Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 14, 2021

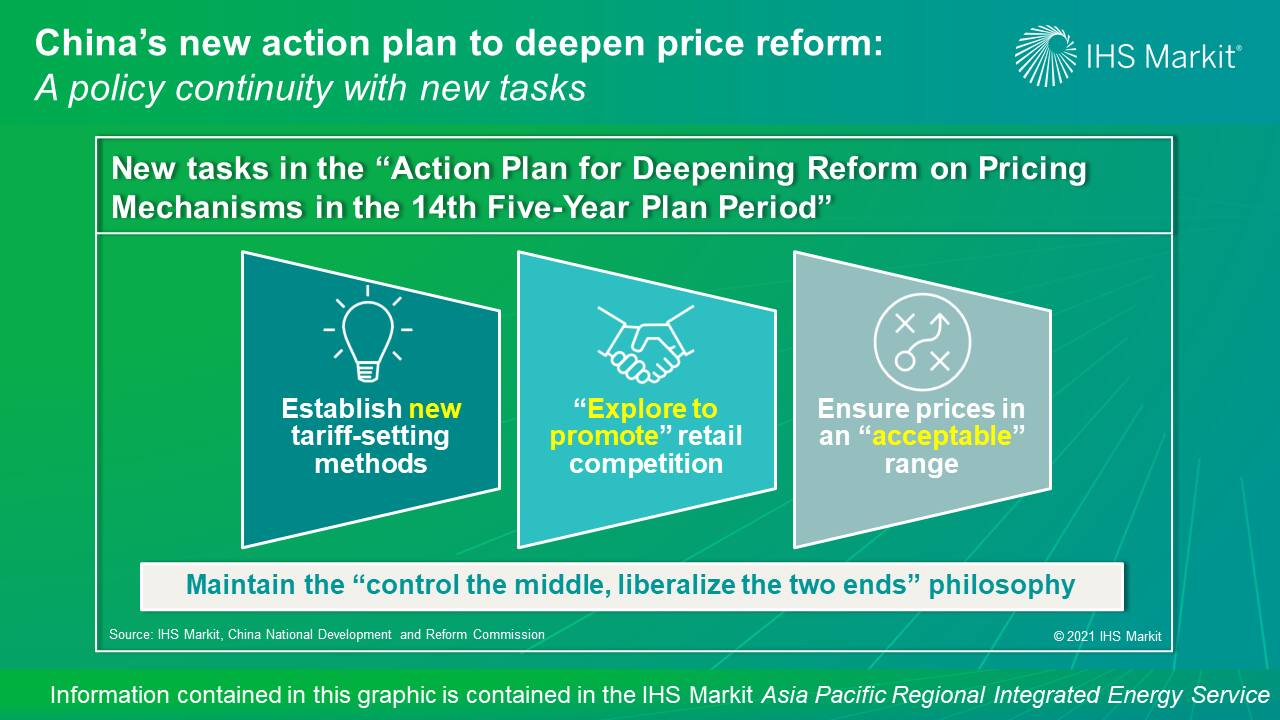

China’s new action plan to deepen price reform: A policy continuity with new tasks

In May 2021, China's National Development and Reform Commission issued the "Notice on the Action Plan for Deepening Reform on Pricing Mechanisms in the 14th Five-Year Plan Period" (the Action Plan). The Action Plan targets that, to achieve high-quality development, by 2025, the prices in competitive markets across the entire economy will mainly be market-based and natural monopoly segments will follow well-established regulated pricing mechanisms. The Action Plan is a continuation of the 2015 "Opinions on Advancing Pricing System Reform" which set a 2020 target for transparent and market-based pricing systems across the entire economy, though progress lagged partially owing to the disruptions created by COVID-19.

Related to the natural gas market, the Action Plan specifically states to steadily advance price reform under the "control the middle, liberalize the two ends" philosophy. The goal of this approach is to have upstream wellhead, citygate, and retail prices set by the market while pipeline tariff regulations will continue to follow a cost-plus basis with cost supervision and scheduled adjustment cycles. New aspects in the Action Plan include the plan to establish new midstream tariff-setting methods and gradually introduce cost-control measures.

The Action Plan indicates the general policy direction to create a competitive retail gas market but in a cautious manner—to "promote" the fair opening of the citygas distribution network and "explore to promote" retail price deregulation. City gas distribution pipeline network is a natural monopoly business, but retail gas could be a competitive market if the distribution network opens access to third parties. The measured approach reflects the challenges for distribution opening and retail competition for most gas consuming sectors where there are over 1,000 citygas distributors and hundreds of millions of users across sectors. Furthermore, retail competition can help balance the market by providing price signal but leave small players exposed to price volatility and supply risk.

The Action Plan emphasizes the importance of seeking progress on price reform while maintaining stability to ensure that the overall price levels remain within a reasonable range. The Action Plan does not define what constitutes "a reasonable range" but states the needs to strengthen price tracking and analysis of commodities, including natural gas, to timely propose measures to stabilize prices. As a result, policies will likely continue to influence market-based pricing in China to control price level and volatility. For natural gas, the price level will need to maintain a delicate balance between supply security—gas prices high enough for gas suppliers to make adequate profits—and demand growth—gas prices low enough that end-users can accept.

Learn more about our coverage of the Asia Pacific energy market through our Asia Pacific Regional Integrated Energy Service.

Jenny Yang is a senior director covering Greater China's gas and LNG analysis.

Posted on 14 June 2021.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-new-action-plan-to-deepen-price-reform-a-policy-continu.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-new-action-plan-to-deepen-price-reform-a-policy-continu.html&text=China%e2%80%99s+new+action+plan+to+deepen+price+reform%3a+A+policy+continuity+with+new+tasks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-new-action-plan-to-deepen-price-reform-a-policy-continu.html","enabled":true},{"name":"email","url":"?subject=China’s new action plan to deepen price reform: A policy continuity with new tasks | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-new-action-plan-to-deepen-price-reform-a-policy-continu.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China%e2%80%99s+new+action+plan+to+deepen+price+reform%3a+A+policy+continuity+with+new+tasks+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-new-action-plan-to-deepen-price-reform-a-policy-continu.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}