Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 03, 2021

Egypt's E&P Investment Safeguards

Introduction

Over the past decade Egypt has held various licensing rounds, which

have usually been successful in awarding a good number of blocks,

and it hopes to obtain similar results through the ongoing Egyptian

Natural Gas Holding Company (EGAS) and the Egyptian General

Petroleum Corporation (EGPC) 2021 Egypt Bid Round.

The legal attractiveness of Egypt's licensing rounds for the investor is partly linked to investment assurances present in the upstream contracts. These include a stabilisation mechanism that allows for the possibility of restoring the contractor's initial economic conditions after the occurrence of significant negative economic circumstances deriving from legislative or regulatory changes. The stabilisation clause is connected to a dispute resolution clause providing further protection. Moreover, there are other features of the contract that provide additional stability.

Stabilisation

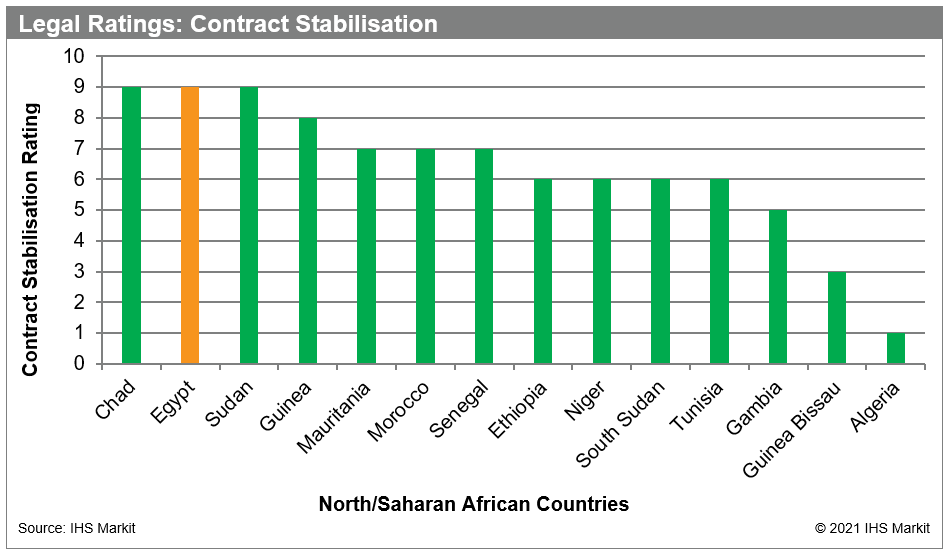

IHS Markit's PEPS ranks Egypt's contract stabilisation terms among

the best across the North/Saharan African countries.

Egypt's stabilisation clause is an economic equilibrium clause,

the type of stabilisation clause most used globally today.

Generally, economic equilibrium clauses state that if the initial

economic balance between the parties is altered in a negative

manner because of legislative or regulatory changes, the parties

will negotiate contractual amendments reinstating the initial

economic balance.

Since 1998, Egypt has been using the same stabilisation clause.

According to this, if, after contract signature, there are

legislative or regulatory changes "significantly" affecting in a

negative manner the economic interest of the contractor (or forcing

the contractor to remit to the government the proceeds from the

sale of the contractor's petroleum), the parties ("parties" per the

model PSC's title comprise the government, the relevant Egyptian

national oil company (NOC), and the contractor) must negotiate,

within 90 days, contractual modifications restoring the initial

economic balance. If the parties cannot reach an agreement, they

will settle the dispute according to the disputes and arbitration

clause.

Dispute Resolution and Arbitration

The contractor might have access to arbitration to enforce

its stabilisation rights, but the position is not entirely clear.

The dispute resolution forum depends on who the parties to the

dispute are.

As background information, in Egypt, upon a commercial

discovery, the model PSC requires the relevant Egyptian NOC and the

contractor to form an operating joint venture company (a private

company to which the NOC and the contractor each contribute 50% of

the capital) to carry out petroleum operations.

Since 1998, Egypt has been using the same disputes and arbitration

clause. Any dispute, breach, termination, or invalidity between the

government and the parties ("parties" in this

provision means the contractor and the relevant Egyptian NOC) must

be settled by the Egyptian courts.

Conversely, any dispute, breach, termination, or invalidity

between the NOC and the contractor must be

settled according to the arbitration rules of the Cairo Regional

Center for International Commercial Arbitration (CRCICA). Moreover,

unless the parties agree otherwise, the venue of the arbitration is

in Cairo. As a result of the arbitration rules and of the selected

venue, the arbitration is a domestic one.

The award is final and binding, and the execution is referred to

the competent courts based on Egyptian law. However, the execution

of awards in Egypt is not always straightforward.

If the arbitration procedure as described above cannot occur, the

NOC and the contractor transfer the dispute to an ad hoc

tribunal according to the UNCITRAL arbitration rules in force at

contract signature.

Additional Stability

There are two additional features indirectly reinforcing the PSC's

stability:

- First, the NOC in Egypt generally pays corporate income tax (CIT) and royalty on behalf of the contractor.

- Second, each new concession agreement requires Parliament to pass a legislative act authorising the Minister of Petroleum and Mineral Resources to sign a contract on the government's behalf. The concession agreement acquires force of law, so, in case of conflict with the general Egyptian law, the agreement should prevail (as lex specialis).

Conclusion

Egypt's model PSCs contain a stabilisation clause offering the

contractor some stability guarantees. This clause is linked to a

dispute resolution procedure, albeit the procedure might not always

provide access to an arbitration, which, if triggered, in any case

cannot be defined as internationally anchored. Moreover, two

additional stability elements for the contractor are that the NOC

generally pays CIT and royalty on the contractor's behalf and that

concessions have force of lex specialis. These investment

assurances, including the stabilisation clause, should be an

attractive element for the prospective contractor participating in

the 2021 Egypt Bid Round.

A longer, more detailed, version of this piece will soon be available to our subscribers.

Screen upstream opportunities and above-ground risk with PEPS from IHS Markit.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fegypts-ep-investment-safeguards.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fegypts-ep-investment-safeguards.html&text=Egypt%27s+E%26P+Investment+Safeguards+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fegypts-ep-investment-safeguards.html","enabled":true},{"name":"email","url":"?subject=Egypt's E&P Investment Safeguards | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fegypts-ep-investment-safeguards.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Egypt%27s+E%26P+Investment+Safeguards+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fegypts-ep-investment-safeguards.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}