Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 08, 2014

Are we missing the methane associated with unconventional oil?

EPA rules to reduce fugitive methane do not account for oil wells with associated gas. Will these type oil wells be moved under the rules and what challenges may result?

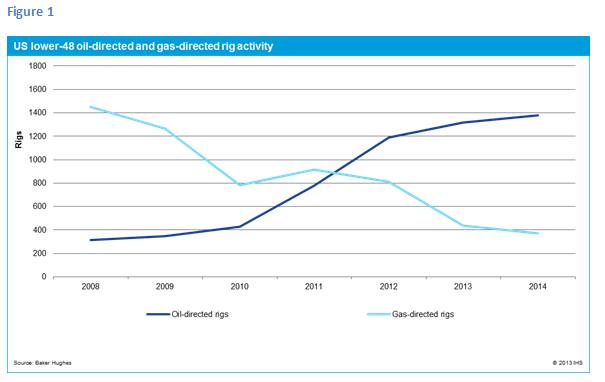

According to the US Environmental Protection Agency's (EPA's) annual GHG Inventory, natural gas systems (production, processing, transmission and storage, and distribution) accounted for 23% of US methane emissions in 2012. Methane is the main component of natural gas and is a greenhouse gas roughly 30 times more powerful than carbon dioxide over a 100-year period. Owing to rising US natural gas production in recent years, EPA has focused on addressing methane emissions from natural gas systems. But US producers have reacted to low gas prices relative to rising oil prices by switching rigs from gas-directed drilling to oil-directed drilling in many unconventional plays (see figure 1). This raises the question - are methane emissions from oil wells co-producing natural gas being appropriately quantified and managed?

In 2012, EPA revised federal New Source Performance Standard (NSPS) under 40 CFR Part 60, Subpart OOOO to regulate volatile organic compounds (VOCs) from natural gas systems. Both methane and VOCs are released during well completion flowback, so controlling for VOCs provides an additional benefit of reducing methane. EPA expects the rule to reduce methane emissions by 1.0-1.7 million tons (52‒89 Bcf) annually or 7% of baseline methane emissions from natural gas systems as reported in EPA's GHG Inventory in 2009. By January 1, 2015, natural gas operators must reduce VOCs by using reduced emissions completions (RECs) or "green completions" on all new natural gas wells. Until that time, operators can reduce emissions by flaring.

These rules only apply to gas wells and not to oil wells with associated gas (i.e., gas produced as a by-product of crude oil production). However, simply applying the same rules to oil wells may not be reasonable. Certain oil plays have low gas-to-oil production ratios, making investments in mitigation techniques, such as using RECs, economically infeasible. Furthermore, increased oil production in remote areas such as the Bakken has highlighted infrastructure constraints in take-away capacity for associated gas. Some states are taking the lead on addressing emissions from both oil and gas wells. For instance, Colorado's rules limiting emissions of VOCs and methane apply not only to gas wells but also to oil wells (as long as certain thresholds are met in terms of volume of gas produced and reservoir pressure).

In the final NSPS OOOO rule, EPA noted that requiring RECs or flaring on oil wells was not cost effective based on the limited information they had available. But the agency is trying to close the information gap. In April 2014, along with several other whitepapers addressing emissions from natural gas production, EPA issued a whitepaper entitled, "Oil and Natural Gas Sector Hydraulically Fractured Oil Well Completions and Associated Gas during Ongoing Production." Among issues raised in the paper, EPA noted that a comprehensive estimate of associated gas emissions does not exist, but rather it is estimated under several categories in the GHG Inventory. EPA solicited recommendations on how to best estimate emissions from this subset of wells, and the agency also requested public comment on possible mitigation techniques, their costs, and other operational issues related to emissions reductions. The review period ended June 16, 2014.

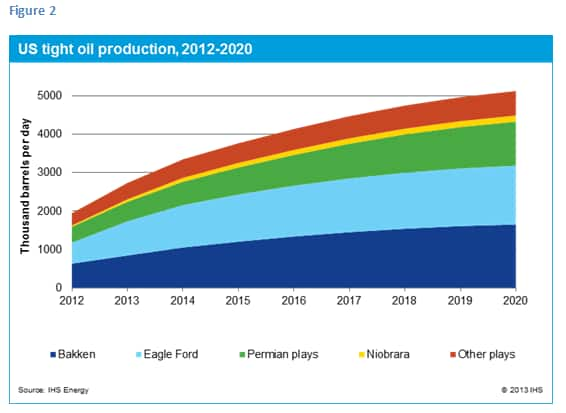

Tight oil production in the United States is expected to grow by over 50% from 2014 to 2020 (see figure 2). According to methane abatement research from ICF International for the Environmental Defense Fund, methane emissions from oil and gas activities are projected to grow 4.5% from 2011-2018 despite NSPS OOOO reductions due to increased venting and flaring of associated gas at oil wells which is not covered under the regulation. Therefore, emissions from associated gas production will likely continue to draw attention from environmental and regulatory stakeholders. EPA is already taking steps to complete its data arsenal on this issue by developing better estimates of methane emissions and mitigation techniques from this subset of wells, which will likely be used to develop some kind of regulatory proposal over the next few years. In the meantime, operators are collaborating to identify best practices on this issue and states such as North Dakota, are exploring alternative incentives to reduce methane emissions and the practice of flaring.

Posted 8 July 2015

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fare-we-missing-the-methane-associated-with-unconventional-oil.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fare-we-missing-the-methane-associated-with-unconventional-oil.html&text=Are+we+missing+the+methane+associated+with+unconventional+oil%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fare-we-missing-the-methane-associated-with-unconventional-oil.html","enabled":true},{"name":"email","url":"?subject=Are we missing the methane associated with unconventional oil?&body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fare-we-missing-the-methane-associated-with-unconventional-oil.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Are+we+missing+the+methane+associated+with+unconventional+oil%3f http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fare-we-missing-the-methane-associated-with-unconventional-oil.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}