Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 15, 2021

Corporate renewable procurement in Southeast Asia: Current opportunities and outlook

Corporate demand for renewable energy has been growing and is forecast to log at least a 100-fold increase over the coming decade in Southeast Asia. Southeast Asia's commercial and industrial (C&I) sector power demand is forecast to rise from 600 TWh in 2020 to 933 TWh over the coming decade. In 2020, RE100 members recorded nearly 5 TWh of power consumption in Southeast Asia, with only 7% currently from renewable sources, despite their commitment to renewables. With 56% of the RE100 members having operations in Southeast Asia, the 100% renewable target year drawing closer, operations growing in this region of strong economic growth, and RE100 and similar initiatives proliferating, the demand for renewables will undoubtedly rise as well.

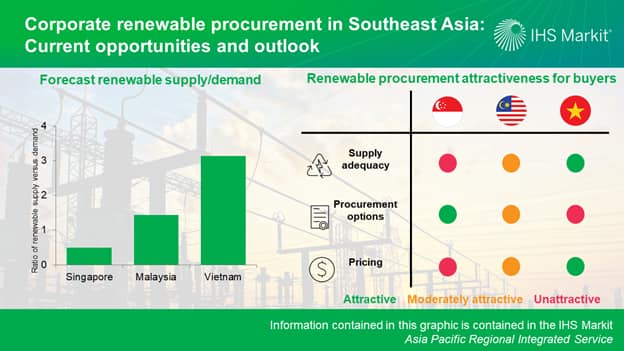

With the growing demand for renewable energy and high energy density businesses, on-site rooftop generation may not be able to provide sufficient electricity to meet energy needs and help corporations to achieve 100% renewable energy. The corporate renewable procurement options available in Southeast Asia vary greatly between markets and are dependent on power market liberalization status and market structures. However, one common theme is that all markets in the region are taking steps to introduce more corporate renewable procurement options to ensure that access to renewable energy improves to remain attractive to corporations looking to set up operations overseas and to achieve national renewable targets. Markets are opening more options through liberalizing the electricity retail segment and other innovative solutions such as peer-to-peer trading of renewable energy.

The price for off-site renewable procurement is going to be high in the near term for countries with a lack of supply and limited procurement options. By 2025, IHS Markit expects that renewable buyers in Malaysia, Singapore, and Vietnam will start to see prices decline and a trend toward the levelized cost of electricity of the respective renewable source or the cost of supply. This would likely be the result of more procurement options to better match the demand and supply for renewables, and, in Singapore's case, an increase in renewable imports.

Learn more about our Asia Pacific energy research.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-in-southeast-asia-current.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-in-southeast-asia-current.html&text=Corporate+renewable+procurement+in+Southeast+Asia%3a+Current+opportunities+and+outlook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-in-southeast-asia-current.html","enabled":true},{"name":"email","url":"?subject=Corporate renewable procurement in Southeast Asia: Current opportunities and outlook | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-in-southeast-asia-current.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Corporate+renewable+procurement+in+Southeast+Asia%3a+Current+opportunities+and+outlook+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcorporate-renewable-procurement-in-southeast-asia-current.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}