Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 12, 2019

China’s gas market midstream reform: True transformation will take time

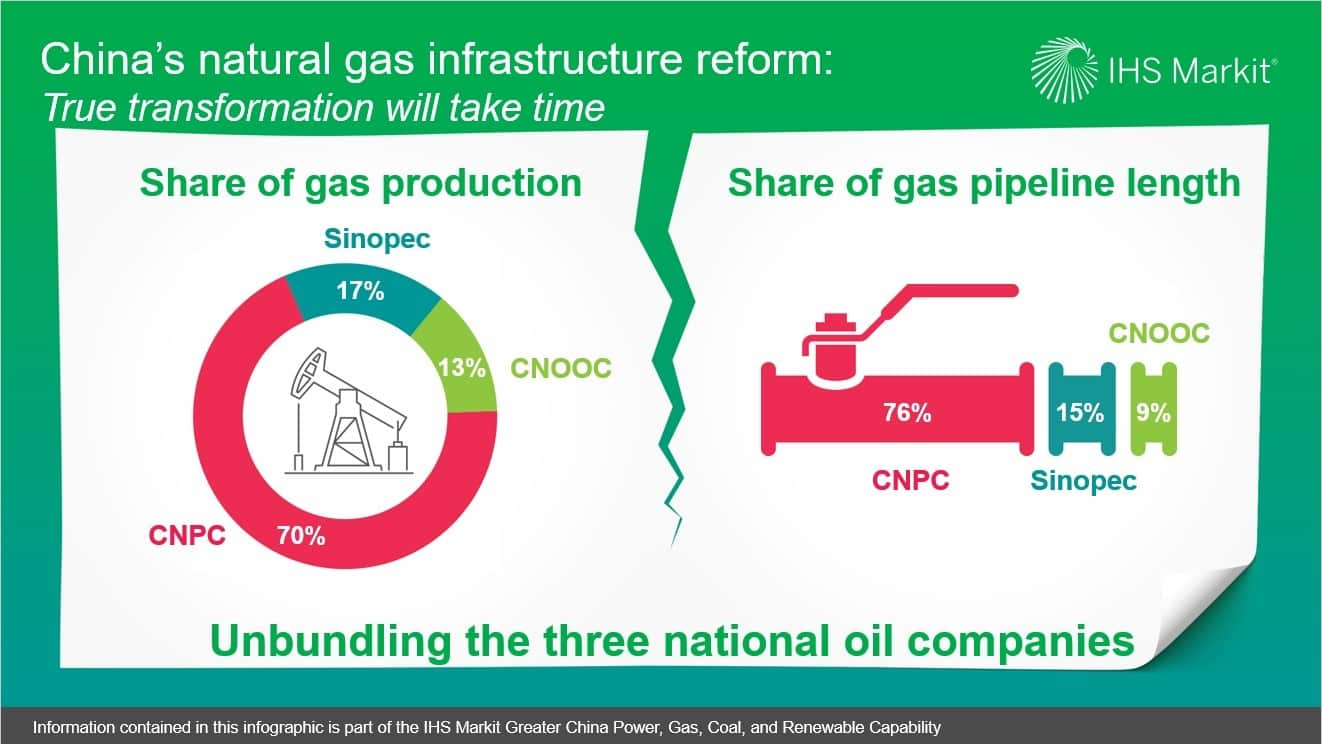

Midstream infrastructure network has long been a key bottleneck in China's natural gas market development. Physically, the transmission length is merely 15% that of the United States, keeping pipeline connection rate to just 24% of total population and 41% of urban population. In addition, the national oil companies, PetroChina in particular, dominate the pipeline business. Although policies on third-party access (TPA), have been in place since 2013, only a handful of TPA cargos have come through and there is virtually no TPA to the transmission network. This limits options for both gas producers and buyers and prevents gas flow optimization in the pipeline network.

Figure 1: China's natural gas infrastucutre reform

In March 2019, the National Development and Reform Commission announced in the annual Work Report the plan to establish a national pipeline company. The work plan is reportedly finalized and now pending the State Council's approval. The implementation may proceed in three phases. First, transferring existing pipeline assets and employees to a new company, tentatively named China Pipeline Corporation and at the same level as the current three national oil companies. Second, allowing state and private investment funds to invest capital up to 50% of China Pipeline Corporation to develop new projects. Third, initiating an initial public offering for China Pipeline Corporation.

This is a major step in the right direction to improve market efficiency. Once fully implemented, the plan will transform the current market landscape, allowing downstream market access to more gas suppliers, midstream operator to optimize gas flow with midstream investment opportunities available to new players, and more supply options for citygas distributors and end users. However, many details have yet been made public, including the timeline for each step, which assets to be included, and initial ownership allocation. The government also needs to resolve the questions how to compensate for import losses and maintain supply security, before it can turn to improving market efficiency.

Looking back, midstream reforms in the United States and Europe each took two decades to complete. Given China's complex market and the fact that new pipelines still need to be built, it will take time to achieve equitable and nondiscriminatory midstream TPA.

Jenny Yang is the research manager of the Greater China

Power, Gas, Coal, and Renewables service at IHS

Markit.

Posted 12 June 2019

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-gas-market-midstream-reform.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-gas-market-midstream-reform.html&text=China%e2%80%99s+gas+market+midstream+reform%3a+True+transformation+will+take+time%e2%80%83+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-gas-market-midstream-reform.html","enabled":true},{"name":"email","url":"?subject=China’s gas market midstream reform: True transformation will take time | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-gas-market-midstream-reform.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China%e2%80%99s+gas+market+midstream+reform%3a+True+transformation+will+take+time%e2%80%83+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-gas-market-midstream-reform.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}