Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 21, 2020

Coronavirus (COVID-19) offering retail fuel stations a “stress test” for the future

Extreme lockdown measures and voluntary social distancing have combined to hammer US gasoline demand. In fact, sales during the final week of March were nearly 47% below the same period the previous year, with the demand drop-off exceeding 50% in some regions. IHS Markit believes this is near rock bottom, with retail gasoline demand expected to average 48% below the prior year during April. Moreover, gasoline sales will remain far below their "pre-COVID" level for at least another year.

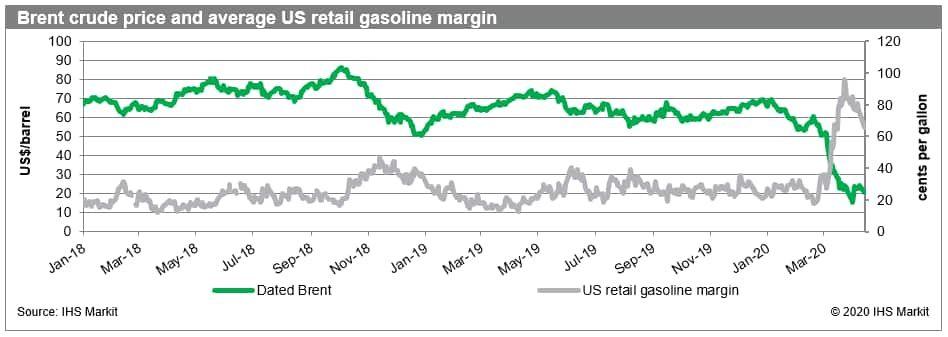

Interestingly, the collapse in gasoline sales has not directly been a problem for retail stations thus far. Per gallon margins have skyrocketed since oil prices collapsed in early March. Margins will eventually come back down to earth - and indeed they have trended downward since March 25 - but, for now, the average US retail station's fuel earnings are actually higher than they were before COVID-19.

Figure 1: Brent crude price and average US retail gasoline

margin

However, the fuel demand destruction - and the pandemic more broadly - is also hurting retailers' "inside sales". Fewer customers purchasing fuel means, all else equal, fewer customers purchasing food, beverage, and other merchandise in the convenience store. The average margin on non-fuel sales is at or above 30%, far higher than the typical 5% to 9% for regular gasoline. However, this non-fuel margin is relatively fixed so a decline in sales causes a proportional decline in earnings. And all stations depend on their non-fuel earnings to survive. In fact, selling gasoline and diesel has become - even before the pandemic - something of a secondary priority for many retailers.

Of course, not all service stations are created equal when it comes to their non-fuel offering. Some stations receive the majority of their convenience store traffic from customers who just happen to be there purchasing fuel. Other convenience stores, whether because of their location, their cleanliness, and/or the quality of their non-fuel offering, are more "purposeful" shopping destinations. Obviously, stations in the latter category will fare better during the COVID-19 pandemic since they are not as reliant on fuel volumes to drive their non-fuel sales. In fact, the pandemic could conceivably mean an increase in non-fuel sales for some stations. After all, most Americans live closer to a gas station than they do a grocery store, and that geographic proximity could make all the difference during an infectious pandemic

The lockdown measures enacted to deal with COVID-19 will end in a matter of weeks or (at the longest) months. This will help all retail stations, but none more so than those that lack a strong non-fuel offering. However, the nation is steadily marching towards a future in which fuel demand will more closely resemble the temporary conditions wrought by the pandemic. In this way, COVID-19 offers something of a "stress test" for the nation's retailers; the stations that are suffering the most today are those that will be most vulnerable to closure going forward. In fact, the hardships of the next few months could very well end up accelerating network rationalization that would otherwise have been spread out over the next decade.

IHS Markit has an industry-leading retail fuel consultancy. For more information or to discuss a project, please contact us.

Rob Smith is a Director of the Global Fuel Retail at IHS Markit.

Posted 21 April 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcoronavirus-offering-retail-fuel-stations-a-stress-test.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcoronavirus-offering-retail-fuel-stations-a-stress-test.html&text=Coronavirus+(COVID-19)+offering+retail+fuel+stations+a+%e2%80%9cstress+test%e2%80%9d+for+the+future+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcoronavirus-offering-retail-fuel-stations-a-stress-test.html","enabled":true},{"name":"email","url":"?subject=Coronavirus (COVID-19) offering retail fuel stations a “stress test” for the future | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcoronavirus-offering-retail-fuel-stations-a-stress-test.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Coronavirus+(COVID-19)+offering+retail+fuel+stations+a+%e2%80%9cstress+test%e2%80%9d+for+the+future+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcoronavirus-offering-retail-fuel-stations-a-stress-test.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}