Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 30, 2021

China’s Five-Year Plans’ review and expectation: Natural gas ticks the box for many policy goals

In March 2021, China announced the first of its 14th Five-Year Plans (FYPs)—the Outline of the 14th FYP (2021-25) for National Economic and Social Development and the Long-Term Objectives Through 2035 (the national 14th FYP). This is the first in the series of 14th FYP policy documents to set development plans and goals for many parts of the economy. Following the national FYP, more plans and targets for specific sectors, markets, and individual provinces or companies—particularly state-owned enterprises—will arrive in the coming months and years. Together, these policies will the framework for the development of the Chinese economy and its subsectors in the next five years and beyond and significantly affect the global energy market.

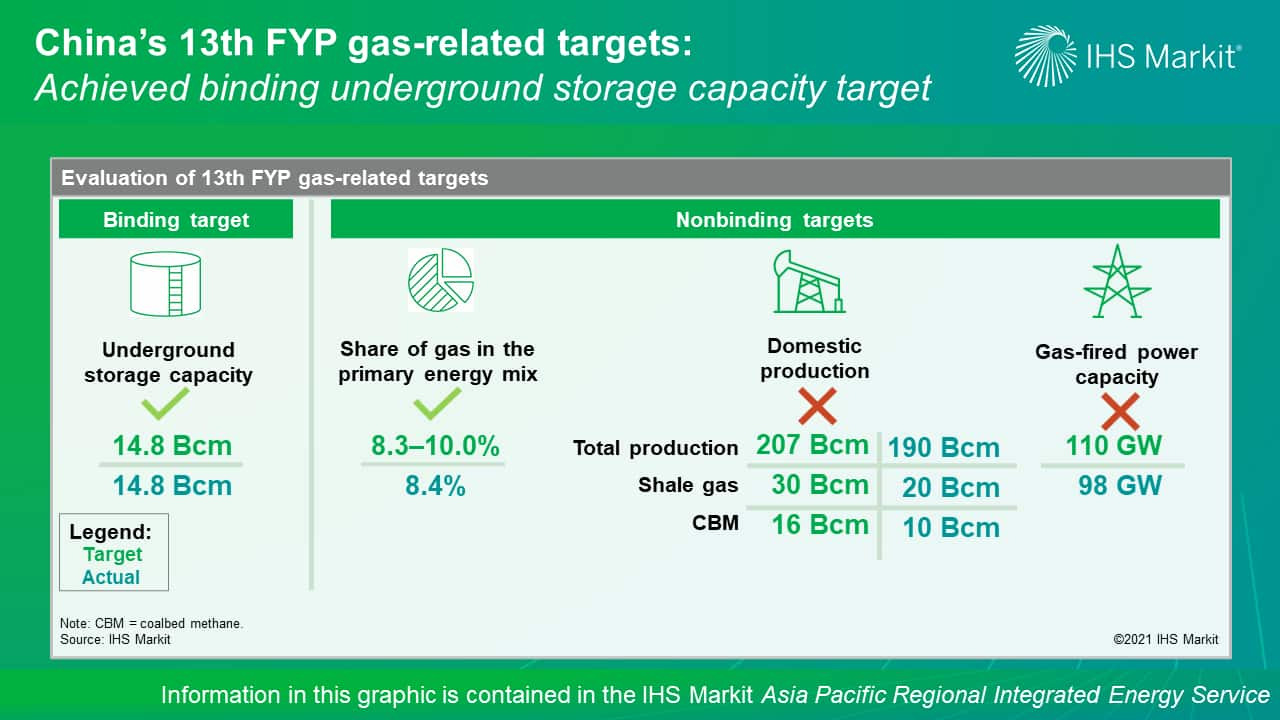

An assessment of the 13th FYP energy-related targets reveals that China achieved many important targets but not all, with COVID-19 being a key disrupting factor. Two key 13th FYP energy-related targets—total energy consumption and structure—were among the achieved ones. In particular, the share of natural gas in the primary mix reached 8.4%, surpassing the 8.3% target. The only binding gas-related target in the 13th FYP for Natural Gas Development—14.8 Bcm of underground gas storage working capacity—was also achieved. Many nonbinding gas-related targets, both on supply and demand side, were unsuccessful.

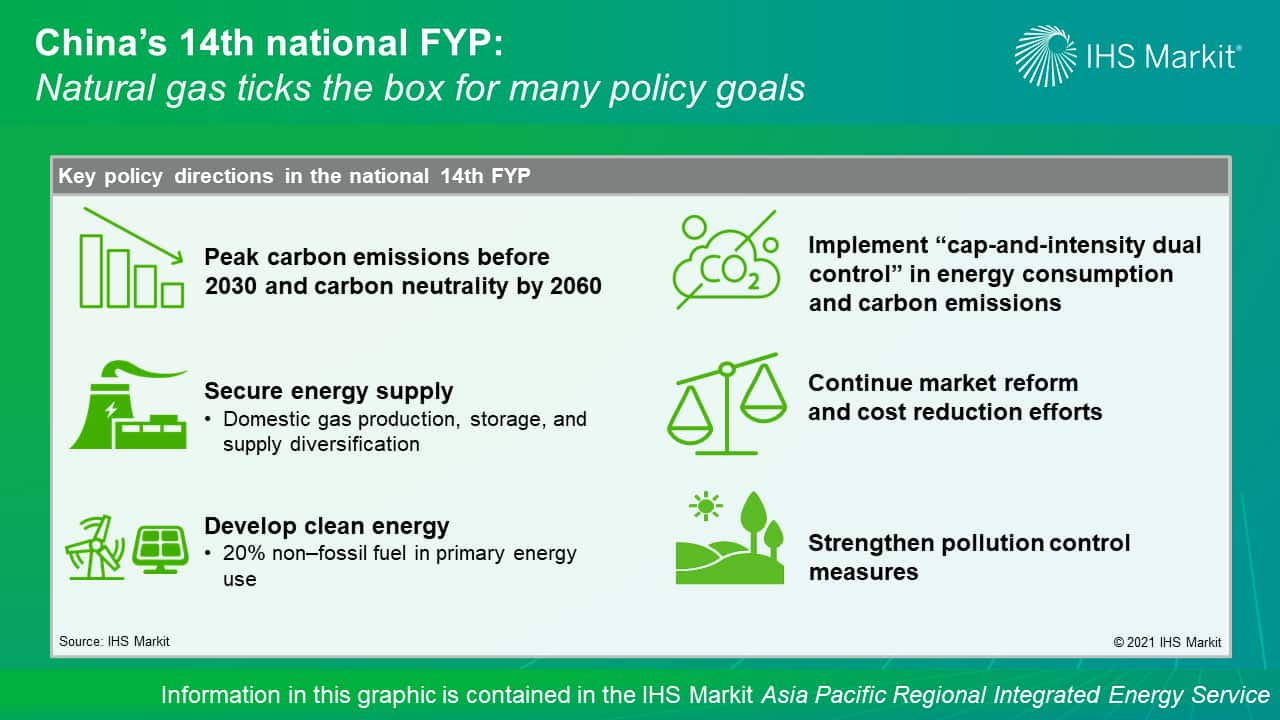

The government will provide policy continuity from recent directions. The national 14th FYP confirms quality over quantity for economic growth and excludes a real GDP growth target for the 2020-25 period. Regarding the natural gas market, the government continues to elevate the importance of supply security and market reform.

Low-carbon options will be the key development areas under unprecedented policy focus on carbon emission reduction. For the first time in the history of FYPs, the government discusses China's longer-term climate goals and introduces the idea of a carbon emissions cap to supplement the intensity targets. The official carbon emissions cap target will be announced at a later date.

Aligning with many policy goals, natural gas will remain a growth engine for energy supply in the 14th FYP period. The policy direction on air pollution reduction, carbon emission control, and gas supply and midstream infrastructure development indicates continued support for higher penetration of gas in the growing energy mix. On the other hand, the focus on supply security and cost reduction from market reforms indicate an expectation of decelerating gas demand growth in the 14th FYP period compared with that in the previous five years. In the current IHS Markit outlook, China's gas demand will grow 6% compound annual average during 2021-25—compared with the 11% growth in the previous five year—to reach 429 Bcm in 2025.

Learn more about our coverage of the APAC energy market through our Asia Pacific Regional Integrated Service.

Jenny Yang is a senior director covering the Greater China gas and LNG analysis on the IHS Markit Climate and Sustainability team.

Posted 30 April 2021

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-fiveyear-plans-review-and-expectation-natural-gas-ticks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-fiveyear-plans-review-and-expectation-natural-gas-ticks.html&text=China%e2%80%99s+Five-Year+Plans%e2%80%99+review+and+expectation%3a+Natural+gas+ticks+the+box+for+many+policy+goals+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-fiveyear-plans-review-and-expectation-natural-gas-ticks.html","enabled":true},{"name":"email","url":"?subject=China’s Five-Year Plans’ review and expectation: Natural gas ticks the box for many policy goals | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-fiveyear-plans-review-and-expectation-natural-gas-ticks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China%e2%80%99s+Five-Year+Plans%e2%80%99+review+and+expectation%3a+Natural+gas+ticks+the+box+for+many+policy+goals+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchinas-fiveyear-plans-review-and-expectation-natural-gas-ticks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}