Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 31, 2021

Australasian LNG-focused E&Ps look to add scale and depth to their resource portfolios, and strengthen their funding capabilities through recent merger consolidation wave

The full throttle mergers and acquisition (M&A) market in 2021 has swept over the Australasian LNG-focused E&Ps (Woodside, Santos, Oil Search) in recent weeks, as the group seeks to add scale and depth to their portfolios, and strengthen their funding capabilities through all-stock merger arrangements. In early August, Santos Ltd. and Oil Search Ltd. announced a merger transaction, valuing Oil Search at A$8.9 billion (US$6.5 billion). In the case of Santos, the deal would add significant exposure to strategic, top-tier producing and prospective LNG projects in Papua New Guinea (PNG LNG, Papua LNG), as well as promising oil discoveries along the Alaskan North Slope (including the Pikka oil development) at a value accretive price. Additionally, the transaction jibes with the company's recent acquisition-led growth strategy (Quadrant; ConocoPhillips' northern Australian interests), which has been well-timed and helped the company's share price to consistently outperform its peers and trade at a premium to our valuation, creating equity pricing power to advance an all-stock deal. For Oil Search, the all-stock deal offers exposure to a sizeable but more well-balanced Australasian portfolio with more robust cash flow generating potential, a balance sheet with greater capacity to fund its quality growth prospects, and a stable management team with a proven track record.

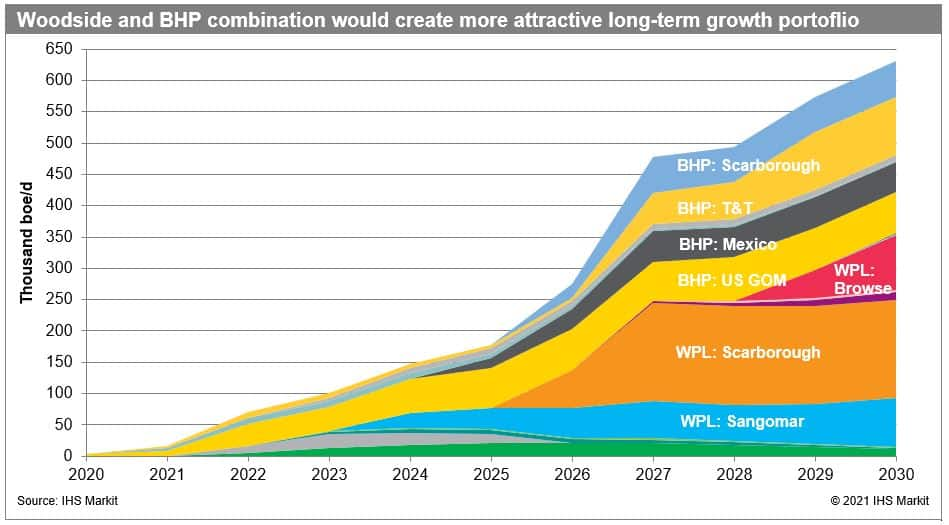

Following the Santos-Oil Search deal, Woodside Petroleum agreed

to a merger with BHP Group's upstream business in mid-August,

valuing BHP's oil and gas assets at A$18.8 billion (US$13.8

billion). While the potential merger follows the general

consolidation framework seen over the past year, it differs from

the Santos-Oil Search transaction in that the Woodside-BHP upstream

portfolios have limited shared interests, outside of the North West

Shelf (NWS) project assets and prospective Scarborough gas field,

and most of BHP's upstream portfolio would be relatively new to

Woodside. Still, we view the deal as favorable for Woodside on the

basis that it adds strength to the company's declining,

LNG-weighted reserve base, through the addition of a more diverse

set of relatively high-quality, significant cash flow-generating

assets, and creates a more attractive long-term growth portfolio

with an array of prospective large-scale deepwater projects across

Australia (Scarborough), the US Gulf of Mexico (Wildling), Mexico

(Trion), and Trinidad and Tobago (incl. Calypso). Also, we forecast

that the new entity will deliver more robust operating cash flows

and also have a stronger balance sheet, via the addition of BHP's

unlevered upstream assets, which will support the self-funding of

future growth and returns to shareholders, especially if oil prices

remain near current levels. However, the combined portfolio will

stay heavily weighted toward both oil and oil-linked LNG production

and thus remain vulnerable to future commodity price cycles. Also,

the all-stock nature of the merger will require the issuance of a

significant block of shares (at a moderate discount based on our

most recent appraised net worth) that also carry a substantial

annual dividend commitment, but it is too early to determine if the

deal will have a material impact on valuation per share.

IHS Markit Connect users can access two full reports related to this blog here:

Learn more about our Energy Company & Transaction Research.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2faustralasian-lng-consolidation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2faustralasian-lng-consolidation.html&text=Australasian+LNG-focused+E%26Ps+look+to+add+scale+and+depth+to+their+resource+portfolios%2c+and+strengthen+their+funding+capabilities+through+recent+merger+consolidation+wave+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2faustralasian-lng-consolidation.html","enabled":true},{"name":"email","url":"?subject=Australasian LNG-focused E&Ps look to add scale and depth to their resource portfolios, and strengthen their funding capabilities through recent merger consolidation wave | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2faustralasian-lng-consolidation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australasian+LNG-focused+E%26Ps+look+to+add+scale+and+depth+to+their+resource+portfolios%2c+and+strengthen+their+funding+capabilities+through+recent+merger+consolidation+wave+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2faustralasian-lng-consolidation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}