Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Nov 24, 2021

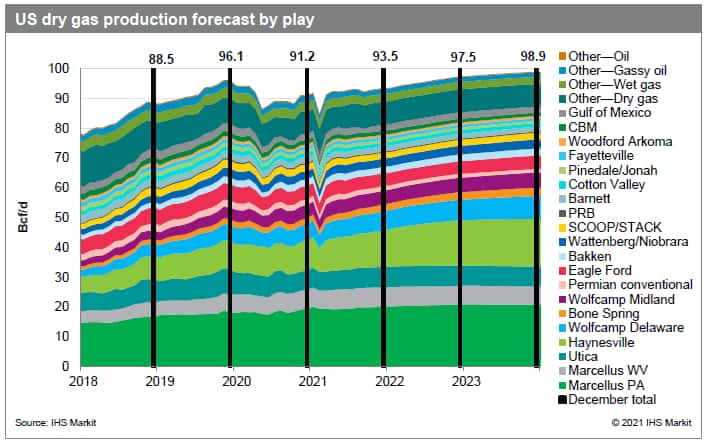

Fourth-quarter US natural gas supply: Operators continue to show restraint in the face of high prices

US lower-48 modeled October dry natural gas production averages approximately 92.9 Bcf/d, 0.4 Bcf/d higher than our third quarter 2021 forecast of 92.5 Bcf/d, according to the latest PointLogic data. Onshore volumes came in higher by about 0.9 Bcf/d than what we projected earlier. Gulf of Mexico volumes are estimated to be down by 0.3 Bcf/d in August, 0.8 Bcf/d in September 2021, and 0.5 Bcf/d in October owing to Hurricane Ida shut ins. Gulf of Mexico dry gas production has been recovering since October, and we expect it to return to pre-hurricane levels by November 2021.

Rig data. September 2021 rig actuals came in at 560 rigs, aligning to what we projected last quarter. The total lower-48 onshore rig count is expected to grow to average 506 rigs in 2021 and 780 rigs in 2022. Actual gas rigs in the Appalachia and Haynesville together came in 15% lower than what we projected, while private operators added rigs in the smaller, oilier plays.

Well completions. Total well completions for 2021 are revised upward from 11,300 wells to about 12,500 wells, as we expect some leakage of cash flows to well completions with WTI prices that are higher than previously projected. Well additions for 2022 are also revised up from 14,800 wells to 15,500 wells.

Drilled-but-uncompleted (DUC) wells. As the pace of completions are higher than drilling in 2021, we expect DUC wells as a significant contributor to 2021 volumes (less than one-third) but hold less than a 5% share by the end of 2022. The year-end 2022 DUC share of well completions fell from 10% in the previous iteration to 5% as some of those DUCs are brought to production in 2021. The net oil and gas DUC wells available in the major plays by mid-2021 were about 5,600, of which dry gas DUC wells account for only 15%.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2021-fourth-quarter-us-natural-gas-supply-update.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2021-fourth-quarter-us-natural-gas-supply-update.html&text=Fourth-quarter+US+natural+gas+supply%3a+Operators+continue+to+show+restraint+in+the+face+of+high+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2021-fourth-quarter-us-natural-gas-supply-update.html","enabled":true},{"name":"email","url":"?subject=Fourth-quarter US natural gas supply: Operators continue to show restraint in the face of high prices | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2021-fourth-quarter-us-natural-gas-supply-update.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Fourth-quarter+US+natural+gas+supply%3a+Operators+continue+to+show+restraint+in+the+face+of+high+prices+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2021-fourth-quarter-us-natural-gas-supply-update.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}