Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 05, 2023

Could Eni's NFW unveil further potential offshore Morocco?

Eni is gearing up to commence drilling operations in the Aaiun Tarfaya Basin offshore Morocco with its Cinnamon-1 exploratory well, utilizing the Topaz Driller jackup. The well will be situated in the Tarfaya Offshore Shallow license at a water depth of approximately 100 m to the northeast of the Cap Juby field, the only offshore discovery in this region that remains undeveloped due to reservoir and economic uncertainties. At the time of writing, the targeted objective/objectives were unknown. However, the focal point of interest in the area is the Lower Jurassic play, identified in the nearby prospects such as Akassa, La Dam, Tarfaya Marin-A and Trident and is characterized by structural closures in underexplored and unexplored reef and forereef buildups. In case of success, the Cinnamon-1 well would become a play opener in the frontier basin with a large resource potential.

The Tarfaya Offshore Shallow block was awarded in 2018. The fiscal terms are favorable with royalties linked to the production and water depth. The Hydrocarbon Law in Morocco underwent revisions in 1992 and later in 2000, aiming to catalyze foreign investment. Consequently, the state oil company ONHYM holds participating interests limited to 25% and benefits from the development of any exploration activities by imposing relevant taxes and royalties. The fiscal regime includes a corporate tax rate of 30% applied to oil production with a 10-year tax exemption on discoveries. There are no royalties imposed on the initial 2.25MMbbl of production from offshore concessions situated at depths below 200 meters, and thereafter, a 10% royalty applies to any production exceeding this threshold.

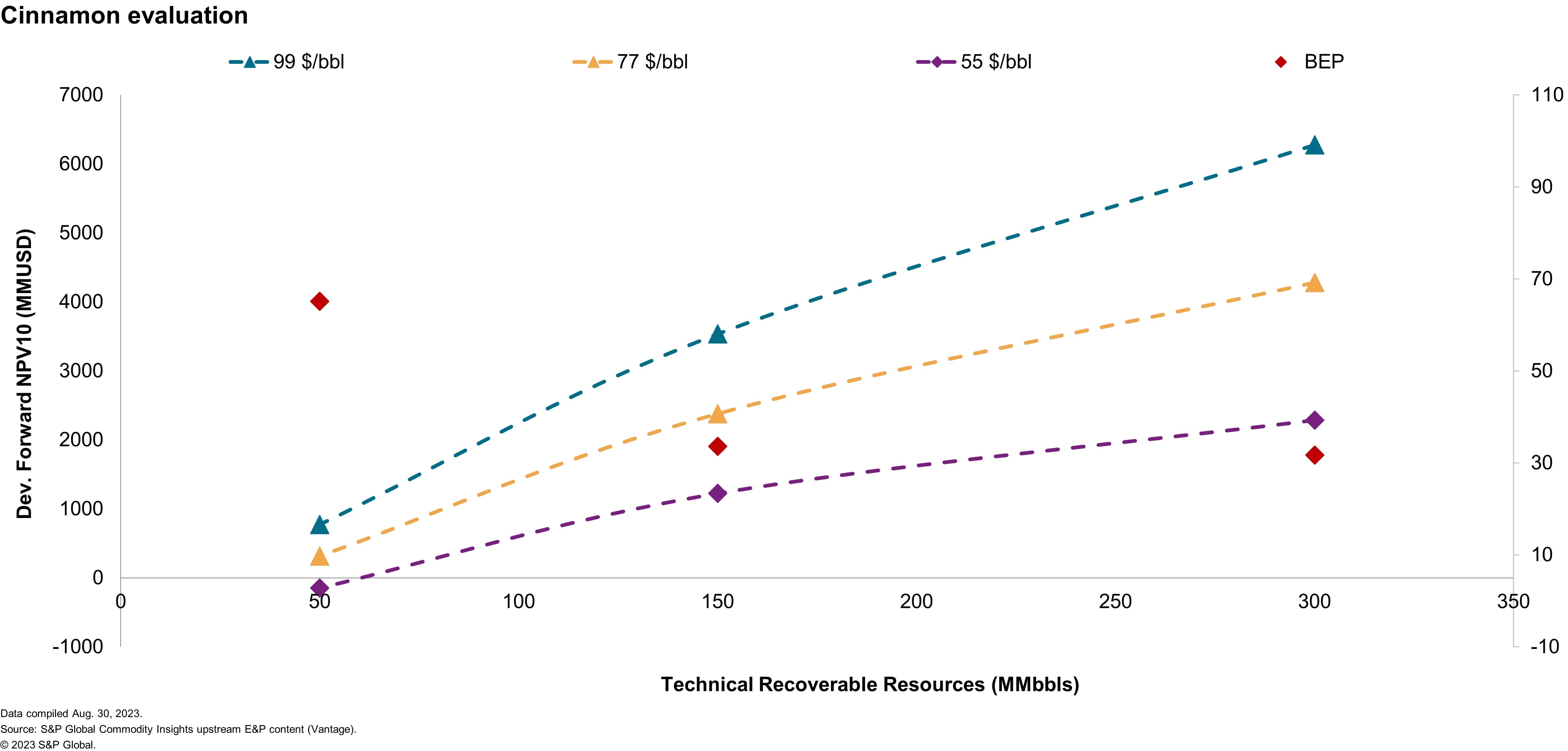

In case of success, analyses show that at a Brent oil price scenario of $77/bbl, Eni would be required to discover recoverable resources of at least 50 MMbbls to break even, while a discovery of 300 MMbbl would generate a net present value (NPV) exceeding USD 4 billion with a healthy break-even price (BEP) around 30$/bbl. Given a more moderate Brent oil price of $55/bbl, minimum economic field size (MEFS) is estimated to be around 60 MMbbl recoverable, while a discovery of 300 MMbbl would be worth more than USD 2 billion with expected payback within 7 years, a rate of return (IRR) of 27.5% and a government take of around 30%.

Currently, Morocco's hydrocarbon production is primarily centered around gas and condensate, with average production rates below 10 million standard cubic feet per day (MMscf/d), which is considerably below domestic consumption. The success of the Cinnamon-1 well not only has the potential to unlock a large hydrocarbon resource within Eni's blocks, but also presents an opportunity for the company to leverage Morocco's favorable fiscal terms as well as to reduce Morocco's reliance on energy imports and enhance its energy self-sufficiency.

***

Want to access more upstream content? Visit S&P EDIN & Vantage.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcould-enis-nfw-unveil-further-potential-offshore-morocco.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcould-enis-nfw-unveil-further-potential-offshore-morocco.html&text=Could+Eni%27s+NFW+unveil+further+potential+offshore+Morocco%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcould-enis-nfw-unveil-further-potential-offshore-morocco.html","enabled":true},{"name":"email","url":"?subject=Could Eni's NFW unveil further potential offshore Morocco? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcould-enis-nfw-unveil-further-potential-offshore-morocco.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Could+Eni%27s+NFW+unveil+further+potential+offshore+Morocco%3f+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcould-enis-nfw-unveil-further-potential-offshore-morocco.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}