Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 07, 2020

COVID-19 pressures Egypt’s power and gas sectors

Egypt's power demand faced steep declines from March to July 2020

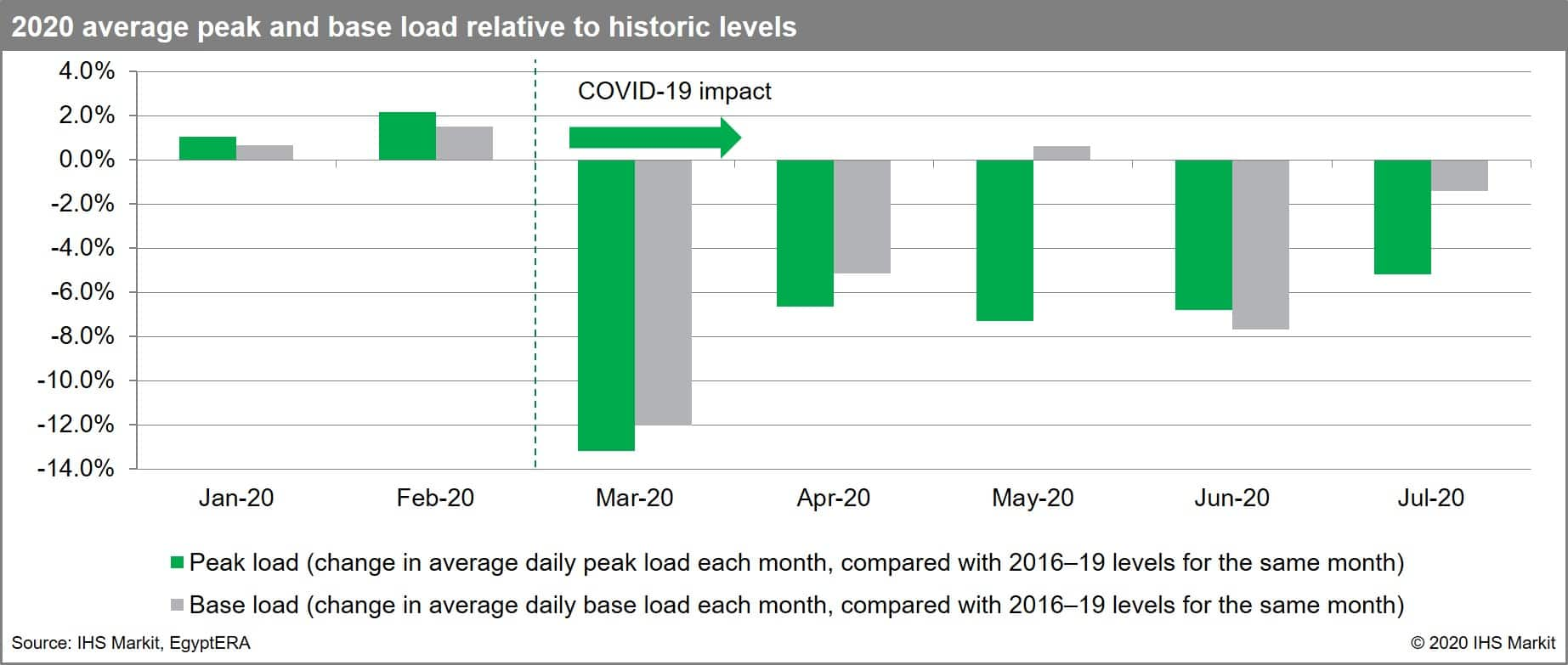

According to the Egyptian energy regulator, EgyptERA, the steepest declines happened in March and April 2020, when the average daily peak and base load fell by about 10% and 9%, respectively, compared with the same period in prior years.

In July 2020, as COVID-19 lockdown measures eased and the Egyptian economy started to show early signs of recovery in non-oil industry and in tourism, peak and base loads started to increase. Nonetheless, the highest daily peak load in July 2020 was 29.2 GW, about 9% below the highest daily peak load in fiscal year 2019/20 (from July 2019 to June 2020), which reached 32 GW in July 2019. Given that peak demand was already slowing—the annual peak load grew at less than 2% in 2018/19 and 2019/20 fiscal years, compared with around 5% in previous years—it may not see much growth in 2020/21.

Double jeopardy: Declines in power demand pressure fossil-fuel generation and highlight overcapacity in power and gas sectors

Generation reacted to power demand declines with average monthly power generation from March to July 2020 falling by 5% to 9%, compared with the same months in 2019. However, renewable energy and hydropower generation increased between March and July 2020.

Gas-fired power stations, on the other hand, saw a year-on-year decline in generation of about 10%, between March and May 2020. Similarly, oil-fired units reduced their generation by 68% on a year-on-year basis, between May and July 2020. As a result of natural gas and fuel oil acting as balancing fuels, recent state-owned thermal power projects face underutilization risks.

The likely slowdown of the annual peak load in 2020/21 will exacerbate the power system's overcapacity situation and further diminish the need for new capacity additions in the short term. Additionally, falling gas demand in the power sector underscores the oversupply of the Egyptian gas sector, since power has been a key anchor for the gas market.

The production of large offshore gas fields ramped up following the shortage in gas supply in 2012-14. This ramp-up was initially absorbed by growth in the industry and the power sector, mostly through oil substitution. However, since 2019 growth in gas demand has virtually stagnated, with natural gas demand from the power sector declining by almost 4% in the first half of 2020 (compared to the same period in 2019). This oversupply of gas puts pressure on upstream developers looking to recover heavy investments made over the past five years, all the while facing record low gas prices, lower industrial gas demand, and oversupplied export routes.

To learn more about our renewable energy research, visit our Global Power and Renewables service page.

Elsa Kiener,senior researcher,global power and renewables at IHS Markit,specializes in global power markets, including Middle East and North Africa.

Raul Timponi, associate director, IHS Markit, specializes in global power markets.

Anna Shpitsberg is a director of global power and renewables at IHS Markit, specializing in power market development and conducts research and consulting on emerging trends, the evolution of regulation, and industry strategy as it relates to the power sector, globally.

Posted on 7 October 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcovid19-pressures-egypts-power-and-gas-sectors.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcovid19-pressures-egypts-power-and-gas-sectors.html&text=COVID-19+pressures+Egypt%e2%80%99s+power+and+gas+sectors+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcovid19-pressures-egypts-power-and-gas-sectors.html","enabled":true},{"name":"email","url":"?subject=COVID-19 pressures Egypt’s power and gas sectors | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcovid19-pressures-egypts-power-and-gas-sectors.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=COVID-19+pressures+Egypt%e2%80%99s+power+and+gas+sectors+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcovid19-pressures-egypts-power-and-gas-sectors.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}