Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 16, 2018

A deepwater case study: How adopting & simplifying standards and specifications helps cut cost and grow production

Beyond the initial cost and economics, one of the key challenges to deepwater success is the long time it can take to reach Final Investment Decision (FID) and first production. Among the key reasons for delay is a lack of consistency and standardization in the business processes and workflows for maturing these opportunities through the lifecycle, including exploration.

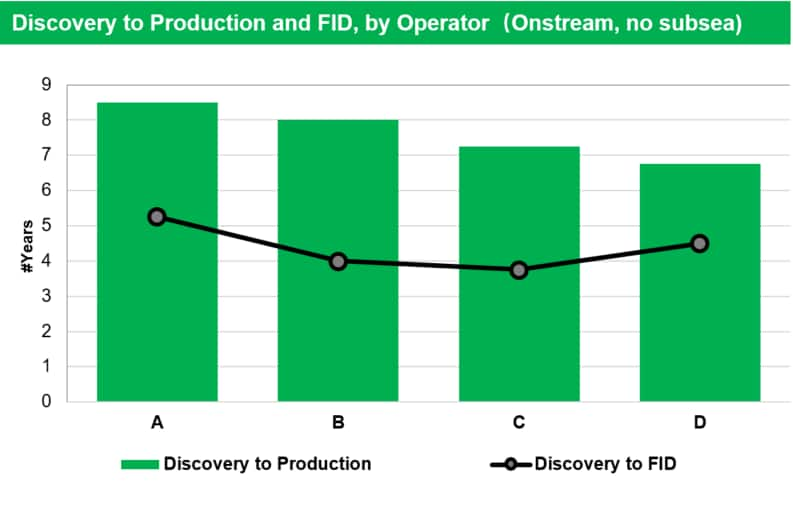

Figure 1: Onstream Projects Only, No Subsea

A few years ago, Company A was taking more time from Discovery to FID and Discovery to production (5.2 years and 8.5 years respectively) than others, such as Company B, C or D, indicating a need to focus not only the quality and consistency of technical evaluations, but also to improve the cycle time, from exploration to concept selection - this was especially important given a significant number of deepwater opportunities and projects in the early phases of their maturation pipeline. As is the case for many IOCs and NOCs, Company A had exploration and new business development teams in various regions responsible for the workflows, analogue databases, tools, and assumptions (including costs) to mature these opportunities and progress them into the development phase. Exploration projects along both sides of the Atlantic margin can benefit from shared learnings, consistent evaluation methodology, aligned assumptions, and use of common analogues to reduce the evaluation cycle time.

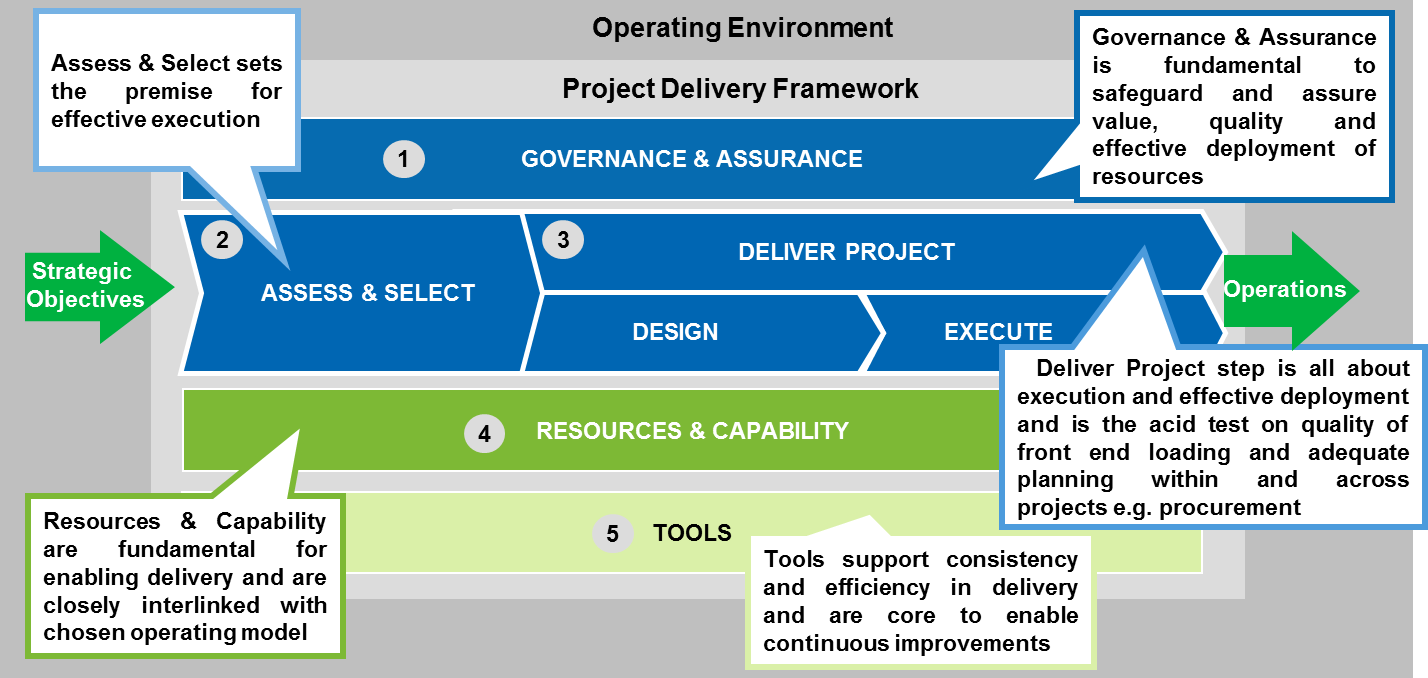

The framework below illustrates one approach to codifying the effective management and delivery of major upstream projects, beginning with the development of an understanding of the operating environment and its link to company strategic objectives. Managing capital projects requires involve many parts of a successful organization operating model, with five key elements to support workflows, as illustrated below: 1) governance and assurance, 2) assess and select, 3) project delivery (i.e., design and execute), 4) resources and capability, and 5) tools.

We begin by clearly defining the purpose of the organization, with process architecture and workflows drawn upon industry-leading practices, clear decision-gates and accountabilities across the maturation lifecycle, roles and responsibilities typically built around RACIs for easy reference during a project, and initial screening and front-end loading to reduce scope changes.

Figure 2: Operating environment and project delivery framework

We find it helpful to characterize and categorize projects in the portfolio to ensure the appropriate allocation of resources, and correct application of operating model and risk management.

Best practice adapts the organizational design to the project type, size, complexity, risk, etc.

However, despite our best efforts to simplify and standardize, the business remains complex and the operating environment is often challenging. Therefore, organizations and their processes and workflows require a high degree of resilience and adaptability, that we will refer to as organizational agility. Regardless of equipment and process standardization, rig efficiency will vary, work stoppages and downtime are inevitable, and contingency planning and root cause analysis are essential.

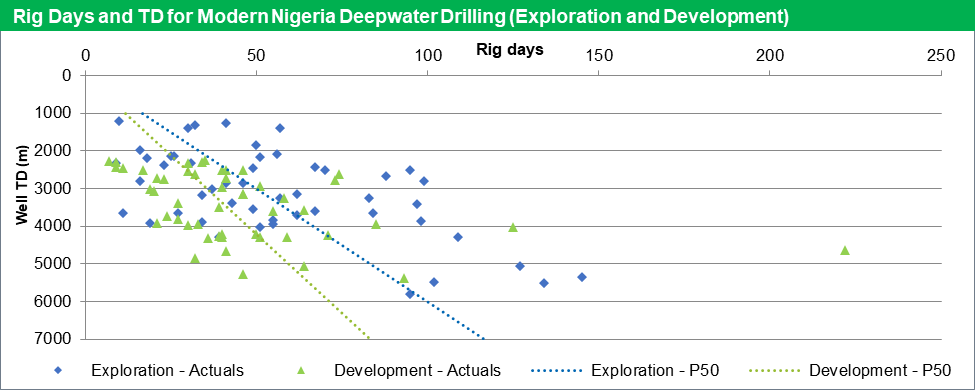

For example, the IHS Markit EDIN database contains 3,980 offshore Nigeria wells with valid spud dates. The earliest recorded well, Orimedu 1, was spudded in 1963; since the year 2000, there have been 387 exploration wells and 856 development wells drilled. These wells include both shallow and deepwater, range in TD from 1000 to 6000 meters, and required up to 450 rig days to drill! Even since 2015 (below), rig efficiency (i.e., TD/Rig days) ranges from a maximum of 89 m/day (Addax) to a minimum of 78 m/day (Exxon Mobil), with an average for three companies (also Chevron) of 82 m/day. Moreover, the pace and predictability of exploration wells is even more challenging, due to greater variation in the number of zones being drilled and tested, the amount of testing required, special logging activities, and because some exploration wells may simply be side-tracks from other wells and therefore have very short drilling times.

Figure 3: Rig days and TD for modern Nigeria deepwater drilling

On average, modern deepwater Nigeria exploration wells have required 150% as much time as development wells to drill and with generally more uncertainty. However, the worst-case scenario (i.e., 222 days, 4643 meters) was a development well! Despite the presence of world-class operators, the benefits of modern technology, and operator efforts to simplify and standardize, deepwater drilling off the coast of Africa is difficult and uncertain. Organizations, business processes, and workflows, must be designed and managed to afford a very high degree of resilience and adaptability.

To read more, download our whitepaper, 6 Ways to Cut Costs and Grow Production.

Kunfeng Zhu is a Principal Research Analyst at IHS Markit.

Tianshi Huang is Senior Consultant at IHS Markit.

Baihui Yu is a Consulting Analyst at IHS Markit.

Michael Muirhead is a Geologist at IHS Markit.

Justin Pettit is Vice President - Upstream Energy at IHS Markit.

Posted 16 November 2018

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeepwater-case-study.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeepwater-case-study.html&text=A+deepwater+case+study%3a+How+adopting+%26+simplifying+standards+and+specifications+helps+cut+cost+and+grow+production+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeepwater-case-study.html","enabled":true},{"name":"email","url":"?subject=A deepwater case study: How adopting & simplifying standards and specifications helps cut cost and grow production | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeepwater-case-study.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=A+deepwater+case+study%3a+How+adopting+%26+simplifying+standards+and+specifications+helps+cut+cost+and+grow+production+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fdeepwater-case-study.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}