Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 23, 2021

Electricity forward and derivatives market in India: Will it help address the current issues and attract new investments?

In July 2020, the Ministry of Power (MoP) approved the introduction of electricity forward contracts and derivatives market in India. The reform is much awaited and came on the back of the resolution of the dispute between the Central Electricity Regulatory Commission (CERC) and the Securities and Exchange Board of India (SEBI). This is an important incremental step in expanding the overall structure of physical delivery market, besides adding electricity as a commodity in the financial market.

As per the proposed structure, physical and financial markets will operate separately on different exchanges and will be regulated by CERC and SEBI, respectively. Electricity contracts i.e., the existing physical delivery contracts and nontransferable specific delivery (NTSD) contracts shall be regulated by CERC, while the commodity derivatives in electricity other than NTSD contracts shall be regulated by the financial regulator SEBI. Following this order from MoP, in July 2020, CERC issued a draft on power market regulation[1] addressing some of the pressing concerns.

Is India ready for the electricity forward and derivatives market?

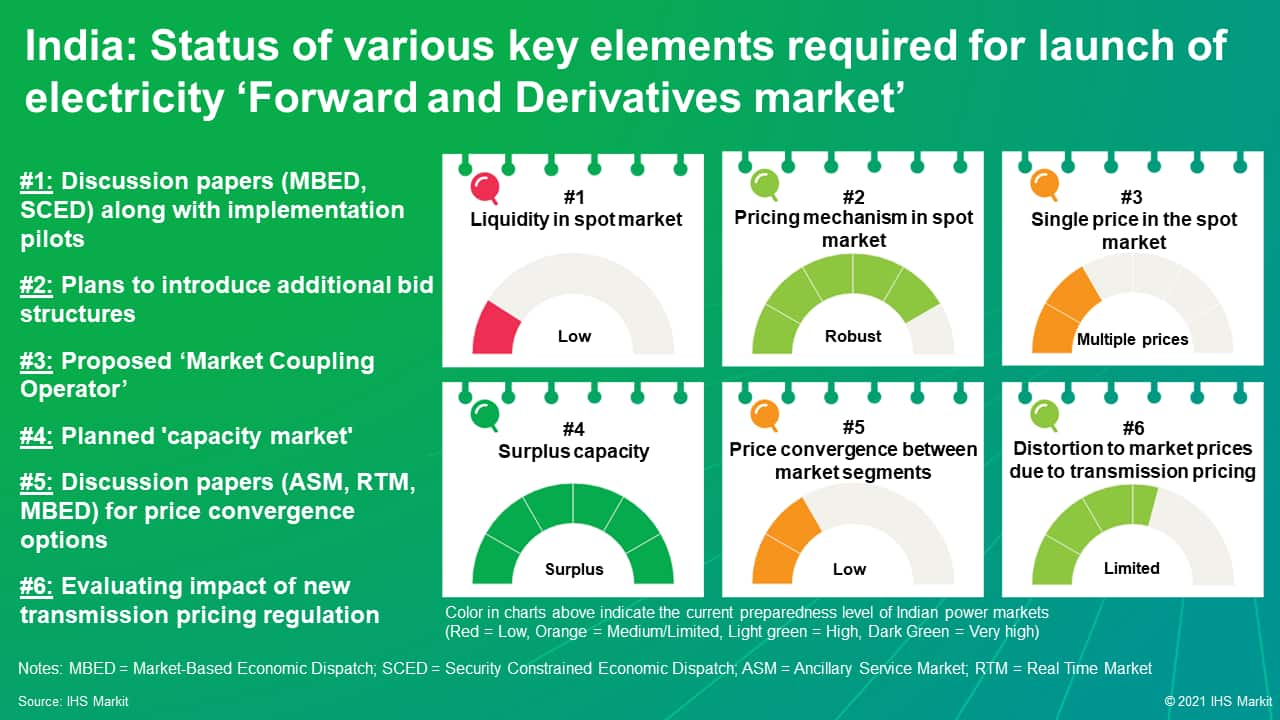

The experience from global power markets indicates that several elements need to be in place for the launch of the electricity forward and derivatives market. For India, a robust basic structure is already in place and the regulator is all geared up for a successful implementation. IHS Markit expects a series of market reforms to be proposed in the next couple of years to smoothen the transition for a successful implementation, and estimates liquidity in the physical spot market (a key structural requirement) will evolve in phases.

Will it help address the current issues and attract new investments? The reform is expected to assist the Indian power sector to overcome some of the current inadequacies by introducing an organized forward power market. Some of the benefits have been summarized below:

- Currently, DISCOMs have ~90% of their requirement tied-up under LT contracts. The new market structure will help the distribution companies (DISCOMs) and open access (OA) participants to reduce their overall cost of procurement by optimizing their power portfolio which under the current structure is either very costly or not possible owing to structural rigidities.

- Currently, the Indian spot market continues to experience high volatility with an average standard deviation of 20-40% in market prices for past 10 years. Forward and derivatives markets will lead to lower volatility in the spot market (in medium to long-term) leading to lower price risks for participants (for example in France, post-introduction of the derivatives market, the volatility in spot market prices reduced by 25 - 40%).

- With increased liquidity, better information, larger participation, and re-trade of contracts forward and derivatives markets will lead to price convergence among different market segments. In India, prices between the bilateral and spot markets continue to remain divergent (limited price convergence observed during specific months or parts of a year).

- Forward and derivative markets will provide forward price signal which can serve as benchmark for evaluating investment decisions. DISCOMs/buyers will be able to assess the reasonableness of their purchase agreements being signed against these prices. However, system would need a separate mechanism and additional reforms (for example forward capacity markets) to provide price signals for system reliability and attracting investments for new capacity additions.

To learn more about our Asia Pacific power research, please visit our Asia Pacific Regional Integrated Service page.

Rashika Gupta, Ph.D., is a director on the Climate and Sustainability team at IHS Markit, responsible for research and analysis for the India, Sri Lanka, Pakistan, and Bangladesh markets.

Ashish Singla, associate director with the Climate and Sustainability team covering research and analysis on power and renewables for South Asian countries at IHS Markit.

Posted on 23 February 2021

[1] On 15th February 2021, CERC notified 'Power Market regulations 2021' covering various aspects discussed in the draft

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2felectricity-forward-and-derivatives-market-in-india-will-it-he.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2felectricity-forward-and-derivatives-market-in-india-will-it-he.html&text=Electricity+forward+and+derivatives+market+in+India%3a+Will+it+help+address+the+current+issues+and+attract+new+investments%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2felectricity-forward-and-derivatives-market-in-india-will-it-he.html","enabled":true},{"name":"email","url":"?subject=Electricity forward and derivatives market in India: Will it help address the current issues and attract new investments? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2felectricity-forward-and-derivatives-market-in-india-will-it-he.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Electricity+forward+and+derivatives+market+in+India%3a+Will+it+help+address+the+current+issues+and+attract+new+investments%3f+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2felectricity-forward-and-derivatives-market-in-india-will-it-he.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}