Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 10, 2020

2019 oil and gas corporate venture capital investments in cleantech startups at record high

Over the past decade, oil and gas players have increasingly pursued open innovation strategies to complement internal research and development activities. Corporate venture investing is one such form of technology sourcing that allows companies to access both innovations and new, technology-enabled business models developed by startups. As companies seek more cost-efficient technology development models and look to cast a wider net for new ideas and solutions, corporate venture capital investing is further establishing itself as a key element of the industry's overall approach to strategic technology development.

After the demonstrated success of this investment vehicle for incubating new E&P technologies developed outside their organizations, companies are now increasingly leveraging it to support their low-carbon aspirations and access technologies developed outside the oil and gas sector entirely, such as renewable energy generation, plastics recycling, and mobility. To deepen the alignment with long-term strategic aspirations, corporate venture groups appear to be emphasizing cleantech investment themes over core E&P applications (since 2016, investments in startups developing clean energy technologies constituted the majority of oil and gas corporate venture investment activity).

IHS Markit tracks investment activity by oil and gas corporate venture capital groups via a database that provides details of all portfolio investments from January 1998 through December 2019. Data collected include the name of the startup, oil and gas sector investor(s), startup location, technology category, investment round, and funding amount (when available). Tracking corporate venture investment activity provides a window into emerging industry technology trends, including:

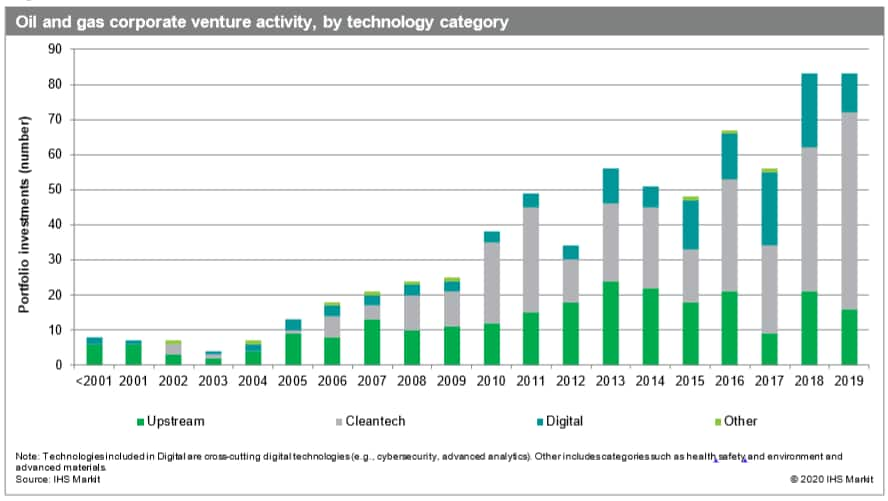

- Corporate venturing continues as a strong source of oil company innovation. Oil and gas corporate venture capital groups participated in 83 rounds of startup funding during 2019 (see Figure 1). This level of investment activity is comparable to that in 2018, solidifying the arrival of a robust technology development ecosystem that supports entrepreneurs and strategic and financial investors seeking to incubate early-stage innovation for the energy industry.

Figure 1: Oil and gas corporate venture activity by technology category

- Oil and gas corporate venture activity is enabling the energy transition. In 2019, 67% of investment activity funded startups developing clean energy technology (cleantech startups represented 49% and 45% of investment activity in 2018 and 2017, respectively).1 This result represents a dramatic increase in the industry's support for clean energy innovation as companies execute their strategies for managing the energy transition and look to their corporate venture capital groups to support and advance these strategies.

Learn more about our upstream technology solutions.

Carolyn Seto is research and analysis director on our upstream technology team at IHS Markit.

Posted 10 July 2020

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2019-oil-and-gas-corporate-venture-cleantech-investments.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2019-oil-and-gas-corporate-venture-cleantech-investments.html&text=2019+oil+and+gas+corporate+venture+capital+investments+in+cleantech+startups+at+record+high++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2019-oil-and-gas-corporate-venture-cleantech-investments.html","enabled":true},{"name":"email","url":"?subject=2019 oil and gas corporate venture capital investments in cleantech startups at record high | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2019-oil-and-gas-corporate-venture-cleantech-investments.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=2019+oil+and+gas+corporate+venture+capital+investments+in+cleantech+startups+at+record+high++%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2f2019-oil-and-gas-corporate-venture-cleantech-investments.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}