high grading continues and capital remains accessible. The chance of a momentum- driven price rally as production or rig count declines remains possible.

Successful negotiations with Iran would send another 100-200,000 barrels per day to markets within 2-3 months of “Implementation Day” and up to 600,000 barrels a day after one year. Given oversupply conditions, this will be difficult for the market to absorb, placing more pressure on global oil prices including WTI. Saudi Arabia may respond aggressively if Iran pushes oil onto the market at a rapid rate.

Crude and refined product stocks are up substantially this year—and with the current mild contango conditions (a situation where the futures price of a commodity is above the expected future spot price) more storage is available. Remaining ullage (the amount of spare room in a tank) will dictate how long the market can absorb excess production. Ullage is a difficult to assess number given the variety and opacity of storage data.

Feedback loops could slow the time it takes for US production to fall enough. A rising contango due to lower ullage will also prompt more hedging, allowing producers to continue drilling.

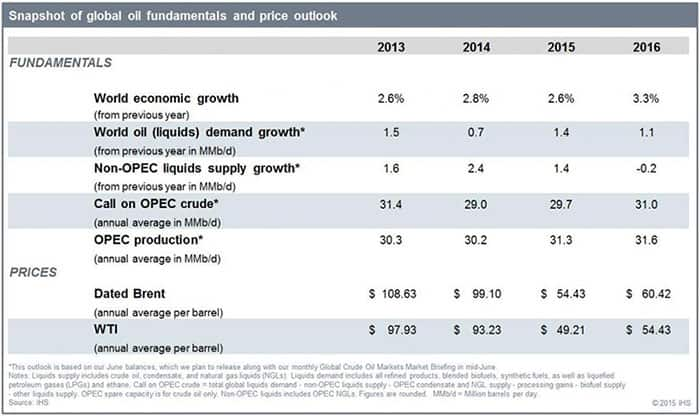

We have revised the 2015 Dated Brent average down to $54.43/bbl, with 2016 at $60.42/bbl and WTI at $49.21/bbl and $54.43/bbl respectively.

This is an excerpt of key monthly messages intended to offer the most concise overview of our August global crude market short term outlook. A much larger report and analysis is released in the first part of each month with a more detailed Excel file from the IHS crude price outlook.

Do you need to understand the state and likely trajectory of global oil supply/demand and prices?

Download the Crude Oil Markets brochure and request a quote and more details.

Posted 18 August 2015

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.