Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 11, 2021

Challenging scenario for Argentina soybean complex in 2021/22

While Brazil and the US are expanding in soybean planting and production, the Argentina soybean industry faces challenges compared to the previous season as policy, costs, competition and inflation are impacting soybean production. However, corn production is taking a step up.

Policy, costs, competition and inflation are negatively impacting soybeans, but corn is taking a step up. Below are some of our forecasts on the market outlook of the soybean industry in Argentina for the 2021/ 22 season.

- Soybean planting was 10% completed by November 3 in Argentina, compared to 6% last year and 8% for the five-year average. The fast-planting pace is related with farmers trying to adjust the crop calendar to the expected rainfall under La Niña's influence.

- IHS Markit forecasts Argentina's soybean planting areas in the 2021/ 22 season at 16.9 million hectares, down 2% from the previous season, at the lowest level since 2007. The export tariff policy, higher production costs, the competition with corn production and the strong inflationary pressure over processors' operating costs are behind the reduction in the soybean planted area.

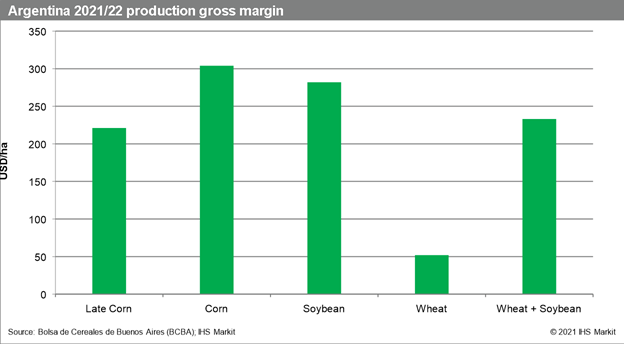

- With surging soybean production costs, especially through glyphosate and phosphate fertilizer prices, farmers in Argentina have become increasingly perceptive of international commodity prices. Despite lower production costs of soybeans compared to corn, corn production margin is expected to be 8% higher than soybean margin in the 2021/ 22 marketing year due to lower taxes and better prices of the grain. Corn production area has been increasing since 2016 when corn export tariff favored corn over the soybean complex. Currently exports tariffs are 12% for corn, 33% for soybean, and 31% for soybean products.

- The higher export tariff makes profits from soybean sales more dependent on the crush industry performance, whose activity has remained almost stagnated over the last ten years. Regardless of the surge in international soybean oil prices, lower soybean meal prices and the strong inflationary pressure on operating costs undermined gains and led processors to operate with low margins for months. This context reduced the relationship between actual use capacity and installed capacity to the second-lowest level a decade in 2021 and eroded industries' potential to pay more for the oilseed.

- With Argentina's farmer selling pace below the 5-yr average confirms the challenges that the soybean industry in Argentina is facing and highlights the restrictions over Argentina's crushing activity as the country continues to lose space to Brazil and the US in the international supply of soybean products.

- Our Argentina 2021/ 22 soybean production forecast was reduced by 500,000 tonnes to 43 million tonnes, with chances of further reduction if our forecast for production becomes too optimistic going forward.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchallenging-scenario-for-argentina-soybean-complex-in-202122.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchallenging-scenario-for-argentina-soybean-complex-in-202122.html&text=Challenging+scenario+for+Argentina+soybean+complex+in+2021%2f22+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchallenging-scenario-for-argentina-soybean-complex-in-202122.html","enabled":true},{"name":"email","url":"?subject=Challenging scenario for Argentina soybean complex in 2021/22 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchallenging-scenario-for-argentina-soybean-complex-in-202122.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Challenging+scenario+for+Argentina+soybean+complex+in+2021%2f22+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fchallenging-scenario-for-argentina-soybean-complex-in-202122.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}