Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 10, 2020

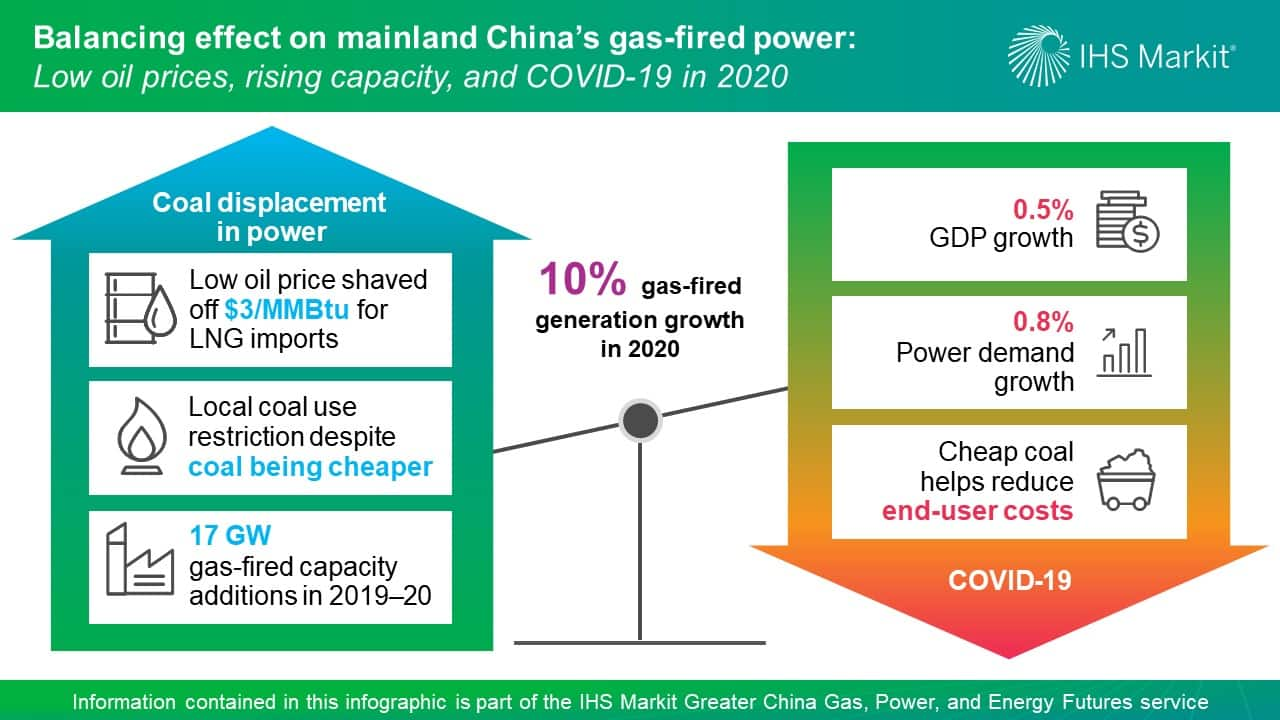

The balancing effect of low oil prices, rising capacity, and COVID-19 on gas-fired power in China

Collapsing oil demand caused by the global spread of the coronavirus (COVID-19) disease 2019 has more than halved oil prices from the average 2019 level, even with the recent agreement to reduce oil production. The Brent oil price, which is expected to average $36/bbl in 2020 will bring the average landed price of LNG imports down by around $3/MMBtu. At this level, the monthly average landed prices of LNG imports approach but do not break the level at which gas is competitive against coal in power generation. The landed price of LNG imports needs to fall to $2.5/MMBtu for gas to be competitive against coal in power generation. Only when the Brent oil price drops below $20/bbl for several months that the average contracted LNG imports will become competitive against coal for power generation in 2020.

Figure 1: Balancing effect on mainland China's gas-fired

power

Nonetheless, gas-fired power generators will realize some fuel-cost savings, depending on fuel procurement contracts and generators' accessibility to the international LNG market.

First, some gas-fired power plants were built as the foundational users of LNG imports, such as projects associated with Dapeng LNG or Putian LNG receiving terminals. They have oil-linked gas supply contracts, and therefore, their fuel costs will come down directly with the oil price collapse. But the fuel price for volumes above contracted level will likely need to be negotiated and not the original oil-linked prices.

Second, spot prices will also be under the pressure of the pandemic-induced low gas demand growth and low-term LNG prices. Gas-fired power generators with access to spot LNG cargoes will benefit from this. For example, Guangdong Energy and Shenzhen Energy, with 8.7 GW of combined gas-fired capacity in Pearl River Delta area, can also import LNG cargoes via sharing a 0.35 million metric tons per annum (MMtpa) terminal capacity at Guangdong Dapeng LNG. In addition, Guangdong Energy and Shenzhen Energy reportedly have some slots under capacity use agreements at the 3.5 MMtpa Zhuhai LNG and 4.0 MMtpa Shenzhen LNG, respectively. However, the incremental gas-fired power generation is capped by generation capacity, grid dispatch, and terminal capacity availability.

Finally, domestic wholesale and retail gas prices will likely decrease through the government reducing regulated prices or the national oil companies' own strategies to move gas inventory, especially during the lockdown when industrial demand was seriously impacted. However, the fuel cost decline will be much smaller, taking into consideration the blended prices of supply.

<span/>Although gas remains a premium fuel over coal in most cases, gas-fired power generators can utilize different options to increase generation. Power generators with both coal and gas in their fleets can optimize their own portfolio based on fuel procurement and burn more gas, if gas-fired power tariff is unchanged. In addition, power trading based on a discount to the on-grid tariff also favors gas-fired power, because the lower the gas prices are, the larger on-grid tariff discount gas-fired generators can offer. Furthermore, the Chinese government may cut gas-fired power tariff, reducing the coal and gas generation cost differential. However, updating on-grid power tariff is typically a drawn-out process and will likely lag fuel-cost adjustment.

<span/>During the first quarter of 2020, gas-fired generation grew 8.4% year on year, despite the fact that overall power demand contracted for 6.5% and coal-fired generation dropped 9.4%. The majority of gas-fired power generation growth came from Guangdong and Jiangsu, thanks to high recent capacity additions, low hydropower imports, gas price discount, and the availability of power trading options. With most of these supportive factors fading away, new capacity additions will be the main driving force for gas-fired power sector in in the remaining of the year and 2021.

Cost consideration in both the weak economic and power demand growth will undermine gas-fired generation growth in 2020. <span/>With more than 10 GW of new capacity coming online this year, IHS Markit expects gas-fired power generation to grow by 10.1% under the 0.8% total power demand growth in 2020. Nonetheless, gas demand from power generation will lead gas demand growth by sector with 4.8 Bcm in incremental demand in 2020.

Learn more about our coverage of the Greater China energy market through our Greater China Gas, Power, and Energy Futures service.

Xiao Lu is a Senior Research Analyst covering Greater China's gas and LNG analysis.

Posted 10 June 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbalancing-low-oil-prices-rising-capacity-covid19-gas-fired.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbalancing-low-oil-prices-rising-capacity-covid19-gas-fired.html&text=The+balancing+effect+of+low+oil+prices%2c+rising+capacity%2c+and+COVID-19+on+gas-fired+power+in+China+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbalancing-low-oil-prices-rising-capacity-covid19-gas-fired.html","enabled":true},{"name":"email","url":"?subject=The balancing effect of low oil prices, rising capacity, and COVID-19 on gas-fired power in China | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbalancing-low-oil-prices-rising-capacity-covid19-gas-fired.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+balancing+effect+of+low+oil+prices%2c+rising+capacity%2c+and+COVID-19+on+gas-fired+power+in+China+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fbalancing-low-oil-prices-rising-capacity-covid19-gas-fired.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}